Discover financial empowerment resources

Discover financial empowerment resources

This Government of Canada dashboard lets you explore trusted data from 2019 onward. Examine trends on how Canadians manage their financial commitments, how they maintain emergency savings, and where...

With February 2025 the thirteenth Index Release, the Institute’s Financial Resilience Index Model complements the national Financial Well-Being Studies instrument and the Financial Well-Being Index Model instruments. Access this resource to read the...

Savings are one of the strongest predictors of household financial resilience and well-being, yet Canadian households struggle to save due to an array of economic, behavioural and institutional factors. The Financial Consumer Agency of Canada (FCAC) created the National Financial Literacy...

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

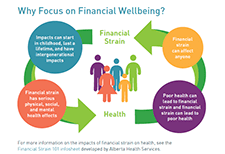

The Reducing the Impact of Financial Strain (RIFS) project is a ground-breaking collaboration between communities and their Primary Care Networks that aims to reduce financial strain as a barrier to health, particularly in areas of cancer, chronic-disease-management, and prevention. Did you know...

In their study, entitled, “Experiences of Financial Stress and Supports in Caregivers During Pediatric Hospital Admission,” Nadarajah et al interviewed caregivers of children admitted to a pediatric hospital and conducted qualitative analyses to assess financial needs, health related financial...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 19 years, AFN has provided a forum for grantmakers and financial institutions to connect, collaborate, and collectively invest in helping more people achieve economic security. The 2023...

Gender-based violence (GBV) is one of the most prevalent human rights issues in the world. Worldwide, an estimated one in three women will experience physical or sexual abuse in her lifetime. GBV is a multifaceted issue that undermines the health, dignity, security and autonomy of women and has a...

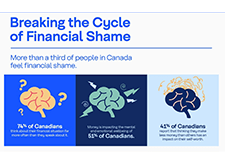

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

The weekly themes for Financial Literacy Month 2023 are: Week 1 (November 1-4): Get the pulse on your financial health – What is financial health and why is it important? Week 2 (November 5-11): Check up on your debt – Check up on your progress in managing and paying down debt. Week 3...

This Financial Resilience Institute report, authored by Eloise Duncan and commissioned by FP Canada and the Institut québécois de planification financière (IQPF) is being published for everyone with a stake in the financial resilience and well-being of Canadians. This study, leveraging the...

The Office of the Superintendent of Bankruptcy (OSB) is continuing its efforts to help Canadians experiencing serious financial difficulties find the right debt solution. These efforts include increasing consumer awareness about the unregulated Debt Advisory Marketplace and helping consumers...

A recent Prosper Canada report shows that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere...

World Elder Abuse Awareness Day takes place each year on June 15th and is a good opportunity to remind ourselves, friends and family about the importance of recognizing the signs of financial abuse and taking preventative measures. Older adults are often the target of financial abuse, but anyone...

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable,...

In 2022, the Consumer Price Index rose 6.8%, the highest increase since 1982 (+10.9%). Prices for day-to-day goods and services such as transportation (+10.6%), food (+8.9%) and shelter (+6.9%) rose the most. Canadians felt the impact of rising prices. Data from the Canadian Social Survey...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 18 years, AFN has provided a forum for grantmakers to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects their work over...

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day...

The ballooning cost of living has had a disproportionate impact on low-income households, 77.6% of whom are financially vulnerable or extremely financially vulnerable. Prosper Canada's recently commissioned study from the Financial Resilience Institute, shows the unarguable deteriorating state of...

This report is about the financial resilience and financial well-being of Canadians with low incomes based on the Seymour Financial Resilience Index ® It provides a call to action for more targeted support from policymakers, financial institutions and community non profit organizations for...

Drive through a low-income neighborhood in virtually any American city and it quickly becomes apparent that the area’s financial health is at risk. The giveaway? The abundance of payday lenders. According to the St. Louis Federal Reserve, there are now more than 20,000 of these organizations...

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey...

American Indian and Alaska Native (AI/AN) peoples have long faced barriers to asset building. More than half of AI/AN populations are un- or underbanked, financial services often don’t operate on reservations, and access to capital is difficult. Native peoples have been excluded from financial...

Having wealth, or a family’s assets minus their debts, is important not just for the rich— everyone needs wealth to thrive. Yet building the amount of wealth needed to thrive is a major challenge. Nearly 13 million U.S. households have negative net worth. Millions more are low wealth; they do...

Improving people’s financial circumstances has never been more critical. Disadvantaged population groups have experienced even higher levels of financial strain and poor financial wellbeing during the pandemic. This has negatively impacted their physical and mental health. To support efforts to...