Resources

Reports, presentation slides and video time stamps

Read the presentation slides for this webinar.

Download the executive summary.

Time stamps for the video:

0.38 – Welcome and housekeeping

5:59 – Canada’s financial help gap overview

35:35 – Panel discussion

1:20 – Q&A

Missing for those who need it most: Canada’s financial help gap

A new study by national charity Prosper Canada, undertaken with funding support from Co-operators, finds that Canadians with low incomes are increasingly financially vulnerable but lack access to the financial help they need to rebuild their financial health. The report, shows that affordable, appropriate and trustworthy financial help for people with low incomes is a critical but missing piece in Canada's financial services landscape. People with low incomes are unlikely to find help when they need it to plan financially, develop and adhere to a budget, set and pursue saving goals, file their taxes outside of tax season, and access income benefits. Executive summary: Canada's financial help gap L’aide qui manque pour ceux qui en ont le plus besoin Sommaire Exécutif: L’écart en matière d’aide financière au Canada

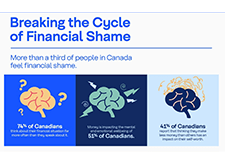

More Canadians are finding it difficult to meet food, shelter and other necessary expenses

In 2022, the Consumer Price Index rose 6.8%, the highest increase since 1982 (+10.9%). Prices for day-to-day goods and services such as transportation (+10.6%), food (+8.9%) and shelter (+6.9%) rose the most. Canadians felt the impact of rising prices. Data from the Canadian Social Survey (CSS) show that the share of persons aged 15 and older living in a household experiencing difficulty meeting its necessary expenses trended upward from just under one-fifth (19%) in the summer of 2021 to just under one-quarter (24%) in the summer of 2022. By the end of 2022, more than one-third (35%) of the population lived in such a household.

Annual report 2022

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 18 years, AFN has provided a forum for grantmakers to connect, collaborate, and collectively invest in helping more people achieve economic security. This report reflects their work over the past year working across 7 issues areas:

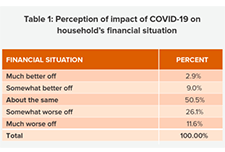

Consumer Vulnerability: Evidence from the Monthly COVID-19 Financial Well-being Survey

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day financial management and financial well-being. As of September 2022, the survey results show that over the past several months, financial hardships have increased for many Canadians due to the rapidly evolving economic environment. While financial vulnerability can affect anyone regardless of income, background or education, hardships have increased more for those living on a low income, Indigenous peoples, recent immigrants, and women, due to the disproportionate financial impact of the pandemic on these groups (households with low income, Indigenous people, new immigrants, and women.) This brief report provides an overview of survey results collected between August 2020 and September 2022. In publishing this report, FCAC’s goal is to provide insight into the financial well-being of Canadians, to identify which groups are experiencing greater vulnerabilities and hardships, and to inform and target our collective response as financial ecosystem stakeholders.

Resources

Presentation slides, handouts, and video time-stamps

Read the presentation slides for this webinar.

Download the Overview of Financial vulnerability of Low-Income Canadians: A Rising Tide

Time-stamps for the video recording:

00:00 – Start

6:05 – Agenda and Introductions

8:24 – Overview of Financial vulnerability, of low-income Canadians: A rising tide (Speaker: Eloise Duncan)

25:40 – Panel discussion: how increasing financial vulnerability is playing out in community and how policy makers should respond.

45:35 – Q&A

Accessible financial services incubator

Drive through a low-income neighborhood in virtually any American city and it quickly becomes apparent that the area’s financial health is at risk. The giveaway? The abundance of payday lenders. According to the St. Louis Federal Reserve, there are now more than 20,000 of these organizations across the country—which tops even the ubiquitous McDonald’s storefront by roughly 40%.1 These alternative financial services providers offer short-term loans at interest rates that can top 400%. They appeal to desperate consumers with no access to traditional, more affordable credit and offer an immediate fix that can lead to months, if not years, of financial pain. In its Payday Lending in America series, the Pew Charitable Trusts reports that Americans spend roughly $7.4 billion (B) on payday loans each year. Could traditional financial institutions find a way to deliver credit to this consumer niche without compromising their own health? The Filene Research Institute, a consumer finance think-and-do tank, hypothesized that the answer was yes. Read the full report.

