Discover financial empowerment resources

Discover financial empowerment resources

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

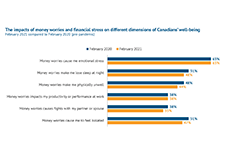

This brief discusses how more financially vulnerable Canadians are most challenged based on the Seymour Financial Resilience Index TM. This E-Brief builds on Statistics Canada Canadians' Well-being in Year One of the COVID-19 Pandemic report and Seymour’s February 2021 Index Release...

As stated in the Poverty Reduction Act, the Market Basket Measure (MBM) is now Canada’s Official Poverty Line. The Northern Market Basket Measure (MBM-N) is an adaptation of the MBM that reflects life and conditions in two of the territories – Yukon and Northwest TerritoriesNote. As with...

Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. This survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response...

Practitioners engaged in the nascent field of financial development lack a shared system of tracking and analyzing customer progress toward financial security. Practice leaders—ranging from direct service organizations such as the Chicago-based LISC to NeighborWorks America of Washington,...

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these...

Millennials (individuals age 18–37 in 2018) are the largest, most highly educated, and most diverse generation in U.S. history This paper assesses the financial situation, money management practices, and financial literacy of millennials to understand how their financial behaviour has changed...

This study presents findings from a measurement of financial literacy using questions assessing basic knowledge of four fundamental concepts in financial decision making: knowledge of interest rates, interest compounding, inflation, and risk diversification. Worldwide, just one in three adults are...

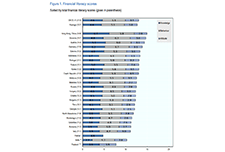

This report provides measures of financial inclusion including elements of financial resilience and a newly-created score on financial well-being. Twenty-six countries and economies, including 12 OECD countries, participated in this international survey of financial literacy, using the 2018...

Financial education has become an important complement to market conduct and prudential regulation and improving individual financial behaviours a long-term policy priority in many countries. The OECD and its International Network on Financial Education (INFE) conducts research and develops tools...

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to...

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults,...

The Common Foundations are a minimum standard for how to do impact measurement without prescribing a particular tool or approach. This can help to overcome a widespread challenge of grantmakers, donors, lenders and investors imposing impact measurement approaches on the social purpose organizations...

This brief describes the data collected and lessons gleaned from the Financial Coaching Impact & Evaluation Fellowship, which took place over the course of 10 months in 2017. Ultimately, this brief argues that the Financial Well-Being Scale and the Financial Capability Scale are promising...

In this video presentation Katherine Scott from the Canadian Council on Social Development (CCSD) shares the new Neighbourhood Financial Health Index, a mapping tool which uses composite data about income, assets, debt, and poverty to show levels of financial health at the neighbourhood...

The Center for Financial Security (CFS) and Annie E. Casey Foundation have developed a short set of standardized client outcome measures to create the Financial Capability Scale (FCS). In 2011, CFS worked with four organizations to collect data on client outcome measures, with the goal of...

This working paper compares three commonly used measures of low income used in Canadian poverty analysis. It is the fourth in a series of working papers intended to promote a discussion by participants in our Sounding Board and others. Thresholds and incidences of low-income for the Low Income...

Low income lines are the most commonly used tool for defining and measuring poverty. They provide thresholds below which a household is considered to be living on low income. Low income lines can be constructed in different ways. This brief explains the LICO (Low income cut-off), LIM (Low income...

The intention at the time of the creation of the Market Basket Measure was that the content of the basket and its definition of disposable income would be reviewed once several years of data had been collected using the original measure. This was necessary to ensure that it continued to embody a...

This is a report on child poverty in British Columbia and connections to the working poor, employment insecurity, living on low incomes, and gives policy recommendations to respond to this...

Grande Prairie is not unique from other communities in that poverty and its effects can pose a challenging obstacle in the journey towards sustainability. In recognition of the need to address poverty within the community, Grande Prairie’s Community Action to End Poverty (CAEP) Committee was...

Almost all poverty measures commonly used in Canada work by setting a dollar amount – a poverty line – below which a household is said to be in poverty, above which a household is not considered poor. But when we measure poverty only according to income, we may incorrectly assess whether or not...

To date no meta-analysis specific to Canada has been done to consider effectiveness in financial literacy programming and evaluation among existing financial literacy resources. This research project, therefore, seeks to explore the following: Issues in effective delivery of financial literacy...

This study aims to validate the results of a 2012 pilot study that developed a short instrument to measure financial capability, using national survey results as reference point. More importantly, this study also develops a numerical scoring system to provide respondents with a transparent and easy...