Empower U Evaluation Report

For a family living in poverty, every day is about making tough choices – to pay rent or buy groceries? Having the means to attain the basic necessities, is one thing. Having the skills, confidence and access to resources to manage finances in ways that build pathways out of poverty is something far different. Thanks to the generosity of partners, supporters and donors of Empower U, families can move beyond just managing the day-to-day challenges of poverty. Participants in the program learn valuable money management skills and are given the means to build savings and assets to create financial stability. A future where they and their families can thrive.

Eyeing the ID: Bio-metric Banking for Saint John

NB Social Pediatrics and the Saint John Community Loan Fund recently surveyed 157 New Brunswick and Nova Scotia residents about their experiences with finances, banking, and ID to better understand if biometrics or ID banks could be effective solutions for people living without ID. Eyeing the ID: Bio-metric Banking for Saint John identifies access to identification, as well as stringent identification requirements as the most prevalent barriers to receiving services in the community and were also inherently linked to other barriers, such as housing and finances. For example, lack of address was identified as a barrier to accessing an ID because government agencies require a mailing address to send ID documents to customers, but lack of ID is also directly linked to precarious housing because you often need ID to be placed on local subsidized housing lists, and to set up power and utilities. Cyclical barriers to services could be improved by addressing ID requirements and making ID more accessible. The top three solutions identified to mitigate ID barriers were biometrics, ID banks, and an ID acquisition service. Also available in French: Un regard sur l’identification : Services bancaires à identification biométrique à Saint John

Ethnography of vulnerable newcomers’ experiences with taxes and benefits

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of this study is to develop the CRA’s understanding of newcomers’ experiences as they first encounter the Canadian tax and benefit system. These findings illuminate potential directions for improving tax and benefit information and services available for newcomers.

Who Doesn’t File a Tax Return? A Portrait of Non-Filers

The Canada Revenue Agency administers dozens of cash transfer programs that require an annual personal income tax return to establish eligibility. Approximately 10–12 percent of Canadians, however, do not file a return; as a result, they will not receive the benefits for which they are otherwise eligible. In this article, we provide the first estimates of the number and characteristics of non-filers. We also estimate that the value of cash benefits lost to working-age non-filers was $1.7 billion in 2015. Previous literature suggests either a rational choice model of tax compliance (in which the costs of filing are weighed against its benefits) or a more complex behavioural model. Our study has important consequences for policy-making in terms of the administrative design and fiscal costs of public cash benefits attached to tax filing, the measurement of household incomes, and poverty rates.

Start at the Beginning; a Person-Centered Design and Evaluation Framework for Policies to Boost Household Cashflow and Beyond

The financial hardships households faced in the midst of the pandemic reveals the scale of the precarity that millions of households were experiencing well before the crisis began. This highlights the urgency of the need to reimagine our system of benefits—both public and private—to effectively and equitably support households to recover from this pandemic and build security for the future. The Aspen Institute Financial Security Program (Aspen FSP)’s Benefits 21 initiative is dedicated to integrating and modernizing the American system of benefits to ensure all households have financial security and can live economically dignified lives.

The Wealth of Unattached Men and Women Aged 50 and Older, 1999 to 2016

The evolution of the wealth, assets and debts of various groups of Canadians since the late 1990s has been documented in several studies. Yet little is known about the evolution of the wealth holdings of unattached men and women aged 50 and older, who make up a large part of the population. This study assesses how the wealth holdings of unattached men and women aged 50 and older evolved from 1999 to 2016 using data from the Survey of Financial Security of 1999, 2005, 2012 and 2016, and fills this information gap.

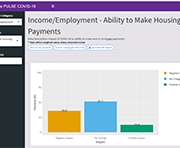

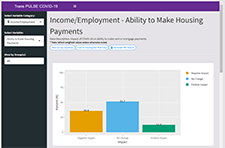

Trans PULSE Canada COVID Data Dashboard

In September – October 2020, the Trans PULSE Canada study team conducted the COVID Cohort to assess the social, economic, and health impacts of the COVID-19 pandemic on trans and non-binary people in Canada. This dashboard serves as an interactive tool for community members and researchers to explore key findings from the Trans PULSE Canada COVID survey, and to break down the results by one or more socio-demographic characteristics. The proportions in the dashboard are weighted to represent the 2019 Trans PULSE Canada sample.

Responding to Client’s “Now, Soon, & Later” Needs

This is a three-part webinar series exploring how practitioners, policymakers, and product developers are supporting the diverse savings needs of LMI households during the ongoing crisis. Solutions that help families save flexibly for short, intermediate, and/or long-term goals that address their current and future needs are discussed.

Creating Financial Security: Financial Planning in Support of a Relative with a Disability

This handbook covers the following topics:

Northwest Territories Income Assistance Handbook

The Income Assistance Program provides Financial Assistance to Northerners to help meet basic and enhanced needs. The program encourages and supports greater self-reliance to improve the quality of lives. This plain language handbook is for people who may want to play for Income Assistance. It provides information on: The handbook also contains helpful contact information on the following resources in the Northwest Territories including:

CPA Canada 2020 Canadian Finance Study

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these unprecedented times. Nielsen conducted the CPA Canada 2020 Canadian Finance Study via an online questionnaire, from September 4 to 16, 2020 with 2,008 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. Among the key pandemic-related findings:

Helping financial empowerment champions deliver critical services to low-income Canadians

Service design consultancy Bridgeable provides an overview of the project partnership with Prosper Canada in April 2020 to take a design sprint approach in providing remote tax-filing and benefits application service solution. Over the course of four consecutive days, Bridgeable worked with eighteen financial empowerment champion (FEC) partners to generate solutions to four key aspects for remote service delivery:

Budgeting resources webinar

This webinar hosted by Credit Canada features guest expert Prosper Canada's Manager of Learning and Training, Glenna Harris. She shares some of their tried-and-true resources to help get people started on budgeting and debt management. She also provides a new tool - Financial Relief Navigator - that can help connect people with income supports they might be eligible for.