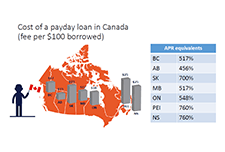

Payday loans are an expensive way for consumers to borrow money. The use of these short-term, high-cost loans has more than doubled in Canada recently to four percent of Canadian households. The Financial Consumer Agency of Canada (FCAC) has been tasked with raising public awareness about the costs of, and alternatives to, payday loans. FCAC conducted a national survey of 1,500 Canadian payday loan users to inform the Agency’s approach to educating consumers. This report presents the survey’s findings and FCAC’s planned actions to foster consumer understanding of (1) payday loan costs, (2) skills and resources to reduce the need to access payday loans and (3) resources for paying down debts and exiting a debt cycle.

Predatory Lending: A Survey of High Interest Alternative Financial Service Users