Discover financial empowerment resources

Discover financial empowerment resources

Seeking help on tax filing and accessing benefits in Manitoba? Click on 'Access this resource' to visit the Community Financial Counselling Services website for more...

Almost all participants (Canadians and community-based organisations (CBOs)) voiced support for the idea of automatic enrolment because it would improve access to the benefit by streamlining the enrolment process for all eligible recipients. As eligible youth are from families experiencing low...

The Canada Learning Bond is money available to children and youth born in 2004 or later from low and moderate income families. You can get up to $2000 from the Government of Canada by opening an Registered Education Savings Plan (RESP). You can access this money when you enroll in full-time or...

There are many good reasons to keep up to date on your tax filing each year. You may file a tax return even if you don’t have any income. It could help you access certain refundable tax credits and other...

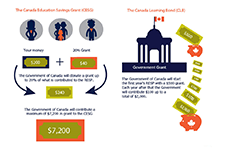

Saving for your child’s education can be difficult, especially if you are trying to save for multiple goals or pay down debt at the same time. The federal government offers contributions to your child’s Registered Education Savings Program (RESP) through its grant programs: the Canada...

The Canada Learning Bond (CLB) is money that the Government adds to a Registered Education Savings Plan (RESP) for children from low-income families. This money helps to pay the costs of a child’s full- or part-time studies after high school at apprenticeship programs, CEGEPs, trade schools,...

The Canada Education Savings Program (CESP) recently developed a Toolkit for Public Primary Caregivers to help child welfare organizations open Registered Education Savings Plans (RESPs) and access the Canada Learning Bond (CLB) for children in care. Most children in care automatically qualify...

The Canada Learning Bond is money that the Government of Canada adds to a Registered Education Savings Plan (RESP) to help pay the costs of full- or part-time studies after high school. If you are eligible for the Canada Learning Bond and have not already received it in an RESP, you will receive...

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open...

The ability to build assets allows an individual or family to meet long-term financial goals and create economic stability for the future. This toolkit contains resources on goal setting, action planning and information on financial products and government supports that can help with building...

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of...

This two-page brochure describes the benefits of acting now to receive $500 to help start saving for a child's education after high school. The brochure is also available in the following Indigenous languages: Canada Learning Bond – Cree Canada Learning Bond – Denesuline Canada Learning...

This fact sheet from the Government of Canada answers Frequently Asked Questions about the Canada Education Savings Plan. This includes details about the Canada Learning Bond, the Canada Education Savings Grant, and Registered Education Savings Plans...

This fact sheet from ESDC explains how to open an RESP and access the Canada Learning...

Not having a Social Insurance Number (SIN) and not filing taxes may represent challenges to access government programs and supports such as the Canada Education Savings Grant (CESG) and the Canada Learning Bond (CLB). Limited data availability has prevented a full assessment of the extent of these...

Answer the questions in this Government of Canada online tool to get a customized list of benefits for which you may be eligible. The Benefits Finder may suggest benefits from federal, provincial or territorial...

This webinar shares results on Statistics Canada research on barriers to uptake for the Canada Learning Bond (CLB). Specifically, this research examines whether tax filing or Social Insurance Number (SIN) access are greater barriers to accessing the CLB. Read the slides which accompany this...

Introduced in 1998, the Canadian Education Savings Program (CESP) was designed as an incentive to encourage education savings for the post-secondary education of a child. The program is centred on Registered Education Savings Plans (RESPs), where savings accumulate tax-free until withdrawn, to pay...

This is a one-hour webinar on increasing take up of Registered Education Savings Plans (RESPs) among people on low incomes. Our panelists share challenges and success stories in their work to help clients save for their children’s post-secondary education. Learn successful outreach strategies,...

Children’s education savings accounts are a vital tool in boosting high school completion rates, increasing post-secondary education attainment, and reducing poverty. Research shows that saving for a child’s education is connected to improved child development, greater educational and career...

The Canada Learning Bond (CLB) is an educational savings incentive that provides children from low income families born in 2004 or later with financial support for post-secondary education. Personal contributions are not required to receive the CLB, however take-up remains low among the eligible...

This one-page fact sheet tells you everything you need to know to make your child's future possibilities grow! The Canada Learning Bond (CLB) is a grant of $500 up to $2000 from the Government of Canada to eligible families to help with the cost of a child’s education after high school. It...

This case study is about the Omega Foundation’s SmartSAVER program. It has effectively elevated the Canada Learning Bond (a post-secondary education savings program for low income families) from a struggling idea to a fully-fledged and well-utilized national resource. In so doing, Omega and...