Discover financial empowerment resources

Discover financial empowerment resources

When immigrants arrive in Canada, they face many financial challenges. From opening a bank account to using a credit card, from buying a house to paying for insurance, they may find it difficult to navigate the nuances of Canadian markets. Newcomers rely on industry professionals to assist them in...

Maytree released the 2020 edition of the Welfare in Canada report. For each province and territory, this report provides data and analysis on the total welfare income that households receiving social assistance would have qualified for in 2020, including COVID-19 pandemic-related supports. Welfare...

NB Social Pediatrics and the Saint John Community Loan Fund recently surveyed 157 New Brunswick and Nova Scotia residents about their experiences with finances, banking, and ID to better understand if biometrics or ID banks could be effective solutions for people living without ID. Eyeing the...

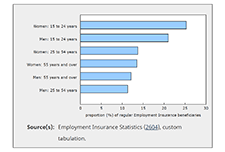

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and...

This report costs poverty based on three broad measurable components: opportunity costs, remedial costs and intergenerational costs. The authors state that these costs could potentially be reallocated, and benefits could potentially be realized if all poverty were eliminated. The total cost of...

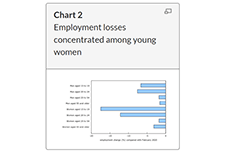

February Labour Force Survey (LFS) data reflect labour market conditions during the week of February 14 to 20. In early February, public health restrictions put in place in late December were eased in many provinces. This allowed for the re-opening of many non-essential businesses, cultural and...

The 2020 State of the Child Report includes six recommendations and gives a snapshot of some of the challenges New Brunswick children and youth will have to overcome as the province moves forward and juggles the new realities of public health measures to prevent the spread of COVID-19 while...

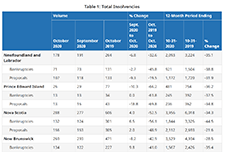

The Office of the Superintendent of Bankruptcy Canada releases statistics on insolvency (bankruptcies and proposals) numbers in Canada. The latest statistics released on November 4, 2020 show that the number of insolvencies in Canada increased in the third quarter of 2020 by 7.9% compared to the...

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit...

In response to the COVID-19 pandemic and the complexities of the benefits and financial relief measures available to Canadians, we developed the Financial Relief Navigator (FRN), an online resource that helps vulnerable Canadians and those that work with them access critical emergency benefits and...

The Social Assistance Summaries series tracks the number of recipients of social assistance (welfare payments) in each province and territory. It was established by the Caledon Institute of Social Policy to maintain data previously published by the federal government as the Social Assistance...

The new Economic and Social Inclusion plan for New Brunswick builds upon progress accomplished over the past 10 years. It includes nine priority actions divided into three pillars: Income Security: includes actions addressing improvements to social assistance, changes to the Employment...

These reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and territory....

This report examines the financial health and vulnerability of households in Canada’s 35 largest cities, using a new composite index of household financial health at the neighbourhood level, the Neighbourhood Financial Health Index or NFHI. The NFHI is designed to shine a light on the dynamics...

This report's release was part of Child Rights Education Week and also in celebration of the 30th anniversary of the United Nations Convention on the Rights of the Child (UNCRC). 2019 was declared the International Year of Indigenous Languages by the United Nations. The report contains an overview...

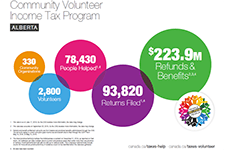

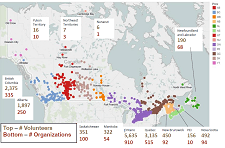

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les...

In this toolkit you'll find materials to help you learn about what's involved in tax filing, and some materials to support setting up your own community tax clinic. Updated June 10, 2024 Demystifying the Disability Tax Credit Updated March 19, 2024 Tax season prep Updated February 23,...

The research symposium "Overcoming barriers to tax filing for people with low incomes" was held in Ottawa on Thursday, February 7, 2019, hosted by Prosper Canada and Intuit. The symposium presents research results and insights from practitioners in the field on barriers to tax filing experienced...

For Canadians living with low incomes, tax filing is an important opportunity to boost incomes by accessing a wide range of government benefits. In this webinar, "Insights on hosting volunteer income tax clinics," experts in Canada share their knowledge and practices on what it takes to host...

Overcoming Poverty Together: The New Brunswick Economic and Social Inclusion Plan, 2014-2019, builds on the momentum of New Brunswick’s initial economic and social inclusion plan launched in 2009. It serves as a roadmap for the province to move towards economic and social inclusion for all. The...

This series summarizes the poverty reduction strategies now in place or in development in provinces and territories across Canada. Details were gathered from public documents made available by the profiled jurisdiction. This paper details the New Brunswick...

In this presentation, Althea Arsenault, Manager of Resource Development, NB Economic and Social Inclusion Corporation, shares insights from the 'Get Your Piece of the Money Pie' tax clinic program. This program has operated since 2010, and currently files over 23,000 returns each year. This...

Fraudsters often use emotions to lure people in, making a person feel afraid of missing out on an opportunity that others are profiting from. With all the cryptocurrency hype in the media and online, it’s no surprise that scammers are taking note and trying to cash in on investors’ interest...

This toolkit contains resources and information which may offer support to organizations, agencies, or frontline staff supporting individuals, during a challenging time. This toolkit has been made possible through funding by the Canadian Investment Regulatory Organization (CIRO) and is now...