Financial literacy around the world: insights from the S&P’s rating services global financial literacy survey

The Standard & Poor's Ratings Services Global Financial Literacy Survey is the world’s largest, most comprehensive global measurement of financial literacy. It probes knowledge of four basic financial concepts: risk diversification, inflation, numeracy, and interest compounding. The survey is based on interviews with more than 150,000 adults in over 140 countries. In 2014 McGraw Hill Financial worked with Gallup, Inc., the World Bank Development Research Group, and GFLEC on the S&P Global FinLit Survey.

How to build financial health in Native communities

American Indian and Alaska Native (AI/AN) peoples have long faced barriers to asset building. More than half of AI/AN populations are un- or underbanked, financial services often don’t operate on reservations, and access to capital is difficult. Native peoples have been excluded from financial wealth accumulation through government asset stripping, industry redlining, and simple neglect, thanks to historic (and ongoing) discrimination, exclusion, and racism baked into government and private-sector policies. Solutions are within reach. Recently, the Financial Security Program, the Oklahoma Native Assets Coalition, Inc (ONAC), and the Center for Native American Youth hosted an event featuring Native leaders representing various geographies, experiences, and tribal affiliations. The group discussed experiences in building assets and Indigenous perspectives on generational financial wealth. Finally, the speakers gave recommendations on how foundations, corporations, non-profits, and others can partner with tribal governments and Native-led nonprofits to build financial wealth in Native communities. ONAC has produced a “List of Eighteen Suggestions to Better Support Native Practitioners Administering Asset Building Programs in their Communities”.

101 solutions for inclusive wealth building

Having wealth, or a family’s assets minus their debts, is important not just for the rich— everyone needs wealth to thrive. Yet building the amount of wealth needed to thrive is a major challenge. Nearly 13 million U.S. households have negative net worth. Millions more are low wealth; they do not have the assets or liquidity needed to maintain financial stability and invest in themselves in the present, nor are they on track to accumulate the amount of wealth they will need to have financial security in retirement. This report examines what it will take to create truly shared prosperity in the United States. It is focused on solutions that would grow the wealth of households in the bottom half of the wealth distribution, and it explores reparative approaches to building the wealth of Black, Indigenous, and other people of color (BIPOC).

Together, these groups represent at least half of all U.S. households.

Recognizing and responding to economic abuse

With speakers from CCFWE, Johannah Brockie - Program Manager for Advocacy and System Change and Jessica Tran - Program Manager for Education and Awareness, this webinar will guide you through the definition of economic abuse, how to identify an economic abuser, impacts of economic abuse, Covid-19 impacts, tactics, what you should do if you are a victim of economic abuse, and key safety tips. Economic Abuse occurs when a domestic partner interferes with a partner’s access to finances, employment or social benefits, such as fraudulently racking up credit card debt in their partner’s name or preventing their partner from going to work has a devastating effect on victims and survivors of domestic partner violence, yet it’s rarely talked about in Canada. It’s experienced by women from all backgrounds, regions and income levels but women from marginalized groups, including newcomers, refugees, racialized and Indigenous women, are at a higher risk of economic abuse due to other systemic factors.

Resources

Opening and Welcome

Session: Tackling pandemic hardship: The financial impact of COVID-19 on low-income households

Tackling pandemic hardship: The financial impact of COVID-19 on low-income households – YouTube

Download summary and detailed reports: The financial resilience and financial well-being of Canadians with low incomes: insights and analysis to support the financial empowerment sector

Download slide deck: The differential impact of the pandemic on low income families

Booth Chats: Big ideas for a more equitable recovery

Resolve Financial and Credit Counselling

Video Pitch: Booth chat: Jeri Bittorf, Resolve Financial and Credit Counselling Services Coordinator – YouTube

Slide Deck: K3C Credit Counselling (ablefinancialempowerment.org)

Seniors Financial Empowerment Network

Video Pitch: Booth Chat: Sarah Ramsey, City of Edmonton, Community Development Social Worker – YouTube

Seneca College

Video Pitch: Booth Chat: Varinder Gill, Seneca College, Professor & Program Co-ordinator – YouTube

Prosper Canada: Integrating Financial Empowerment into Ontario Works

Video Pitch: Booth Chat: Ana Fremont, Prosper Canada Manager, Program Delivery and Integration – YouTube

