Discover financial empowerment resources

Discover financial empowerment resources

Drive through a low-income neighborhood in virtually any American city and it quickly becomes apparent that the area’s financial health is at risk. The giveaway? The abundance of payday lenders. According to the St. Louis Federal Reserve, there are now more than 20,000 of these organizations...

Ontario has just become the first province to open its legal gambling market to private internet gaming providers. As of April 4, 2022, Ontarians can play casino-style games online and place bets on sports, including single games, through sites regulated by iGaming Ontario. According to the...

Research shows that 15 percent, or close to five million Canadians, are underbanked, and three percent are completely unbanked, meaning that they have very limited or no access to financial services within the traditional banking sector. Ironically, underbanked individuals often come from...

High levels of household indebtedness in Canada has been a concern for policymakers at all levels of government over the past decade. As the economic costs of COVID-19 grow, household indebtedness becomes a faster growing and increasingly more serious concern. While responsive government...

ACORN Canada undertook a study focusing on high interest loans, especially when taken online. For the purpose of the study, high interest loans were defined as loans such as payday loans, installment loans, title loans etc. that are taken from companies/institutions that are not regular banks or...

Using pooled data from the 2012 and 2015 waves of the National Financial Capability Study (NFCS), this research finds that young adults who were required to take personal finance courses in high school were significantly less likely to borrow payday loans than their peers who were not. These...

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty...

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial...

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or...

This webinar, "High cost lending in Canada: Risks, regulations, and alternatives," is about why high cost lending products are concerning, especially for financially vulnerable Canadians. Speakers discuss what is driving the use of these products, what kind of regulations are involved, and what...

When household emergencies strike or there’s not enough in the bank to make it to the next paycheck, some families turn to small-dollar credit—small loans from alternative financial service (AFS) providers, such as payday lenders or pawnshops, or from mainstream sources. In October 2014, the...

This paper analyzes findings from a survey by ACORN Canada of a sampling of its membership to understand why they turn to alternative financial services such as high interest payday loans. The survey finds that the majority of the 268 respondents turn to these services as a last resort because they...

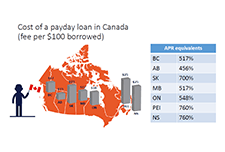

Payday loans are an expensive way for consumers to borrow money. The use of these short-term, high-cost loans has more than doubled in Canada recently to four percent of Canadian households. The Financial Consumer Agency of Canada (FCAC) has been tasked with raising public awareness about the costs...

This report provides an overview of the payday lending landscape in British Columbia compared to the rest of the country and explores the underlying factors contributing to the growth of the industry in recent years. It puts forth a series of recommendations to help ensure consumers have access to...

In 2014, the licensed Canadian payday loan industry provided nearly 4.5 million short-term loans to Canadian households, at a total value of $2.2 billion. Despite its unfavourable reputation, the licensed payday loans industry provides a necessary service for cash-strapped Canadians. Placing...

Financial vulnerability is not limited to the world’s poorest people or nations. Despite the United States’ relative wealth, many Americans are financially insecure, lacking either the ability to meet monthly bills or the necessary savings to cover unexpected expenses. Helping fragile consumers...

Despite the fact that, with only basic identification, all Canadians have the legal right to open a bank account, there has been an explosive growth in fringe financial institutions (FFIs) over the past decade or so which offer financial services such as cheque cashing, payday loans, and income...

Twelve million Americans take out payday loans each year, spending $9 billion on loan fees. The data included here provide facts on the market and borrower usage, plus a brief review of the Consumer Financial Protection Bureau (CFPB) proposed framework to regulate payday and auto title...

This is a short New York Times article on debt and the racial wealth gap - black Americans are more likely to experience debt issues than white...

Georgia has long struggled to rein in payday lenders, but even ambitious regulations can’t always stop the predatory practice. This is a brief article written for The New Yorker...

This guide summarizes banking practices in Canada, including opening an account, bank cards, and types of...

Since the early 1990s payday lending businesses have become increasingly prolific in most parts of Canada, including Calgary. Social agencies and advocates working to reduce poverty view payday lenders and other fringe financial businesses as problematic for those looking to exit the cycle of...

Alcohol overuse and poverty, each associated with premature death, often exist within disadvantaged neighbourhoods. Cheque cashing places (CCPs) may be opportunistically placed in disadvantaged neighbourhoods, where customers abound. This article explores whether neighbourhood density of CCPs and...

If you’re short on cash, a payday loan may seem like a quick way to get money, but there is a high cost. Fees on payday loans are generally much higher than those on other forms of credit, and they will take a big bite out of your budget. Make sure you have all the facts about a payday loan by...

The FDIC recognizes that public confidence in the banking system is strengthened when banks effectively serve the broadest possible set of consumers. As a result, the agency is committed to increasing the participation of unbanked and underbanked households in the financial mainstream. The FDIC...