Since the 2015 election, the Liberal government has made two major adjustments to federal

programs targeted at children and youth. First, the uniform payment to every family with

children was replaced by the new Canada Child Benefit, a benefit worth more to lower

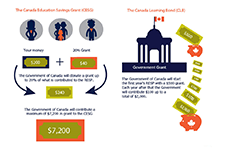

income families and withheld from the wealthy. In a similar vein, the government announced it would phase out some of the existing tax credits for post-secondary education (PSE), which were available to all families with taxable income, so it could use the savings to increase the value of grants for students from low income families. Still, the work to improve support to children from low income families is not done – 1 million low income children each year are still missing out on the Canada Learning Bond.

Asset Building Toolkit