Discover financial empowerment resources

Discover financial empowerment resources

This CRA site has information on what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. There's also information on available tax filing...

The Canada Learning Bond is money that the Government of Canada adds to a Registered Education Savings Plan (RESP) to help pay the costs of full- or part-time studies after high school. If you are eligible for the Canada Learning Bond and have not already received it in an RESP, you will receive...

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of...

A free online course to learn about personal income taxes in Canada, developed by the Canada Revenue Agency. Contents include: Starting to work: Why you need a social insurance number (SIN), when to fill out a TD1 form, and what’s on your pay stub and T4 slip. Preparing to do your taxes:...

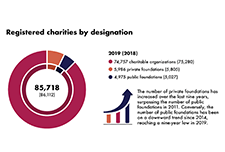

The charitable sector is a major social and economic force, offering vital services to Canadians and people around the world. The Canada Revenue Agency's Charities Directorate employs an education-first approach and client-centric philosophy. It aims to promote compliance with the charity-related...

Questions and answers released by the Canada Revenue Agency (CRA) about filing your taxes, including information on: Prior to filing your tax return changing your address getting someone else permission to access your tax information getting free tax help Filing your tax...

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada...

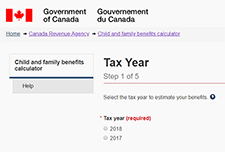

This online tool released by the Canada Revenue Agency can be used to determine the eligibility and payment amounts of child and family benefits. Additional information on child and family benefit programs may be found on the Canada Revenue Agency's child and family benefits...

The mandate of the Committee is to provide advice to the minister of national revenue and the commissioner of the Agency on: the administration and interpretation of the laws and programs related to disability tax measures; ways in which the needs and expectations of the disability community...

The purpose of the study was to obtain Indigenous perspectives on tax filing to identify barriers to filing and benefit uptake. The objective of the research was to develop a better understanding of the reasons that Indigenous Peoples may file, or not file, a tax return. The CRA intends to use the...

Nouveaux arrivants: Le saviez-vous? Il y a des prestations et des crédits auxquels vous pourriez avoir droit si: Vous avez un numéro d’assurance sociale. Vous produisez votre déclaration de revenus chaque année même si vous n’avez aucun revenu. Nous utilisons les renseignements qui...

A registered disability savings plan (RDSP) is a savings plan that is intended to help parents and others save for the long-term financial security of a person who is eligible for the disability tax credit...

This guide is intended for community organizations that are considering joining the Community Volunteer Income Tax Program. It covers the history of the program, how it operates, and offers valuable tips for organizations preparing tax clinics. It outlines the commitment expected from host...

Teaching Taxes introduces participants to Canada’s tax system and teaches them the practical skill of preparing an income tax and benefit return. Includes definitions, history of taxes, types of taxes in Canada, SIN numbers, how to fill in a tax...