Resources

Presentation slides and video time stamps

Read the presentation slides for this webinar.

Time stamps for the video recording:

-

- 5:20 – Start

- 6:12 – Land acknowledgement

- 7:24 – Introduction of speakers

- 9:42 – Today’s presentation

- 10:45 – Barriers to access to benefits

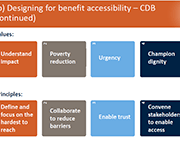

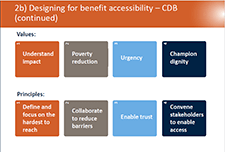

- 15:12 – Designing for benefit accessibility

- 21:53 – ESDC pilot project

- 32:46 –Demo of the disability benefit compass

- 44:36 – Importance of evaluation

- 50:58 – What’s next? What’s possible?

- 58:55 – Questions

Canada’s Disability Inclusion Action Plan

Canada’s Disability Inclusion Action Plan is a comprehensive, whole-of-government approach to disability inclusion. It embeds disability considerations across our programs while identifying targeted investments in key areas to drive change. It builds on existing programs and measures that have sought to improve the inclusion of persons with disabilities, and establishes new and meaningful actions.

Survey on savings for persons with disabilities

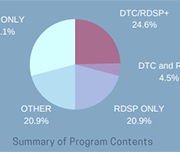

Residents in Canada who have a severe and prolonged mental or physical disability are eligible for the Disability Tax Credit (DTC). This opens the door to other programs, one of which is the RDSP. Less than one-third of eligible residents in Canada (up to age 59) have a Registered Disability Savings Plan (RDSP)—about 31.5% in 2020. To understand why more eligible residents in Canada do not have an RDSP, Employment and Social Development Canada asked Statistics Canada to conduct the Survey on Savings for Persons with Disabilities. Its goal was to collect data from residents in Canada who were eligible for an RDSP but did not open one. These respondents included both persons with disabilities and family members or others who care for persons with disabilities, since the holder of the plan may not be the same person as the beneficiary in all cases. These data show that, in general, eligible residents in Canada lack information about the RDSP, with many not being aware it exists and a substantial portion reporting not having enough information or money to open one.

Disability Tax Credit Tool

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to give them the information they need to fill out that form

2020 Second Annual Report of the Disability Advisory Committee

In November 2017, the Minister of National Revenue, the Honourable Diane Lebouthillier, announced the creation of the Disability Advisory Committee to provide advice to the Canada Revenue Agency (CRA) on interpreting and administering tax measures for persons with disabilities in a fair, transparent and accessible manner. The committee’s full mandate is attached as Appendix A. Key disability tax measures are described in Appendix B. Our first annual report, Enabling access to disability tax measures, was published in May 2019. Since that time, we believe there has been important progress with respect to the administration of and communications about the disability tax credit (DTC). Our second annual report describes in detail the many improvements that the CRA has introduced over the past year in response to the recommendations in our 2019 report. These changes are summarized in “The Client Experience” on the following pages. Section 1 of this second annual report presents a review of the 42 recommendations made in our first annual report. Each recommendation summarizes the relevant context and associated follow-up actions. Section 2 covers the new areas of conversation during the second year of our mandate. Selected topics focus, for example, on DTC data, concerns of Indigenous peoples and eligibility for a registered disability savings plan. Section 3 includes the appendices, which provide details not covered in the text.

Roadblocks and Resilience

This report, Roadblocks and Resilience Insights from the Access to Benefits for Persons with Disabilities project, provides insights on the barriers people with disabilities in British Columbia face in accessing key income benefits. These insights, and the accompanying service principles that participants identified, were obtained by reviewing existing research, directly engaging 16 B.C. residents with disabilities and interviewing 18 researchers and service providers across Canada. We will use these insights to inform development and testing of a pilot service to support people with disabilities to access disability benefits. The related journey map Common steps to get disability benefits also illustrates the complexities of this benefits application process. This journey map illustrates the process of applying for the Disability Tax Credit. The journey map Persons with Disability (PWD) status illustrates the process of preparing for and applying for and maintaining Persons with Disabilities Status and disability assistance in B.C.

Disability Alliance BC

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered Disability Savings Plans (RDSP) and more.

Infographic: An overview of Canadian financial programs for people with disabilities

One in five Canadians are currently living with a disability. This infographic provides an overview of financial programs for people with disabilities in Canada based on findings in Morris et al. (2018) "A demographic, employment and income profile of Canadians with disabilities aged 15 years and over, 2017".

English

Benefits 101

What are tax credits and benefits

Reasons to file a tax return

List of common benefits

Getting government payments by direct deposit

Common benefits and credits Benefits pathways (for practitioner reference only – some illustrations presented are Ontario benefits)

Pathways to accessing government benefits

Overview of tax benefits and other income supports (adults, children, seniors)

Overview of tax benefits and other income supports (people with disabilities or survivors)

Income support programs for immigrants and refugees

Glossary of terms – Benefits 101

Resources – Benefits 101

Key benefits you may be eligible for

Make sure you maximize the benefits you are entitled to if you are First Nations, Inuit, or Métis

Benefits of Filing a Tax Return: Infographic

Common benefits and credits

Resource links:

Benefits and credits for newcomers to Canada – Canada Revenue Agency

Benefit Finder – Government of Canada

Electronic Benefits and credits date reminders – Canada Revenue Agency (CRA)

