Discover financial empowerment resources

Discover financial empowerment resources

This infographic provides a helpful visual summary of tax benefits that can add to income or reduce the taxes people in Canada pay when they file their tax return. The information is especially useful for people in Canada who: Are working or living on a low income; Live with a...

The Canada Disability Benefit website is managed by Plan Institute, a national non-profit organization based in Burnaby, BC. The purpose is to provide individuals, families, and professionals across Canada with up-to-date information and resources on the Canada Disability Benefit (CDB). Their...

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

This publication is an outreach product to help promote the program "How to open a Registered Disability Savings Plan (RDSP) for yourself or a loved one with a disability". This infographic was created in response to feedback from stakeholders and was designed in collaboration with experts in...

The report presents a summary of CDSP annual statistics up to the end of 2022. These include the RDSP take-up rates, the number of RDSP beneficiaries, and the values of CDSB, CDSG, contributions, and total assets. Starting in 2024, the program will release comprehensive CDSP statistics on an annual...

In 2014, the government of BC declared October RDSP Awareness Month to help raise awareness about the Registered Disability Savings Plan (RDSP). The RDSP is the world’s first savings plan specifically designed for people with disabilities. Even with little to no personal contributions, there are...

This infographic by community food centres Canada provides a helpful visual summary of tax benefits that can add to income or reduce the taxes Canadians pay when they file their tax return. The information is especially useful for people: Working or living on a low income; Living with a...

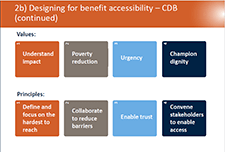

In this webinar you will learn about the barriers facing people with disabilities in accessing benefit programs and the work currently underway to identify, influence and pilot solutions to help advance the access to benefits process now and in the future. This webinar includes: - An...

Canada’s Disability Inclusion Action Plan is a comprehensive, whole-of-government approach to disability inclusion. It embeds disability considerations across our programs while identifying targeted investments in key areas to drive change. It builds on existing programs and measures that have...

Residents in Canada who have a severe and prolonged mental or physical disability are eligible for the Disability Tax Credit (DTC). This opens the door to other programs, one of which is the RDSP. Less than one-third of eligible residents in Canada (up to age 59) have a Registered Disability...

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to...

In November 2017, the Minister of National Revenue, the Honourable Diane Lebouthillier, announced the creation of the Disability Advisory Committee to provide advice to the Canada Revenue Agency (CRA) on interpreting and administering tax measures for persons with disabilities in a fair,...

This report, Roadblocks and Resilience Insights from the Access to Benefits for Persons with Disabilities project, provides insights on the barriers people with disabilities in British Columbia face in accessing key income benefits. These insights, and the accompanying service principles that...

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered...

One in five Canadians are currently living with a disability. This infographic provides an overview of financial programs for people with disabilities in Canada based on findings in Morris et al. (2018) "A demographic, employment and income profile of Canadians with disabilities aged 15 years and...

Benefits and credits provide income and financial support for many individuals. This toolkit contains information on common tax credits and benefits, benefits for specific populations, and practitioner resources including case studies and information on identification documentation for accessing...

Answer the questions in this Government of Canada online tool to get a customized list of benefits for which you may be eligible. The Benefits Finder may suggest benefits from federal, provincial or territorial...

The mandate of the Committee is to provide advice to the minister of national revenue and the commissioner of the Agency on: the administration and interpretation of the laws and programs related to disability tax measures; ways in which the needs and expectations of the disability community...

The Disability Tax Credit helps Canadians by reducing the amount of income tax they are required to pay. The Registered Disability Savings Plan helps people with a disability or their caregiver save for the future by putting money into a fund that grows tax free until the beneficiary makes a...

Disability supports should be designed to provide benefit and not burdens to eligible recipients. Unfortunately, this is not a reality when it comes to one of the main benefits open to Canadians with disability: the federal Disability Tax Credit (DTC). Designed to recognize some of the higher...

When the government establishes a social program whose primary purpose is to help provide support to low-income people with disabilities, its success should be measured on how well it achieves that purpose. Unfortunately, there are reasons to seriously question the usefulness of Canada’s...