Discover financial empowerment resources

Discover financial empowerment resources

Prosper Canada's comprehensive report, Closing the Divide: Solutions for Canada's Financial Help Gap, sets out clear steps governments, financial services, and community organizations can take to ensure every Canadian – no matter who they are or where they live – can access the financial help...

When you work with an investment advisor, it is important to know your rights as an investor. Available in...

Financial Services Regulatory Authority’s role, as a regulator, is to ensure that insurance companies’ proposed rates are fair and not excessive. This website will help you learn about: What to do after an accident How to save on auto insurance Filing a complaint Getting an auto...

This guide, prepared by FAIR Canada, will help consumers who have complaints against their bank or investment firm and want to be financially compensated for their losses. This guide provides and overview of external complaint-handling systems that may be available when seeking compensation. It is...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 19 years, AFN has provided a forum for grantmakers and financial institutions to connect, collaborate, and collectively invest in helping more people achieve economic security. The 2023...

FAIR Canada engaged The Strategic Counsel (TSC), a national market research firm, to undertake focus groups to better understand Canadian investors. The overall purpose of this research is to provide a broad portrait of Canadian investors including their knowledge, attitudes, behaviours, and...

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable,...

If you have a complaint, it is important you fully understand your rights, so that you don’t feel taken advantage of during the process. After reading the guide, you will: ● Know how and who to contact when you first make a complaint. ● Understand your basic rights during the process,...

People save for different reasons. For instance, you may want to save for emergencies, or for your children’s education, or for your old age. Having goals for your savings helps to keep you motivated. You sleep better knowing you have some money set aside. Saving accounts earn interest. That...

When it comes to investing, there are many considerations to make before choosing if and what types of investments are best for your situation. This webinar explores the topic of investor education and consumer protection for financially vulnerable Canadians. We'll start by discussing the basics...

Today’s investment landscape offers such a range of products, investing tools, and information that the average investor may feel overwhelmed. As advancements in technology continue to accelerate, new online investing platforms and opportunities are showing no signs of slowing down any time...

Recover and Rebuild: Helping Canadians build financial security during the pandemic and beyond The 2021 ABLE Financial Empowerment (FE) virtual series is a collection of online financial empowerment events designed to provide frontline FE practitioners, FE stakeholders, policy-makers and...

The federal budget released on April 19, 2021 covers the Canadian government's plan for: Part 1 - Finishing the Fight Against COVID-19 Chapter 1: Keeping Canadians Healthy and Safe Chapter 2: Seeing Canadians and Businesses Through to Recovery Part 2 - Creating Jobs and...

In November 2017, the Minister of National Revenue, the Honourable Diane Lebouthillier, announced the creation of the Disability Advisory Committee to provide advice to the Canada Revenue Agency (CRA) on interpreting and administering tax measures for persons with disabilities in a fair,...

The DUCA Impact Lab defines fair banking as any financial product or service that lives up to the following set of principles: Pricing is clear, transparent, and well understood Pricing is representative of the cost of funds, cost of administration and risk, rather than what the market will...

Canadians living in households that experienced food insecurity (insecure or inadequate access to food because of financial constraints) during the early months of the COVID-19 pandemic were significantly more likely to perceive their mental health as fair or poor and to report moderate or severe...

The current pandemic has reinforced the need for additional information on the health of Canadian children and youth, particularly for those younger than age 12. Results from the new Canadian Health Survey on Children and Youth (CHSCY) indicate that 4% of children and youth aged 1 to 17, as...

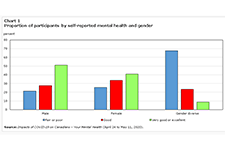

Previous research has demonstrated that the COVID-19 pandemic is negatively affecting the mental health of Canadians. Today, a new study highlights gender differences in the pandemic's impacts on the mental health of participants in a recent crowdsourcing survey, conducted by Statistics Canada...

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of...

As the need for basic income grows, the Basic Income Canada Network (BICN) is often asked how Canada could best design and pay for it. To answer that in a detailed way, BICN asked a team to model some options that are fair, effective and feasible in Canada. The three options in this report do just...

Everyone needs to bank and nearly everyone has a relationship with at least one financial institution. Financial Institutions need relationships with consumers too, in order to thrive as businesses. The role these relationships play in financial decision making for Canadians is an important...

The Investor Protection Clinic, the first clinic of its kind in Canada, provides free legal advice to people who believe their investments were mishandled and who cannot afford a lawyer. The Clinic was founded together with the Canadian Foundation for Advancement of Investor Rights (FAIR Canada),...

This is a pre-budget presentation from the Government of Canada on the state of the middle class in Canada. Middle class challenges, successes, and government commitments. All Canadians benefit from strong, sustained, and inclusive economic growth and everyone has a real and fair chance at economic...

This paper examines small-dollar credit alternatives to the current payday-loan product in the province of Alberta. While we recognize that most people have credit requirements from time to time, the unbanked and underbanked who can least afford to do so are forced to obtain credit under the...

This report quantifies the benefit of the ILA model through a return on investment calculation. Feedback from current partners of the ILA was also gathered in an attempt to reflect the strengths and weaknesses of the model in order to evaluate the potential of bringing these benefits to scale. This...