Consumer Vulnerability: Evidence from the Monthly COVID-19 Financial Well-being Survey

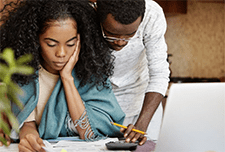

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day financial management and financial well-being. As of September 2022, the survey results show that over the past several months, financial hardships have increased for many Canadians due to the rapidly evolving economic environment. While financial vulnerability can affect anyone regardless of income, background or education, hardships have increased more for those living on a low income, Indigenous peoples, recent immigrants, and women, due to the disproportionate financial impact of the pandemic on these groups (households with low income, Indigenous people, new immigrants, and women.) This brief report provides an overview of survey results collected between August 2020 and September 2022. In publishing this report, FCAC’s goal is to provide insight into the financial well-being of Canadians, to identify which groups are experiencing greater vulnerabilities and hardships, and to inform and target our collective response as financial ecosystem stakeholders.

Rising prices and the impact on the most financially vulnerable: A profile of those in the bottom family income quintile

This study uses the 2022 Portrait of Canadian Society Survey to examine the impact of rising inflation on the lowest income Canadians. Using multiple pre-pandemic data sources, the study takes a closer look at people living in the bottom family income quintile, examining their family income, debt and assets levels, as well as some indicators of economic hardship.

Canada’s new working class: A modern understanding of the 6.5 million Canadians in the working class

The pandemic has accelerated a polarization of jobs that has become a structural trend in the Canadian economy. Previous Cardus research has shown that this polarization of the labour market between low- and high-skilled occupations, with a declining share of jobs available for mid-skilled workers, has led to an “hourglass economy.”

Yet, even while the share of the labour force employed in professional occupations rises, the working class retains the largest share of workers in the Canadian economy, making them an important political economy constituency. But who is the working class in Canada? This paper seeks to answer this question by proposing a modern taxonomy of the workforce and a picture of the working class that draws on a rich body of demographic, economic, and labour-market data.

Social determinants and inequities in health for Black Canadians: a snapshot

The following snapshot aims to highlight how Anti-Black racism and systemic discrimination are key drivers of health inequalities faced by diverse Black Canadian communities. Evidence of institutional discrimination in key determinants of health is also presented, including education, income, and housing. Finally, national data is shared demonstrating inequalities in health outcomes and determinants of health. Readers are invited to reflect on how racism and discrimination may contribute to these inequalities.

A statistical portrait of Canada’s diverse LGBTQ2+ communities

Statistics Canada presents a demographic and social profile of Canada's diverse LGBTQ2+ communities based on published analyses. Much of the data in this release focus on LGB Canadians (lesbian, gay, bisexual), since Statistics Canada has been collecting detailed information on these communities since 2003.

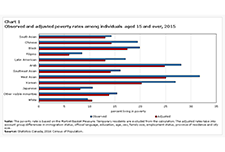

Low-income persistence in Canada and the provinces

Each year, some Canadians fall into low income, while others rise out of it. For example, over one-quarter (28.1%) of Canadians who were in low income in 2017 had exited it by 2018. This study examines the low income exit rate in Canada—an indicator that can be used to track the amount of time it takes for people to rise out of low income. Although a potential surge in low income in 2020 as a result of the COVID-19 pandemic was avoided by temporary government support programs, the rising long-term unemployment rate in 2021 suggests a possible increase in poverty and low-income persistence in the future.

Household economic well-being during the COVID-19 pandemic, experimental estimates, fourth quarter 2020

A highlight of some of the findings reported in this briefing:

Gender differences in employment one year into the COVID-19 pandemic: An analysis by industrial sector and firm size

An important aspect of the impact of COVID-19 is its disproportional impact across gender. This Insights article proposes a year-over-year approach that compares employment from March 2020 to February 2021 to their March-2019-to-February-2020 counterparts. It uses the Labour Force Survey to study gender gaps patterns in employment by industrial sector (goods or services) and firm size.

