Discover financial empowerment resources

Discover financial empowerment resources

Seeking help on tax filing and accessing benefits in Manitoba? Click on 'Access this resource' to visit the Community Financial Counselling Services website for more...

On August 5, 2024, FCAC relaunched its national, multi-media advertising campaign titled “Housing Costs on Your Mind?”. The campaign promotes FCAC’s tools and resources related to renting, buying a home and owning a home with a mortgage. The campaign runs until...

Make good financial decisions by getting the facts. Whether you’re deciding which account or credit card to choose, or figuring out if you can afford that mortgage this year or next, ATB has the tool or resource to help you get it right. Head to the ATB website to access these tools and...

Digital literacy skills have become essential. Computers and other digital devices are increasingly part of everyday life; they’ve changed how we do things, and they’re going to keep changing how we do things. To keep up, we need to keep learning so that we can continue to thrive at home, at...

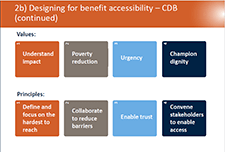

In this webinar you will learn about the barriers facing people with disabilities in accessing benefit programs and the work currently underway to identify, influence and pilot solutions to help advance the access to benefits process now and in the future. This webinar includes: - An...

The Canadian Bankers Association has created a new Cyber Security Awareness Quiz site to test your knowledge and ability to spot a “phishy” email, message or...

A Tax-Free Savings Account (TFSA) can be used to save for any goal. You put after-tax dollars into a TFSA, but your investments grow tax-free and you won’t pay any tax on withdrawal. Use this calculator to estimate the value of the investments in your TFSA when you’re ready to withdraw them,...

Using OSC's online calculator, find out how your investment will grow over time with compound...

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Ideally, this fund would provide enough money to cover your essential living expenses so you can avoid taking on...

This course is offered by the Canadian Foundation for Economic Education, a non-profit organization that works to improve economic, financial, and enterprising capability. This financial literacy course for general audiences covers a range of topics: money basics and the economy, setting goals and...

Global Learning Partners (GLP) helps individuals and organizations to learn by providing practical expertise in learning assessment, design, facilitation and evaluation. Their connecting virtually toolkit covers a variety of topics to learn, teach and connect in a virtual world. The resources...

These resources from the Ontario Securities Commission are oriented towards planning for retirement. Resources include tips on insurance planning, government benefits, RRSP calculator, and...

This infographic is a preview of Commonwealth's research survey of 1290 lower-and moderate-income people to understand their perceptions, needs, and uses of conversational...

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to...

OpportuNext from The Conference Board of Canada is a free-to-use career tool created in partnership with the Future Skills Centre. The tool can be used by anyone looking to plan a career path with a similar skillset or for anyone providing employment...

The Financial Relief Navigator is an online tool that can help you find support to raise your income or lower your expenses in these challenging times. The tool will suggest income benefits or other support programs you may be eligible for in your province/territory in...

Collection of money management resources, including how create effective budgets, realistic spending plans, deal with your debts, save more money, build a stronger credit rating, and prepare for...

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s...

This interactive tool created by Statistics Canada allows you to explore your personal rate of inflation, based on the goods and services you consume. The Consumer Price Index (CPI) is the official measure of inflation in Canada. It is representative of the change in prices experienced by the...

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step...

The Disability and Employment eLearning Task Force in collaboration with the Employment and Training Administration (ETA) released three eLearning Training Modules to help support the professional development needs of the workforce development staff across the United States. The first module...

L’Explorateur d’allègements financiers : un outil pour connaître les mesures d’aide et d’allègement liées à la COVID-19 dont vos clients pourraient bénéficier En réponse à la pandémie de COVID-19 et en raison de la complexité des mesures d’aide et d’allègement offertes à...

In response to the COVID-19 pandemic and the complexities of the benefits and financial relief measures available to Canadians, we developed the Financial Relief Navigator (FRN), an online resource that helps vulnerable Canadians and those that work with them access critical emergency benefits and...

The Financial Literacy Outcome Evaluation Tool offers organizations a collection of evidence-based financial literacy outcomes and indicators. The tool guides users through a series of questions about their program and evaluation goals and then suggests scales (sets of questions) and individual...

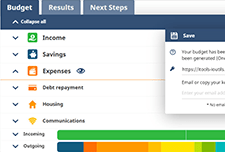

The Financial Consumer Agency of Canada (FCAC)'s online tool helps you create a customized...