Discover financial empowerment resources

Discover financial empowerment resources

Momentum is a Calgary-based community organization that works with people living on low incomes and partners in the community to create a thriving local economy for all. For over 20 years, Momentum has offered matched savings programs that build financial stability by working with participants to...

This collection of financial empowerment tools and resources is intended to support both Indigenous and non-Indigenous organizations working to build financial wellness in First Nation communities. It was created as part of the Financial Wellness in First Nations project (2021-2023) where...

How we define financial vulnerability ultimately determines what supports are created and for whom. Is the current definition aimed at helping everyone who needs it? This webinar explores the conception and redefining of financial vulnerability in Canada based on the research and findings from the...

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open...

The money management courses are offered online, on demand, for free. Learn at your own pace and on your own schedule on a variety of topics, including: budgeting credit assets banking consumerism education...

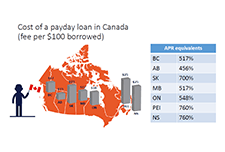

As part of Momentum’s systems change planning process that was grounded in both participant and community experience, the issue of payday loans and other forms of high-cost credit (e.g., pawn, installment, rent-to-own, title and car loans) emerged as a priority issue for Momentum to address the...

Nonprofit organizations in Canada were significantly impacted by COVID-19, including lost revenue and needing to adjust the program delivery. The lack of technology capacity in the nonprofit sector is a key barrier for many nonprofit organizations to adapt to delivering programs online. Momentum, a...

Saving is an important part of financial well-being. Saving money helps you manage short-term needs such as day-to-day spending. It protects you and your family during emergencies. It is the key to reaching your future hopes and dreams. Maybe you are recovering from a hard time financially and...

Making the transition from in-person to virtual program delivery has become a necessary step in continuing financial empowerment services during these times of physical distancing. Financial education workshops are a valuable part of any financial empowerment program, and there are many different...

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular...

Benefits and credits provide income and financial support for many individuals. This toolkit contains information on common tax credits and benefits, benefits for specific populations, and practitioner resources including case studies and information on identification documentation for accessing...

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province,...

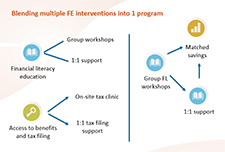

There are many different ways to deliver financial empowerment programs. Financial literacy education, financial coaching, and matched savings programs can be successfully delivered independently, with successful outcomes for participants. They can also be blended together to accomplish several...

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through...

In this toolkit you'll find materials to help you learn about what's involved in tax filing, and some materials to support setting up your own community tax clinic. Find the income tax package for the province or territory where you resided on December 31st of the taxation...

This is a one-hour webinar on matched savings programs and personal savings strategies that work for people living on low incomes. Our panelists share experiences from their programs in Ontario and Calgary. The presenters in this webinar are: Dean Estrella, Momentum, Calgary, AB John...

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or...

Through the Group RESP Research and Education Project, SEED Winnipeg, Momentum (Calgary), the Legal Help Centre of Winnipeg, and an interdisciplinary research team studied the regulation of group plan RESPs and the experiences of low-income subscribers, and developed public legal education...

This document explains the basics of group RESPs, including what they are, what they may cost, what you need to know about your group RESP if you are already enrolled in a plan, and how to figure out your options. Read more about the research behind these materials...

This webinar, "High cost lending in Canada: Risks, regulations, and alternatives," is about why high cost lending products are concerning, especially for financially vulnerable Canadians. Speakers discuss what is driving the use of these products, what kind of regulations are involved, and what...

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty...

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial...

A considerable momentum has developed around the perceived need for a national affordable housing strategy. The design of any such strategy should recognize who is in need, the size of the need, and where that need is greatest. This report presents facts on the affordability of housing for those...

Overcoming Poverty Together: The New Brunswick Economic and Social Inclusion Plan, 2014-2019, builds on the momentum of New Brunswick’s initial economic and social inclusion plan launched in 2009. It serves as a roadmap for the province to move towards economic and social inclusion for all. The...

As we hurtle towards a human community of 9.7 billion people by the year 2050, coupled with new technologies and the growing challenges of our planet’s carrying capacity, there is more and more discussion of systems and how they change or are created. The post-war era has witnessed an...