The Wealth of Unattached Men and Women Aged 50 and Older, 1999 to 2016

The evolution of the wealth, assets and debts of various groups of Canadians since the late 1990s has been documented in several studies. Yet little is known about the evolution of the wealth holdings of unattached men and women aged 50 and older, who make up a large part of the population. This study assesses how the wealth holdings of unattached men and women aged 50 and older evolved from 1999 to 2016 using data from the Survey of Financial Security of 1999, 2005, 2012 and 2016, and fills this information gap.

The Economic Reality of The Asian American Pacific Islander Community Is Marked by Diversity and Inequality, Not Universal Success

By most measures of economic success—whether it be income, education, wealth or employment—Asian Americans are doing well in the United States, both when compared to other communities of color as well to White households. But while these measures of success are noteworthy, the way they are collected, analyzed and presented all too often masks the disparate financial situations of the dozens of ethnic subgroups categorized as “Asian American.” This brief explores some of the misconceptions that feed into broadly held beliefs that all members of the AAPI community are part of one large homogenous and successful group.

Measuring the Financial Well-Being of Hispanics: 2018 Financial Well-Being Score Benchmarks

This report provides a foundational set of benchmarks of the financial well-being of Hispanics ages 18 and older in the United States in 2018, as measured by the CFPB Financial Well-Being Scale, that practitioners and researchers can use in their work. The benchmarks were developed using data from the FINRA Foundation’s 2018 National Financial Capability Survey. This report specifically shows financial well-being score patterns for Hispanic adults by socio-demographics, financial inclusion, safety nets, and financial literacy factors. The report highlights key findings in the data and the implications for organizations that are planning to use the benchmarks.

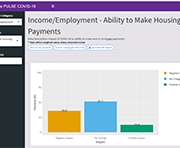

Trans PULSE Canada COVID Data Dashboard

In September – October 2020, the Trans PULSE Canada study team conducted the COVID Cohort to assess the social, economic, and health impacts of the COVID-19 pandemic on trans and non-binary people in Canada. This dashboard serves as an interactive tool for community members and researchers to explore key findings from the Trans PULSE Canada COVID survey, and to break down the results by one or more socio-demographic characteristics. The proportions in the dashboard are weighted to represent the 2019 Trans PULSE Canada sample.

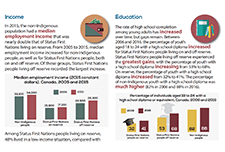

A snapshot: Status First Nations people in Canada

This is a custom report produced in collaboration between the Assembly of First Nations and Statistics Canada. It includes a variety of social and economic statistics for Status First Nations people living on and off reserve and includes comparisons with the non-Indigenous population.

The relationship between COVID-19 pandemic and people in poverty: Exploring the impact scale and potential policy responses

This research project aims to identify the relationship between COVID-19 pandemic and poverty in Vancouver, by analyzing how the COVID-19 pandemic has pushed people into poverty and the impact of COVID-19 on people already living in poverty. Several examples of COVID-19 recovery policies and projects being implemented elsewhere that could support people experiencing poverty in Vancouver are also provided.

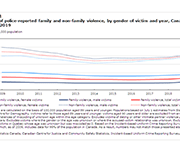

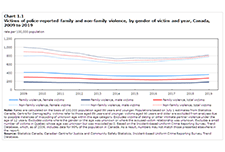

Family violence in Canada: A statistical profile, 2019

Family violence in Canada: A statistical profile is an annual report produced by the Canadian Centre for Justice and Community Safety Statistics at Statistics Canada as part of the Federal Family Violence Initiative. Since 1998, this report has provided data on the nature and extent of family violence in Canada, as well as an analysis of trends over time. The information presented is used extensively to monitor changes that inform policy makers and the public.

