Discover financial empowerment resources

Discover financial empowerment resources

In Canada and the United States, approximately 1 in 5 children live in poverty, contributing to poor health outcomes. Families with children with chronic illness may experience additional financial stress related to hospitalization. This study aimed to capture experiences of financial needs and...

As cash use, access, and acceptance declines in Canada, vulnerable demographics are at risk of being left behind. For many, cash is more than just a method of payment. The growing pattern of electronic payments means that cash could become more scarce, threatening those who rely on it. While a...

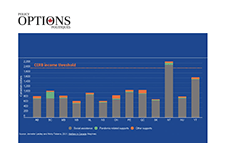

In 2020, the federal government spent over $160 billion on COVID-19 pandemic response measures. These expenses were critical in supporting recently unemployed workers and affected businesses in a time of uncertainty. However, supports through programs like the Canada Emergency Response Benefit...

This report examines the growing racial wealth divide for Black and Latino and the ways that accelerating concentrations of wealth at the top compound and exacerbate this divide. It looks at trends in wealth...

The Zambia Financial Diaries is a year-long panel study that collects data each week on all transactions performed by respondents - all sales and purchases, income earned from informal or formal labor, uses of financial tools, and exchanges of in-kind goods. The purpose of the study is to develop...

The report begins by defining and quantifying Canadian financial exclusion and then presents various theories offered to explain it. It then proceeds to provide a set of suggestions as to how banking services can become more relevant for low-income households. Finally, it runs through a set of...

The rise of economic inequality has become a staple of policy debates and stump speeches. Less visible is the way the rise has altered the landscape of America’s urban neighborhoods. Two books should help change that. Matthew Desmond, an urban sociologist at Harvard, has delivered a jolt with...

Deficits in appropriate and affordable housing may also interact with other forms of exclusion, creating cycles of increased exclusion and risk. In the current study, we consider the interaction between homelessness and access to mainstream financial services. The conceptual model proposes that,...

In June 2005, Social and Enterprise Development Innovations (SEDI), the Policy Research Initiative (PRI), and the Financial Consumer Agency of Canada (FCAC) organized Canadians and Their Money: A National Symposium on Financial Capability. The conference stemmed from an initial examination by SEDI...

There is a large and sophisticated industry of financial professionals available to give financial information and advice to Canadians who can afford their services, but Canadians with low or modest incomes and wealth lack the means to purchase that help. What’s more, sometimes mainstream...

Confused about how Canadian households are doing financially? Financial experts, policymakers, and media tell a conflicting story. What is really happening? This presentation is based on data from the Canadian Survey of Financial Capability in 2008 and 2014. It shows the state of Canadian financial...

To assess the current state of financial health in America and to glean insights that can inform cross-sector efforts to improve consumer outcomes, CFSI designed and commissioned a nationally representative survey focused on consumers’ financial behaviours, attitudes, and preferences. This report...

...

Financial exclusion is a matter of growing concern in Canada considering the decline in the number of mainstream bank branches in some inner-cities and the concurrent rise in the number of fringe banks. This study reports on results from a survey of residents from Winnipeg’s North End, a...

Concern about financial literacy is rising. But national surveys of financial literacy are not very helpful regarding the literacy characteristics of the poor. This case study uses the financial diary method to examine the financial literacies of 13 poor Canadians. The results found that most...