Income Assistance Handbook – Government of Northwest Territories

What to do when you get money from the government – Financial Consumer Agency of Canada (FCAC)

Emergency benefits

General emergency government benefits information & navigation

Financial Relief Navigator tool (Prosper Canada)

Changes to taxes and benefits: CRA and COVID-19 – Government of Canada

Canada Emergency Response Benefit (CERB)

Apply for Canada Emergency Response Benefit (CERB) with CRA – Canada Revenue Agency (CRA)

Questions & Answers on CERB – Government of Canada

What is the CERB? – Prosper Canada

FAQ: Canada Emergency Response Benefit – Prosper Canada (updated June 10th)

CERB: What you need to know about cashing your cheque – FCAC

COVID-19 Benefits (summary, includes Ontario) – CLEO/Steps to Justice

COVID-19 Employment and Work – CLEO/Steps to Justice

GST/HST credit and Canada Child Benefit

COVID-19 – Increase to the GST/HST amount – Government of Canada

Canada Child Benefit Payment Increase – Government of Canada

Benefits payments for eligible Canadians to extend to Fall 2020 – Government of Canada

Support for students

Support for students and recent graduates – Government of Canada

Canada Emergency Student Benefit (CESB) – Government of Canada

Benefits and credits for families with children

Benefits and credits for families with children

Resource links:

Child and family benefits – Government of Canada

Child and family benefits calculator – Government of Canada

Benefits and credits for people with disabilities

Benefits and credits for people with disabilities

RDSP, grants and bonds

Resource links:

Canada Pension Plan disability benefit toolkit – Employment and Social Development Canada (ESDC)

Disability benefits – Government of Canada

Disability tax credit (DTC) – Canada Revenue Agency (CRA)

Free RDSP Calculator for Canadians – Plan Institute

Future Planning Tool – Plan Institute

Creating Financial Security: Financial Planning in Support of a Relative with a Disability (handbook) – Partners for Planning

Nurturing Supportive Relationships: The Foundation to a Secure Future (handbook) – Partners for Planning

RDSP – Plan Institute

Disability Tax Credit Tool – Disability Alliance BC

ODSP Appeal Handbook – CLEO

Disability Inclusion Analysis of Government of Canada’s Response to COVID-19 (report and fact sheets) – Live Work Well Research Centre

Demystifying the Disability Tax Credit – Canada Revenue Agency (CRA)

Benefits and credits for seniors

Benefits and credits for seniors

Resource links:

Canadian Retirement Income Calculator – Government of Canada

Comparing Retirement Savings Options – Financial Consumer Agency of Canada (FCAC)

Federal Provincial Territorial Ministers Responsible for Seniors Forum – Employment and Social Services Canada (ESDC)

Retiring on a low income – Open Policy Ontario

RRSP vs GIS Calculator – Daniela Baron

Sources of income for seniors handout – West Neighbourhood House

What every older Canadian should know about: Income and benefits from government programs – Employment and Social Services Canada (ESDC)

French

Comprendre les prestations

Que sont les crédits d’impôt et les prestations?

Pourquoi produire une déclaration de revenus?

Processus d’accès aux prestations (simple, complexe ou laborieux)

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu

Aperçu des prestations et crédits d’impôt et des autres mesures d’aide au revenu : personnes handicapées ou survivants

Programmes d’aide au revenu pour immigrants et réfugiés – Admissibilité et processus de demande

Glossaire – Prestations et credits

Ressources : Prestations et credits

Principales mesures d’aide auxquelles vous pouvez être admissibles

Assurez-vous de maximiser les prestations auxquelles vous avez droit si vous êtes Autochtone,

Infographie sur les avantages de produire une déclaration de revenus

Prestations et crédits courants

Prestations et crédits pour familles avec enfants

Prestations et crédits pour personnes handicapées

Prestations et crédits pour les personnes âgées

Informations d’identification pour accéder aux prestations

Études de cas

Breaking down barriers: A critical analysis of the Disability Tax Credit and the Registered Disability Savings Plan

The Disability Tax Credit helps Canadians by reducing the amount of income tax they are required to pay. The Registered Disability Savings Plan helps people with a disability or their caregiver save for the future by putting money into a fund that grows tax free until the beneficiary makes a withdrawal. This report, released by the Senate Committee on Social Affairs, Science and Technology, makes 16 recommendations aimed at improving both programs. They are divided into short-term objective to make the process for the two programs simpler and clearer, and a long-term philosophical shift in the way Canada deals with people who are in financial distress but cannot advocate for themselves. Recommendations include removing barriers that prevent people from taking advantage of the Disability Tax Credit and making enrolment in the Registered Disability Savings Plan automatic for eligible people under 60 years of age.

Policy Brief – Why is Uptake of the Disability Tax Credit Low in Canada?

Disability supports should be designed to provide benefit and not burdens to eligible recipients. Unfortunately, this is not a reality when it comes to one of the main benefits open to Canadians with disability: the federal Disability Tax Credit (DTC). Designed to recognize some of the higher costs faced by people with severe disabilities and their caregivers, the DTC appears to be more of a burden for many, with estimated utilisation unacceptably low at around 40 per cent of working-aged adults with qualifying disabilities. Low uptake is a concern not only because people are missing out on the credit itself but also because eligibility to the DTC – which is not automatic – is a gateway to other important and more valuable benefits such as the Child Disability Benefit and Registered Disability Savings Plans (RDSP).