State of Fair Banking in Canada 2020: Borrower and Lender Perspectives

The DUCA Impact Lab defines fair banking as any financial product or service that lives up to the following set of principles: Their Fair Banking 2020 report presents data on the following areas:

Pandemic to Prosperity – January 21, 2021: One year after the first announcement of Covid on U.S. soil

The National Conference on Citizenship (NCoC) developed the Pandemic to Prosperity series. It builds on NCoC’s data infrastructure and advocacy network developed for its national Civic Health Index, with The New Orleans Index, which informed many public and private decisions and actions post-Katrina. This series is designed to enable a solid understanding of the damage to lives and livelihoods as the pandemic continues to unfold, as the United States enters the era of vaccines, and the nation grapples with new shocks and stressors such as disasters and civil unrest; it will also examine aspirational goals around strong and accountable government, functioning institutions from child care to internet access to local news availability, effective civic participation, and outcomes for people by race regarding employment, health, housing, and more. With each new report in the series, indicators will change as the recovery transitions. This report highlights mostly state-level metrics with breakdowns by race, gender, and age where available, relying on both public and private data sources.

Mapping Toronto’s Digital Divide

This report analyzes Toronto's home internet and device access, quality, affordability, and usage, during pandemic closures of businesses, schools, and community organizations. Read this report to help you:

Inter-generational comparisons of household economic well-being, 1999 to 2019

This study of data from the Distributions of Household Economic Accounts compares households' economic well-being from a macro-economic accounts perspective, as measured by net saving and net worth for each generation when the major income earner for a household in one generation reached the same point in the life cycle as the major income earner for a household in another generation. The study finds that while younger generations have higher disposable income and higher consumption expenditure than older generations when they reached the same age, their net saving is relatively similar. As well, younger generations' economic well-being may be more at risk due to the COVID-19 pandemic since they depend more on employment as a primary source of income, they have higher debt relative to income, and they have less equity in financial and real estate assets from which to draw upon when needed.

The changes in health and well-being of Canadians with long-term conditions or disabilities since the start of the COVID-19 pandemic

This article examines how the self-reported health and mental health of people with long-term health conditions or disabilities has changed since the start of the COVID-19 pandemic explored by age, sex and type of reported difficulty. Additionally, the rates of health service disruptions are explored by type of service and region.

The Canadian Housing Survey, 2018: Core housing need of renter households living in social and affordable housing

This article provides a high level overview of those living in social and affordable housing by painting a portrait of them based on the results of the 2018 CHS. Socio-demographic and household characteristics are examined using housing indicators such as core housing need.

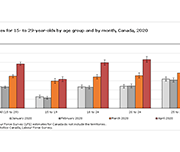

Impact of the COVID-19 pandemic on the NEET (not in employment, education or training) indicator, March and April 2020

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit its spread—have affected young people in a number of ways, including high unemployment rates, school closures and education moving online.

Labour Force Survey, August 2020

The August Labour Force Survey (LFS) results reflect labour market conditions as of the week of August 9 to 15, five months following the onset of the COVID-19 economic shutdown. By mid-August, public health restrictions had substantially eased across the country and more businesses and workplaces had re-opened.

Low Income Measure: Comparison of Two Data Sources, T1 Family File and 2016 Census of Population

This study looks at the differences in after-tax low income measure (LIM) statistics from two data sources which both use administrative tax data as their principal inputs: the 2016 Census of Population and the T1 Family file (T1FF). It presents a summary of the two data sources and compares after-tax LIM statistics by focussing on unit of analysis, LIM thresholds and the percentage of population below the LIM. The study also explores what factors users may want to consider when choosing one data source over the other.

The mental health of population groups designated as visible minorities in Canada during the COVID-19 pandemic

This article examines the mental health outcomes (i.e., self-rated mental health, change in mental health since physical distancing began, and severity of symptoms consistent with generalized anxiety disorder in the two weeks prior to completing the survey) of participants in a recent crowdsource questionnaire who belong to population groups designated as visible minorities in Canada.

Canada’s Forgotten Poor? Putting Singles Living in Deep Poverty on the Policy Radar

This report presents the findings of extensive research about employable singles on social assistance undertaken by Toronto Employment and Social Services, in partnership with the Ontario Centre for Workforce Innovation. Drawing on data from 69,000 singles who were receiving social assistance in Toronto in 2016, and 51 interviews with randomly selected participants, the report highlights these individuals’ characteristics, their complex needs, and the barriers they face in moving off social assistance and into employment. Complementing the quantitative analysis, the interviews provide important insights into the daily realities of participants’ lives and their journeys on and off assistance.

