Discover financial empowerment resources

Discover financial empowerment resources

Mariposa is an AI agent built by Credit Canada, the country’s first and longest-standing non-profit credit counselling agency. Access free, 24/7 AI-powered financial advice and get a personalized debt assessment to help you take the next step toward being...

The tools provided by Autorité des marchés financiers can help guide financial planning for you and your...

Seeking help on tax filing and accessing benefits in Manitoba? Click on 'Access this resource' to visit the Community Financial Counselling Services website for more...

This glossary of investing terms put together by the Canadian Investment Regulatory Organization (CIRO) may be useful for new and seasoned investors...

The CRA has launched taxology podcasts. These weekly informal sessions address different topics whether you’re starting your first job, doing your first return, or need a refresher on the basics. CRA hosts talk to experts to share tips and answer top questions to help listeners understand the...

The Money Matters resources are for use at home and in workshops and activities that are also free for participants. These workbooks are available in several formats and languages. Topics include: Spending Plans Banking Basics Borrowing Money Ways to Save Smart Shopping Building...

The Dollars Seen Differently podcast breaks down financial topics to make them more accessible for people who are blind, Deafblind or have low vision. Hosted by Ryan Hooey, each episode features a down-to-earth conversation with financial experts, offering practical tips and resources on topics...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

Every day in Canada, nearly 1 in 4 people worry about eating, compromise on the quantity and quality of their groceries and/or go without food due to financial constraints. Food insecurity disproportionately impacts some groups, including Indigenous and racialized peoples, people with...

On August 5, 2024, FCAC relaunched its national, multi-media advertising campaign titled “Housing Costs on Your Mind?”. The campaign promotes FCAC’s tools and resources related to renting, buying a home and owning a home with a mortgage. The campaign runs until...

The Money Guidance Competency Framework sets out the core competencies needed to provide a safe, quality service for customers. It is designed for anyone who provides any type of money guidance whatever their sector or job role. The competency framework for Money Guiders sets out the skills,...

Have you ever wondered why people behave in certain ways, and how you can encourage positive outcomes? Behavioural insights is one tool that can support you to meet people where they are at. United Way partnered with the Behavioural Insights team of Canada to develop a course for the social sector,...

Credit Canada's new budget tool lets you select the items you want to cut out of your budget (lottery tickets, daily lunch out...) and then calculates how much you will save. Click on "Access this resource" to try it...

Make good financial decisions by getting the facts. Whether you’re deciding which account or credit card to choose, or figuring out if you can afford that mortgage this year or next, ATB has the tool or resource to help you get it right. Head to the ATB website to access these tools and...

No matter what type of investment you buy or advice you receive, you will be charged fees. There are many different types of fees and ways that you can be charged. Use this calculator by the Ontario Securities Commission to estimate how these fees can affect your investments over...

Visitors to the Learning Hub may read past copies of the quarterly Learning Hub Digest where we share quarterly updates to keep you informed on the latest financial empowerment, resources, research, and learning events. Issue 17: December 2025 Issue 16: September 2025 Issue 15: June 2025 Issue...

With frauds and scams on the rise, it's important for Canadians to recognize fraud and protect themselves from it. The Canadian Anti-fraud Centre has many resources on their website to help Canadians navigate fraud, how to recognize it and how to report...

Centering equity is key to the purpose and mission of any collective impact work, no matter the issue area or focus. It is very difficult to move population or systems change without redressing disparities that exist in almost every community. Part of the challenge is there is not one path to...

This free new course for newcomers consists of 4 short modules that should take 10-15 minutes each to complete. Each module includes short case studies, mini quizzes and other interactive elements. The topics for each module are: Essentials of credit in Canada How to build your credit...

In 2014, the government of BC declared October RDSP Awareness Month to help raise awareness about the Registered Disability Savings Plan (RDSP). The RDSP is the world’s first savings plan specifically designed for people with disabilities. Even with little to no personal contributions, there are...

A collaborative project with provinces to integrate economic, financial and enterprise education into the compulsory school curriculum. See the Building Futures in Manitoba, the Building Futures in Ontario and the new Building Futures in Alberta web sites for more information on these programs and...

Bridge to benefits: Implementing benefits access in social service has been created for organizations that are interested in starting, refining or expanding their work in access to benefits services. This includes benefits services such as helping to fill out applications, providing access to...

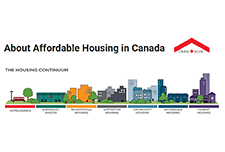

When the housing sector is efficient and well-functioning, the marketplace should be able to meet most people’s housing needs. Fortunately, Canada has one of the best housing systems in the world. As a result, almost 80% of Canadian households have their housing needs met through the marketplace,...

The banking industry has long recognized that it has a role to play strengthening the financial literacy skills of all Canadians. That’s why the CBA administers Your Money Seniors, a free, non-commercial seminar program developed in collaboration with the Financial Consumer Agency of Canada...

ABC Life Literacy Canada has unveiled the newest workbook from its HSBC Family Literacy First program, supported by HSBC Bank Canada. The workbook, entitled “Chug-a Chug-a Choo Choose”, includes a story and four new activities that teach children how to compare costs and identify needs and...