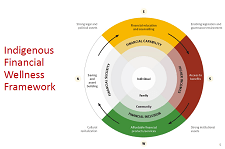

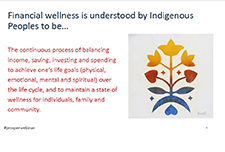

The Ganohonyohk/Prosperity Research Project explored how seven Indigenous Friendship Centre communities in Ontario understood the concept of prosperity. The guiding research question of “How do urban Indigenous Friendship Centre communities in Ontario view a prosperous/wealthy life?” was used to gauge the meaning of prosperity through a community driven lens.

This strength-based research explores culturally appropriate approaches to urban Indigenous prosperity and considers the role of Friendship Centres in promoting prosperity. It concludes that approaches to Indigenous prosperity need to be context-specific and allow for self-determination in establishing communities’ priorities.