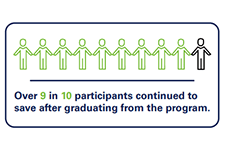

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

Transitions into and out of employment by immigrants during the COVID-19 lockdown and recovery

During the widespread lockdown of economic activities in March and April 2020, the Canadian labour market lost 3 million jobs. From May to July, as many businesses gradually resumed their operations, 1.7 million jobs were recovered. While studies in the United States and Europe suggest that immigrants are often more severely affected by economic downturns than the native born (Borjas and Cassidy 2020; Botric 2018), little is known about whether immigrants and the Canadian born fared differently in the employment disruption induced by the COVID-19 pandemic and, if so, how such differences are related to their socio-demographic and job characteristics. This paper fills this gap by comparing immigrants and the Canadian-born population in their transitions out of employment in the months of heavy contraction and into employment during the months of partial recovery. The analysis is based on individual-level monthly panel data from the Labour Force Survey and focuses on the population aged 20 to 64. Immigrants are grouped into recent immigrants who landed in Canada within 10 years or less, and long-term immigrants who landed in Canada more than 10 years earlier.

Hunger Lives Here: Risks and Challenges Faced by Food Bank Clients During COVID-19

This report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto during COVID-19. Based on phone surveys with over 220 food bank clients in May and June 2020 and an analysis of food bank client intake data, the report demonstrates that COVID-19 has led to increased reliance on food banks. The rate of new clients accessing food banks has tripled since the pandemic began. Among new clients, 76% report that they began accessing food banks as a result of COVID-19 and the associated economic downturn.

Changes in the socioeconomic situation of Canada’s Black population

This study provides disaggregated statistics on the socioeconomic outcomes of the Black population by generation status (and immigrant status), sex and country of origin, and is intended to illustrate and contribute to the relevance of disaggregation in understanding these populations and the diversity of their situation. This study sheds light on some of the issues faced by the Black population and shows differences that exist compared with the rest of the working-age population, by sex, generation and place of origin, from 2001 to 2016.

Race to Lead: Women of Color in the Nonprofit Sector

This report reveals that women of color encounter systemic obstacles to their advancement over and above the barriers faced by white women and men of color. Education and training are not the solution—women of color with high levels of education are more likely to be in administrative roles and are more likely to report frustrations about inadequate and inequitable salaries. BMP’s call to action focuses on systems change, organizational change, and individual support for women of color in the sector.

Weathering Volatility 2.0: A Monthly Stress Test to Guide Savings

In this report, the JPMorgan Chase Institute uses administrative bank account data to measure income and spending volatility and the minimum levels of cash buffer families need to weather adverse income and spending shocks. Inconsistent or unpredictable swings in families’ income and expenses make it difficult to plan spending, pay down debt, or determine how much to save. Managing these swings, or volatility, is increasingly acknowledged as an important component of American families’ financial security. This report makes further progress toward understanding how volatility affects families and what levels of cash buffer they need to weather adverse income and spending shocks.

U.S. Financial Health Pulse: 2019 Trends Report

This report presents findings from the second annual U.S. Financial Health Pulse, which is designed to explore how the financial health of people in America is changing over time. The annual Pulse report scores survey respondents against eight indicators of financial health -- spending, bill payment, short-term and long-term savings, debt load, credit score, insurance coverage, and planning -- to assess whether they are “financially healthy,” “financially coping,” or “financially vulnerable”. The data in the Pulse report provide critical insights that go beyond aggregate economic indicators, such as employment and market performance, to provide a more accurate picture of the financial lives of people in the U.S.

