Discover financial empowerment resources

Discover financial empowerment resources

A video on diversification and asset mix for investing. The full transcript is also...

When you work with an investment advisor, it is important to know your rights as an investor. Available in...

See the impact of markets ups, downs, and more based on historical data. Available in...

The first study of its kind measuring the impact of behaviorally informed advice on investor outcomes. It is common to seek the opinion of an expert when faced with a difficult decision. BEworks' research confirms this phenomenon in a range of consumer scenarios. For instance, parents faced with...

Visitors to the Learning Hub may read past copies of the quarterly Learning Hub Digest where we share quarterly updates to keep you informed on the latest financial empowerment, resources, research, and learning events. Issue 17: December 2025 Issue 16: September 2025 Issue 15: June 2025 Issue...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 19 years, AFN has provided a forum for grantmakers and financial institutions to connect, collaborate, and collectively invest in helping more people achieve economic security. The 2023...

If you’re curious about Canadians experiences with buying crypto assets, you’ll want to read the results of the OSC’s Crypto Assets 2023. It provides insights into the evolution of Canadians’ crypto ownership and knowledge. Read the 2022 crypto survey results...

Widespread household financial insecurity is an undeniably urgent crisis in the United States today. A stunning 51 percent of U.S. households have expenses that are equal to or greater than their income, and 55 percent lack the necessary savings to weather a simultaneous income drop and expense...

Saving is an important part of financial well-being. Saving money helps you manage short-term needs such as day-to-day spending. It protects you and your family during emergencies. It is the key to reaching your future hopes and dreams. Maybe you are recovering from a hard time financially and...

The forced transition from in-person to online activities as a result of the COVID-19 pandemic has had a profound impact on how families and communities buy groceries, acquire medical care, and utilize social services. This rapid shift has raised important questions about how to address access and...

If a recession seems likely, consider how your investing and savings plans may be affected. Increases in the cost of living and borrowing, combined with the overall financial uncertainty over the impact of a potential recession, can be enough to cause personal and financial stress. There is no...

This study by the Ontario Securities Commission examines Canadians’ crypto ownership and knowledge. It found 13% of Canadians currently own crypto assets or crypto funds. The study also found most Canadians did not have a working knowledge of the practical, legal and regulatory dimensions of...

Estimate your child(ren)'s future education costs, and see how your planned RESP savings, including contributions and grants, will cover those...

Ontario has just become the first province to open its legal gambling market to private internet gaming providers. As of April 4, 2022, Ontarians can play casino-style games online and place bets on sports, including single games, through sites regulated by iGaming Ontario. According to the...

American Indian and Alaska Native (AI/AN) peoples have long faced barriers to asset building. More than half of AI/AN populations are un- or underbanked, financial services often don’t operate on reservations, and access to capital is difficult. Native peoples have been excluded from financial...

The Tamarack Institute develops and supports collaborative strategies that engage citizens and institutions to solve major community issues across Canada and beyond. Our belief is that when we are effective in strengthening community capacity to engage citizens, lead collaboratively, deepen...

The P4P Planning Network was launched by Partners for Planning to support relatives, friends, or caregivers of a person with a disability with planning resources and tools. Resources on relationship building, school transitions, community involvement, financial objectives and more are shared and...

Over 50+ mayors in the United States have joined a national initiative Mayor’s for Guaranteed Income (MGI). Many advocates and practitioners now believe the moment has arrived for a guaranteed Income with an equity lens. In this webinar, perspectives from a diverse group of thought leaders...

The evolution of the wealth, assets and debts of various groups of Canadians since the late 1990s has been documented in several studies. Yet little is known about the evolution of the wealth holdings of unattached men and women aged 50 and older, who make up a large part of the population. This...

The Innovations in Financial Capability report is a collaborative report by National CAPACD and the Institute of Assets and Social Policy (IASP) at Brandeis University’s Heller School for Social Policy and Management, in partnership with Hawaiian Community Assets (HCA), and the Council for Native...

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos covers different financial literacy topics., including: What is an RRSP? What is a TFSA? What...

Children’s Savings Account (CSA) programs offer a promising strategy to build a college-bound identity and make post-secondary education an achievable goal for more low- and moderate-income children. CSAs provide children (starting in elementary school or younger) with savings accounts and...

This handbook covers the following topics: An understanding of why financial planning is important and how to align your financial objectives with your life goals and values. An overview of common financial planning components and tools available to individuals with a disability (including...

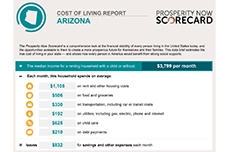

Prosperity Now has created state-level Cost-of-Living profiles as new features on their Scorecard website. The Prosperity Now Cost of Living profiles provide a comprehensive look at the financial stability of every person living in the United States. Each state profile can be downloaded and used to...

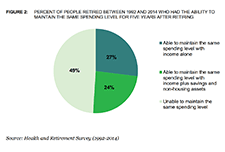

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level...