Money management worksheets

CPA Canada has a selection of money management worksheets you can use with your clients. Goal Setting Financial Fitness Self-Assessment Values Validator Monthly Budget for Teens Role Model Self-Assessment Document Organizer Cash Flow Organizer Net Worth Worksheet Post-Secondary Student Budget

Set SMART goals that are specific, measurable, action-oriented, realistic, time-framed.

Determine how well you are currently managing your finances.

Determine the things in life that are most important to you.

Help teenagers living at home create a monthly budget.

Determine what kind of financial role model you are.

Organize your documents in preparation for filing your taxes.

Get a clear picture of your cash flow — what is coming in and what is going out

Get a snapshot of what you own (your assets) and what you owe (your liabilities)

This worksheet will help students accurately estimate the total budget they need

Financial wellness guide: questionnaire

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial goals.

Your financial toolkit

A comprehensive learning program that provides basic information and tools to help adults manage their personal finances and gain the confidence they need to make better financial decisions. Learn more about the program and how to use the learning modules.

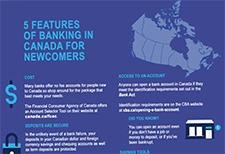

Banking for newcomers to Canada

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. Here is some basic information to get you started. A list of bank resources at the end of this article may also help with the financial transition to Canada.

Crypto Quiz

Are you considering investing in crypto assets, but aren’t sure whether it’s right for you, legal or just a scam? Test your crypto knowledge and learn how to spot the warning signs of fraud using OSC's quiz.

Investment knowledge quiz

Most people know a little about investing, but they need to know more to be able to manage their investments to meet their goals. Try this quiz by the FCAC to see if your knowledge is basic or more advanced.

Start Your Investment Journey

Before you start investing, it is important to consider your budget and financial goals, and how much risk you are comfortable taking on. Like many things in life, investing comes with its own share of risks and rewards. You can do this on your own or with the help of an advisor.

Investment recovery calculator

This calculator will help you find out how long it will take for your investment to recover its value after a market downturn and identify how long it will take to get back on track to reach your original goal.

Investment products

There are many investment products, here's some information about them: Annuities: a contract with a life insurance company. Annuities are most commonly used to generate retirement income. Bonds: when you buy a bond, you’re lending your money to a company or a government for a set period of time. In return, the issuer pays you interest. On the date the bond becomes due, the issuer is supposed to pay back the face value of the bond to you in full. Complex investments: these investments may have the potential for higher gains, but carry greater risks. ETFs: when you buy a share or unit of an ETF, you’re investing in a portfolio that holds a number of different stocks or other investments. GICs: when you buy a guaranteed investment certificate (GIC), you are agreeing to lend the bank or financial institution your money for a set number of months or years. You are guaranteed to get the amount you deposited back at the end of the term. Mutual funds & segregated funds: when you buy a mutual fund, your money is combined with the money from other investors, and allows you to buy part of a pool of investments. Real estate: While real estate investments can offer a range of benefits, there is no guarantee that you will earn an income or profit and, like any investment, there are a number of risks and uncertainties that you need to carefully consider before investing. Stocks: The stock market brings together people who want to sell stock with those who want to buy stock. When you buy stock (or equity) in a company, you receive a piece of the company and become a part owner. Pensions & saving plans: if your employer offers contributions to your retirement or other savings plan, take advantage. Cannabis: Emerging sectors like the cannabis industry have often attracted investors hoping to be among the first to capitalize on the potential growth and high returns of what they believe are untapped markets or products that may be popular in the future. Cryptoassets: Cryptoassets primarily designed to be a store of value or medium of exchange (e.g., Bitcoin) are often referred to as “digital coins.

A guide to the best robo-advisors in Canada for 2022

Robo-advisors first arrived in Canada in the beginning of 2014 presenting young and middle-income investors the option of having their savings passively managed in a bundle of exchange-traded funds (ETFs) matched to their goals and risk tolerance for about a penny on the dollar per year: A perfect set-it-and-forget it solution for people with better things to do. Fast forward to today and the honeymoon atmosphere has dissipated. Against the backdrop of an extraordinarily long-lived bull market in stocks, active management has made a comeback (not least in the ETF space), exotic asset classes like cryptocurrency are on the rise, and new competition is coming from asset-allocation ETFs that do the job of portfolio management all in one security. Suddenly robo-advisors find themselves having to prove their worth anew, all the while trying to establish a profitable business model in a low-margin corner of the investment universe. It’s surprising, really, because amid all the competition their fee structures and value proposition are as good as or better than ever. Investors now must probe deeper in their choice of robo-advisor, asking tough questions around performance, risk and the composition of portfolios. The 2022 survey of the Canadian robo industry shows, they’re not all the same.