Financial well-being in America

This report provides a view into the state of financial well-being in America. It presents results from the National Financial Well-Being Survey, conducted in late 2016. The findings include the distribution of financial well-being scores for the overall adult population and for selected subgroups, which show that there is wide variation in how people feel about their financial well-being. The report provides insight into which subgroups are faring relatively well and which ones are facing greater financial challenges, and identifies opportunities to improve the financial well-being of significant portions of the U.S. adult population through practice and research.

Credit Characteristics, Credit Engagement Tools, and Financial Well-Being

This report presents results from a joint research study between the Consumer Financial Protection Bureau (CFPB) and Credit Karma. The purpose of the study is to examine how consumers’ subjective financial well-being relates to objective measures of consumers’ financial health, specifically, consumers’ credit report characteristics. The study also seeks to relate consumers’ subjective financial well-being to consumers’ engagement with financial information through educational tools.

From the Margins to Center: Responding to COVID-19 with an Equity and Gender Lens

On June 30th, AFN presented an Expert Insights briefing on what it takes to center women of color in the relief, recovery, and rebuild plans for the current health and economic crisis and beyond. The speaker is Dominique Derbigny, deputy director of Closing the Women’s Wealth Gap (CWWG) and author of the report, On the Margins: Economic Security for Women of Color through the Coronavirus Crisis and Beyond. Learn why women of color are suffering severely from the COVID-19 public health and economic crisis, opportunities to advance gender economic equity in near-term recovery efforts, and possible strategies to prevent wealth extraction and foster long-term economic security for women of color.

Expert Insights: Preventing Evictions in Communities of Color During COVID-19

COVID-19 is radically reshaping many aspects of people’s financial health in America, including their housing security. The economic fallout is disproportionately impacting communities of color due to systemic inequities related to race, housing, employment, and more. As the protections put in place at the start of the pandemic fade away, the United States are facing an eviction tsunami that will disparately displace Black and Latinx families. On August 25, AFN’s summer Expert Insights briefed attendees on rental risks and evictions related to COVID-19. Speakers were Solomon Greene with The Urban Institute and Dr. Christie Cade of NeighborWorks America.

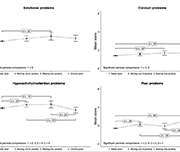

Understanding the Pathways to Financial Well-Being

The National Financial Well-Being Survey Report is the second report in a series from the Understanding the Pathways to Financial Well-Being project. In order to measure and study the factors that support consumer financial well-being, in 2015, the Bureau of Consumer Financial Protection (the Bureau) contracted with Abt Associates to field a large, national survey to collect information on the financial well-being of U.S. adults. The present report uses data collected from that survey to answer a series of questions on the relationship among financial well-being and four key factors: objective financial situation, financial behavior, financial skill, and financial knowledge. In this study, we aim to enhance understanding of financial well-being and the factors that may support it by exploring these relationships.

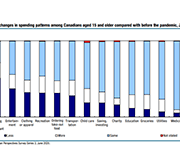

Expected changes in spending habits during the recovery period

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How our economy evolves going forward will largely depend upon the spending choices Canadians make over the coming weeks and months. This study presents results from a recent web panel survey conducted in June, looks at how spending habits may change.

Shelters for victims of abuse with ties to Indigenous communities or organizations in Canada, 2017/2018

There were 85 shelters for victims of abuse that had ties to First Nations, Métis or Inuit communities or organizations operating across Canada in 2017/2018. These Indigenous shelters, which are primarily mandated to serve victims of abuse, play an important role for victims leaving abusive situations by providing a safe environment and basic living needs, as well as different kinds of support and outreach services. Over a one-year period, there were more than 10,500 admissions to Indigenous shelters; the vast majority of these admissions were women (63.7%) and their accompanying children (36.1%). This article uses data from the Survey of Residential Facilities for Victims of Abuse (SRFVA). Valuable insight into shelter use in Canada and the challenges that shelters and victims of abuse were facing in 2017/2018 is presented.

Labour Force Survey in brief: Interactive app

Part of the Canadian Labour Market Observatory, this interactive data visualization application showcases publicly available labour market information. The fully interactive applications allow Canadians to quickly and easily personalize the information in a way that is relevant to them and their interests.

