Translated financial terms

The Consumer Finance Protection Bureau has developed resources to help multilingual communities and newcomers in a selection of languages. The translated financial terms are available in Chinese, Spanish, Vietnamese, Korean and Tagalog. This website has many other multi-lingual resources, covering a range of topics from opening a bank account, money transfers, money management, debt collection and many others. Some terms are US based but most are universal.

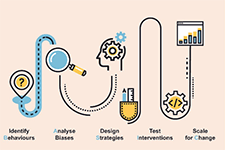

Tools and Ethics for Applied Behavioural Insights: The BASIC Toolkit

A better understanding of human behaviour can lead to better policies. If you are looking for a more data-driven and nuanced approach to policy making, then you should consider what actually drives the decisions and behaviours of citizens rather than relying on assumptions of how they should act. You can start applying behavioural insights (BI) to policy now. No matter where you are in the policy cycle, policies can be improved with BI through a process that looks at Behaviours, Analysis, Strategies, Interventions, Change (BASIC). This allows you to get to the root of the policy problem, gather evidence on what works, show your support for government innovation, and ultimately improve policy outcomes. This toolkit guides policy officials through these BASIC stages to start using an inductive and experimental approach for more effective policy making.

Core competencies frameworks on financial literacy

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These documents describe the types of knowledge that youth aged 15 to 18, and adults aged 18 and up, could benefit from.