2022 Canadian Retirement Survey

The key takeaways from the 2022 Canadian Retirement Survey are: Read the full presentation conducted for Healthcare of Ontario Pension Plan.

Protecting aging investors through behavioural insights

This report identifies behaviourally informed techniques dealers and advisers can use to encourage their older clients to provide the necessary information for enhanced investor protection measures.

Your trusted contact person and why they matter

The Trusted Contact Person initiative has been adopted across Canada. It is part of new regulatory measures to support advisors in their efforts to help investors, particularly older investors and vulnerable, protect themselves and their financial interests. Canadian seniors are increasingly called upon to make complex financial decisions, with higher stakes, later in life than ever before. For many, health, mobility, or cognitive changes that can occur with age, may affect their ability to make these decisions. This can make seniors more susceptible to financial exploitation and fraud. In fact, about half of the victims of investment fraud are over age 55. Watch this new video on understanding the importance of appointing a trusted contact person.

Investor readiness quiz

Investing is an important part of planning for a financially secure future. It can battle the effects of inflation on your savings, grow your wealth, and provide sources of income in retirement. The sooner you invest, the longer compound interest can work to grow your savings exponentially. However, there are some important milestones to achieve and questions to consider before you start investing. Are you ready to invest? Take this quiz to find out!

Early Planning Toolkit

A toolkit for parents/caregivers with a child with a disability ages 2 to 10, containing:

Creating Financial Security: Financial Planning in Support of a Relative with a Disability

This handbook covers the following topics:

State of Fair Banking in Canada

Everyone needs to bank and nearly everyone has a relationship with at least one financial institution. Financial Institutions need relationships with consumers too, in order to thrive as businesses. The role these relationships play in financial decision making for Canadians is an important consideration for anyone seeking to understand the financial health of Canadians and the impact of the banking sector in Canada. This report discusses the findings from a national sample of both banking consumers and lenders who were asked about their perspectives on fairness, access, credibility and transparency.

Ageing and Financial Inclusion: 8 key steps to design a better future

The G20 Fukuoka Policy Priorities for Ageing and Financial Inclusion is jointly prepared by the GPFI and the OECD. The document identifies eight priorities to help policy makers, financial service providers, consumers and other actors in the real economy to identify and address the challenges associated with ageing populations and the global increase in longevity. They reflect policies and practices to improve the outcomes of both current generations of older people and future generations.

The impact of personality traits: a fresh look at gender differences in financial literacy

An emerging body of international literature is beginning to reveal a significant connection between financial capability metrics and personality, suggesting that what influences our financial well-being may be more nuanced than we previously thought. This study investigates how the inclusion of personality traits impacts the analysis of the gender difference in financial capability scores.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

Emergency Fund Calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Use this calculator to estimate how much money should be set aside to pay for financial emergencies.

Saving for Now and Saving for Later: Rainy Day Savings Accounts to Boost Low-Wage Workers’ Financial Security

This report discusses the vulnerability of millions of people in the US who lack adequate emergency savings. A workplace-based solution—rainy day savings accounts— can potentially help workers with low savings weather financial shocks.

Consumer Perspectives on Fintech

This brief raises consumer perspectives on financial technology (fintech), and offers guidance for fintech developers on how to best serve low- to moderate-income clients.

Giving Savings Advice

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at a specific point in the tax preparation process: when entering dependent information. The video also includes examples of commonly heard reasons tax filers give for not wanting to save, and possible responses.

Talking About Savings

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video discusses why promoting savings at tax time is a critical component of VITA volunteers.

Expanding Educational Opportunity Through Savings

This brief discusses the benefits that Children's Savings Accounts (CSAs) bring to help more families save for their children's education. Recommendations to federal policies in the United States are made for the purpose of helping families to start saving early to build greater savings and impact.

Proliteracy.ca: Plan Finances for University or College

Proliteracy.ca analyzes historical living expenses from over 160 cities and tuition from over 100 universities and colleges in Canada to predict the cost of post secondary education in the future. Their tool suggests financing options based on your profile. Learn about RESP, grants, scholarships and various government and commercial programs with their online resources.

The Effects of Education on Canadians’ Retirement Savings Behaviour

This paper assesses the extent to which education level affects how Canadians save and accumulate wealth for retirement. Data from administrative income-tax records and responses from the 1991 and 2006 censuses of Canada show that individuals with more schooling are more likely to contribute to a tax-preferred savings account and have higher saving rates, have higher home values, and are less likely to rent housing.

Retirement 20/20: The 2019 Fidelity Retirement Survey

The Fidelity Retirement Survey is focused on how Canadians near, and already in, retirement approach the next stage of their lives. This is the 14th year of the survey. The results indicate Canadians are retiring earlier than expected. They also show 46% of pre-retirees expect to have some long-term debt when they retire, and that 70% believe they will be working in retirement, among other results.