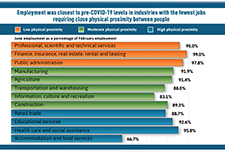

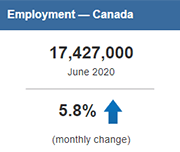

Infographic: COVID-19 and the labour market in June 2020

This infographic displays information on the Canadian labour market in June 2020 as a result of COVID-19.

Labour Force Survey, June 2020

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance payments. New questions were added to measure the extent to which COVID-19-related health risks are being mitigated through workplace adaptations and protective measures.

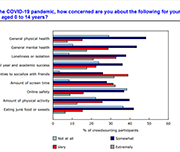

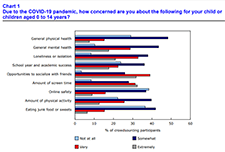

Infographic: The impact of the COVID-19 pandemic on Canadian families and children

This infographic describes parents' experiences during the COVID-19 pandemic including balancing work and schooling, their children's activities and parents' concerns.

Impacts of COVID-19 on Canadian families and children

The COVID-19 pandemic has dramatically altered the way of life for Canadian families, parents and children. Because of physical distancing and employment impacts, parents have altered their usual routines and supports, and many children and families have been isolated in their homes for months. Children, in particular, may not have left their homes or seen any friends or family members other than their parents for an extended period, since children do not typically have to leave their homes for essential services. However, the impact of the pandemic on families has yet to be described. The purpose of this report is to provide a snapshot of the experiences of Canadian parents and families during this unprecedented time.

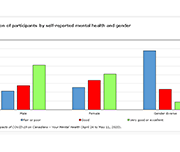

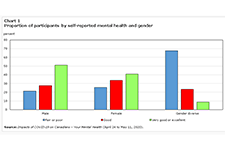

Gender differences in mental health during the COVID-19 pandemic

Previous research has demonstrated that the COVID-19 pandemic is negatively affecting the mental health of Canadians. Today, a new study highlights gender differences in the pandemic's impacts on the mental health of participants in a recent crowdsourcing survey, conducted by Statistics Canada from April 24 to May 11, 2020. Around 46,000 Canadian residents participated in this survey. Female participants were more likely than their male counterparts to report "fair" or "poor" self-rated mental health, "somewhat worse" or "much worse" mental health since physical distancing began, and symptoms consistent with moderate or severe generalized anxiety disorder in the two weeks before completing the questionnaire. Female participants were also more likely than male participants to report that their lives were "quite a bit stressful" or "extremely stressful." Gender-diverse participants—that is, participants who did not report their current gender as exclusively female or male—reported poorer mental health outcomes than both female and male participants across all measures.

Economic impact of COVID-19 among visible minority groups

Since visible minorities often have more precarious employment and higher poverty rates than the White population, their ability to adjust to income losses due to work interruptions is likely more limited. Based on a large crowdsourcing data collection initiative, this study examines the economic impact of the COVID-19 pandemic on visible minority groups. Among the crowdsourcing participants who were employed prior to work stoppages, Whites and most visible minority groups reported similar rates of job loss or reduced work hours. However, visible minority participants were more likely than White participants to report that the COVID-19 pandemic had affected their ability to meet financial obligations or essential needs, such as rent or mortgage payments, utilities, and groceries.

Prosperity Now Scorecard

The Prosperity Now Scorecard is a comprehensive resource featuring data on family financial health and policy recommendations to help put all U.S. households on a path to prosperity. The Scorecard equips advocates, policymakers and practitioners with national, state, and local data to jump-start a conversation about solutions and policies that put households on stronger financial footing across five issue areas: Financial Assets & Income, Businesses & Jobs, Homeownership & Housing, Health Care and Education.

Volunteering in Canada: Challenges and opportunities during the COVID-19 pandemic

In 2018, over 12.7 million Canadians engaged in formal volunteering, with a total of 1.6 billion hours of their time given to charities, non-profits and community organizations—equivalent to almost 858,000 full-time year-round jobs. Today, Canadians are courageously volunteering in the midst of one of the largest health, economic and social challenges of our lifetime. The study, based upon the 2018 General Social Survey on Giving, Volunteering and Participating, measures the contributions of those who have given their time. While these data are from prior to the COVID-19 pandemic, they provide insight into challenges and opportunities facing volunteerism in the current situation.

