Discover financial empowerment resources

Discover financial empowerment resources

This 90-minute webinar provides frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and opportunities for...

This 90-minute webinar provided frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learned the importance of access to benefits for individuals and families, reviewed key skills and opportunities for...

The Embedded Financial Coaching project builds on evidence that embedding financial coaching into employment services leads to stronger employment and financial well-being outcomes. This report provides insights on the project components including delivering financial coaching services, developing...

The Working Centre in Kitchener-Waterloo has been dedicated to aiding marginalized populations for over 40 years. In partnership with Prosper Canada, it embarked on an initiative to connect the populations they serve to government benefits and tax filing support. Recognizing the intricate...

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

This 40-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

The external evaluation firm, Taylor Newberry Consulting, evaluated the Benefits Wayfinder between June 2022 and January 2024. This infographic showcases the feedback received based on feedback collected from 500 users and over 35 organizations across Canada. Impact: L'orienteur en mesures...

This 60-minute webinar for frontline practitioners, social service providers, and funders shares insights from a two-year project designed to help build financial wellness in isolated and rural First Nation communities in Manitoba and Ontario. Partnerships between First Nation communities and...

This 90-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

If you work with people in Canada living on low incomes, you can play a meaningful role in supporting access to benefits regardless of your expertise or sector. Prosper Canada identified 36 barriers that individuals living on low incomes face when trying to access benefits. More than half of the...

The overall purpose of the collaborative project between Seneca College and Prosper Canada was to build a supportive booking system for tax clinics serving low-income...

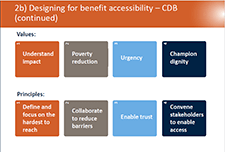

This report provides insights from the project, including highlighting the challenges people with disabilities in British Columbia face in their journey to get income benefits, the opportunities to remove those barriers and implications for future benefits design. The demand for access to benefits...

Community organizations play a vital role in supporting people. In these difficult economic times, helping community members strengthen their financial literacy and build their financial resilience is essential for helping them to navigate financial challenges. Building on Financial Consumer...

This toolkit was created to support the Virtual Self Filing tax filing model piloted in 2020-2022 by Canadian community agencies. In this model, individuals file their own tax returns, but receive support from community agency staff or volunteers to do so. In 2023, this toolkit was updated to...

Increasing Access to Benefits for Peoples with Disabilities project - Insights and Recommendations This 60-minute webinar for front line practitioners and government agencies shares the insights and recommendations from the three-year Increasing Access to Benefits for Peoples with Disabilities...

Organizations play a vital role in providing community members with access to benefits. Tax clinics, homeless shelters, food banks, health centres and others can all do their part to provide these services. This free 60-minute demonstration will showcase our new Bridge to Benefits tool which...

This webinar provides frontline practitioners with recently created tools to support Canadians who are living on a low income to manage their money and learn about saving and investing. Participants will be taken on a guided tour of our new Making the most of your money online course and then...

A recent Prosper Canada report shows that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere...

When Canadians have a financial problem, want to make a financial plan, or need help with their taxes, most simply reach out to their financial institution, adviser, accountant, or commercial tax preparer for the help they need. But who do low-income individuals turn to? A new report by Prosper...

Bridge to benefits: Implementing benefits access in social service has been created for organizations that are interested in starting, refining or expanding their work in access to benefits services. This includes benefits services such as helping to fill out applications, providing access to...

Searching for government benefits can feel like wading through a huge ocean of information. With so many benefits programs out there, it can be hard to know where to start. This webinar will teach you how to help people seeking ways to boost their incomes and/or reduce their expenses by...

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share...

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable,...

In this webinar you will learn about the barriers facing people with disabilities in accessing benefit programs and the work currently underway to identify, influence and pilot solutions to help advance the access to benefits process now and in the future. This webinar includes: - An...

People save for different reasons. For instance, you may want to save for emergencies, or for your children’s education, or for your old age. Having goals for your savings helps to keep you motivated. You sleep better knowing you have some money set aside. Saving accounts earn interest. That...