Providing one-on-one financial coaching to newcomers: Insights for frontline service providers

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE interventions include financial coaching and supports that assist people to build money management skills, access income benefits, tackle debt, learn about safe financial products and services and find ways to save for emergencies. This report shares insights on providing one-on-one financial coaching to newcomers captured through two financial coaching pilot projects that Prosper Canada conducted in collaboration with several frontline community partners.

COVID-19 and support for seniors: Do seniors have people they can depend on during difficult times?

In an effort to avoid the spread of COVID-19, Canadians are engaging in physical distancing to minimize their social contact with others. However, social support systems continue to play an important role during this time. In particular, seniors living in private households may depend on family, friends or neighbours to deliver groceries, medication and other essential items to their homes. This study examines the level of social support reported by seniors living in private households.

Evaluating Tax Time Savings Interventions and Behaviors

This report explores the behaviors and outcomes related to savings and financial well-being of low- and moderate-income (LMI) tax filers in the United States. Findings from research conducted by Prosperity Now, the Social Policy Institute at Washington University in St. Louis and SaverLife (formerly EARN) during the 2019 tax season are presented. This analysis is unique in that it compares tax filers' outcomes over time across three different tax-filing and savings program platforms: volunteer income tax assistance (VITA) sites, online tax filing through the Turbo Tax Free File Product (TTFFP), and SaverLife's saving program.

Economic volatility in childhood and subsequent adolescent mental health problems: a longitudinal population based study of adolescents

This research paper investigates the association between the patterns of duration, timing and sequencing of exposure to low family income during childhood, and symptoms of mental health problems in adolescence.

OECD/INFE Report on Financial Education in APEC Economies: Policy and practice in a digital world

This report responds to a call made by APEC Finance Ministers at their 23rd Ministerial Meeting in Lima in 2016 to advance “the design and implementation of financial literacy policies building on the expertise and standards developed by the OECD International Network on Financial Education”. The findings illustrate that the majority of APEC economies are well-advanced in their efforts to collect relevant data, implement appropriate financial education policies, and address the remaining issues related to financial literacy, inclusion and consumer

protection. They are applying international best practices and making good use of available tools and resources to develop and refine strategic approaches and specific initiatives. However, there is still some way to go in ensuring that everyone living in an APEC

economy has the financial literacy that they need and concerns about financial fraud or abuse, the high complexity of financial services and the low financial literacy of specific population groups are driving policy interest in improving financial education.

2018 White Paper: Financial Wellbeing Remains Challenged in Canada

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income variability and the extent to which Canadians have access to and lever their social capital (i.e. their family and friends who can provide financial advice and/or support in times of hardship). The study also explores consumer financial product and service usage, debt management and debt stress, access to financial products, services, advice and tools, usage of more predatory financial services (e.g. payday lending) and perceived levels of support by consumers’ primary Financial Institution for their financial wellness. The study also provides benefits of improved support for financial providers improving the financial wellness of their customers – including from a banking share of wallet and brand perspective.

How personality traits and economic beliefs shape financial capability and literacy

An emerging body of international literature is beginning to reveal a significant connection between financial capability metrics and personality, suggesting that what influences our financial well-being may be more nuanced than we previously thought. This report investigates how the inclusion of personality traits impacts the analysis of the gender difference in financial capability scores.

The impact of personality traits: a fresh look at gender differences in financial literacy

An emerging body of international literature is beginning to reveal a significant connection between financial capability metrics and personality, suggesting that what influences our financial well-being may be more nuanced than we previously thought. This study investigates how the inclusion of personality traits impacts the analysis of the gender difference in financial capability scores.

The Dynamics of Disability: Progressive, Recurrent or Fluctuating Limitations

Different from common perception, many disabilities do not follow a stable pattern. Persons with disabilities may experience periods of good health in between periods of their limitations and/or experience changes in the severity of their limitations over time. These types of disabilities may be characterized as dynamic because the very nature of the disability is one of change with different possible trajectories over time. As a consequence, the collective experiences of those with disability dynamics are likely to be different than those with so-called “continuous” disabilities. In this paper, four groups of persons with different disability dynamics (or lack of dynamics) are profiled based on data from the 2017 Canadian Survey on Disability. Each group has their own unique demographic, employment, and workplace accommodation profile based on the length of time between periods of their limitations, as well as changes in their limitations over time.

Welfare in Canada, 2018

These reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and territory. Established by the Caledon Institute of Social Policy, Welfare in Canada is a continuation of the Welfare Incomes series originally published by the National Council of Welfare, based on the same approach.

Trends in the Citizenship Rate Among New Immigrants to Canada

This Economic Insights article examines trends in the citizenship rate (the percent of immigrants who become Canadian citizens) among recent immigrants who arrived in Canada five to nine years before a given census. The citizenship rate among recent immigrants aged 18 and over peaked in 1996 and declined continuously to 2016. Most of this decline occurred after 2006. The citizenship rate declined most among immigrants with low family income, poor official language skills, and lower levels of education. There was also significant variation in the decline among immigrants from different source regions, with the decline largest among Chinese immigrants.

Running in Place: Why the Racial Wealth Divide Keeps Black and Latino Families From Achieving Economic Security

This report examines data from the Federal Reserve System’s 2016 Survey of Consumer Finances to understand how the wealth of median Black, Latino and White families have changed since the findings of its previous survey were released in 2013.

Financial Empowerment for Newcomers: Evaluation insights from pilot project

This fact sheet provides insights from Prosper Canada's Financial Empowerment for Newcomers pilot project conducted with three newcomer-serving organizations, Saskatoon Open Door Society (SODS), AXIS Employment Services (AXIS), and North York Community House (NYCH), who implemented and integrated financial coaching into their existing services for newcomers. The project objectives were to provide newcomer-serving front-line staff with training and resources to enable them to accurately assess newcomers’ financial literacy and connect them to appropriate information and resources and to coach newcomers to achieve successful financial independence.

Financial Empowerment for Newcomers infographic

This infographic displays data gathered from interviewing 53 newcomer participants in three provinces (Saskatchewan, Ontario, and Newfoundland) between August and October 2017. Learn more about the stages of newcomer settlement, key money topics and experiences of newcomers, and three types of newcomer client personas.

Does State-Mandated Financial Education Affect High-Cost Borrowing?

Using pooled data from the 2012 and 2015 waves of the National Financial Capability Study (NFCS), this research finds that young adults who were required to take personal finance courses in high school were significantly less likely to borrow payday loans than their peers who were not. These effects do not significantly differ by race/ethnicity or gender, suggesting that financial education may be useful regardless of demographics.

The Who’s Hungry Report

The Who’s Hungry Report provides quantitative and qualitative data about the experience of hunger and poverty in Toronto. To create the reports, trained volunteers conduct face-to-face interviews with over 1,400 food bank clients at nearly 40 member agencies, collecting demographic data as well as information about the day-to-day experience of living with hunger.

Poverty Trends 2018 report

This annual report on poverty in Canada reports that a staggering 5.8 million people in Canada (or 16.8%) live in poverty. The report uses several low-income indicators, including the Low-Income Measure (LIM), the Census Family Low Income Measure (CFLIM) and the Market Basket Measure (MBM). Each measure of low income provides different information on poverty using different methodologies to calculate rates of poverty.

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

Tax time insights: Experiences of people living on low income in Canada

In this presentation, Nirupa Varatharasan, Research & Evaluation Officer with Prosper Canada, explains the research methods and insights gathered in the report 'Tax time insights: Experiences of people living on low income in Canada.' This includes demographic information, the type of tax filing resources accessed by this population, and insights on the types of challenges and opportunities that result from their tax filing processes. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.