Slide Deck: Thunder Bay Financial Empowerment Integration (ablefinancialempowerment.org)

Prosper Canada: Prosperity Gateways – Cities for Financial Empowerment, Toronto Public Library

Video Pitch: Booth Chat: John Stephenson, Manager, Program Delivery and Integration – YouTube

Slide Deck: PowerPoint Presentation (ablefinancialempowerment.org)

Session: Measuring the divide: Has COVID-19 widened economic disparities for Canada’s BIPOC communities

Download slide deck: Income Support During COVID-19and ongoing challenges

Download slide deck: Re thinking income adequacy in the COVID-19 recovery

Session: Financial wellness and healing: Can building financial wellness help Indigenous communities?

Session recording: Financial wellness and healing: Can building financial wellness help Indigenous communities? – YouTube

Download slide deck: Indigenous Financial Literacy: Behaviour Insights from an Indigenous Perspective

Download slide deck: Financial wellness and Indigenous Healing

Session: When money meets race: Addressing systemic racism through financial empowerment

Session: Tous ensemble maintenant : Rétablissement de la santé financière de la population canadienne : l’affaire de tous les secteurs/ All together now: How all sectors have a role to play in rebuilding Canadians’ financial health

Session: When opportunity knocks: Poverty, disability, and Canada’s proposed new disability benefit

Session recording unavailable

Download slide deck: When Opportunity Knocks: Disability without Poverty

Session: The good, the bad and the innovation: The pandemic redesign of tax filing and benefit assistance

Closing remarks from Adam Fair, Vice President, Strategy and Impact, Prosper Canada; Helen Bobiwash

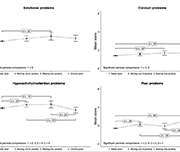

Growing household financial instability: Is income volatility the hidden culprit?

On March 9th, 2018, leading American and Canadian researchers and policy makers from all sectors gathered in Toronto to explore the question: Growing household financial instability: Is income volatility the hidden culprit? The policy research symposium was an invitational event co-hosted by the Investment Industry Regulatory Organization of Canada (IIROC) and Prosper Canada. Its purpose was to shine a light on an issue that has gained prominence in US economic and policy circles but was just emerging as a topic for exploration in Canada in the context of This report summarizes key insights, conclusions and next steps from the symposium in the hopes that it will inform, catalyse and support further action on this issue. To view the conference agenda and links to all conference presentations, please see Appendix 1. Presentation videos can be found online at

growing household financial instability.

https://www.youtube.com/playlist?list=PLC0J2kAG0MZZ5gd_6ZaHjqqEcenL2jCtP

Cross Canada Check-up (updated March 2021)

Canada ranks consistently as one of the best places to live in the world and one of the wealthiest. When it comes to looking at the financial health of Canadian households, however, we are often forced to rely on incomplete measures, like income alone, or aggregate national statistics that tell us little about the distribution of financial health and vulnerability in our neighbourhoods, communities or provinces/territories. The purpose of this report is to examine the financial heath and vulnerability of Canadian households in different provinces and territories using a new composite index of household financial health, the Neighbourhood Financial Health Index or NFHI.

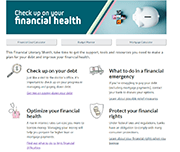

Managing Financial Health in Challenging Times

Managing financial health is difficult during ordinary times—and especially so in challenging times like the ones we're currently facing. Guest speaker RuthAnne Corley, the Senior Stakeholder Engagement Officer with the Financial Consumer Agency of Canada (FCAC), discusses how to manage your financial health despite external challenges. RuthAnne joined FCAC in 2015 where she’s been instrumental in the development of Canada’s "National Strategy for Financial Literacy - Count me in, Canada" and its implementation. Prior to joining FCAC in 2015, RuthAnne managed stakeholder engagement and outreach activities at numerous federal departments and agencies.

Race, Ethnicity, and the Financial Lives of Young Adults: Exploring Disparities in Financial Health Outcomes

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults, focusing on Black and Latinx young adults, in order to inform policies, programs, and solutions that can improve financial health for all.

Roadblock to Recovery: Consumer debt of low- and moderate-income Canadians in the time of COVID-19

Almost half of low-income households and 62 per cent of moderate-income households carry debt, with households on low incomes spending 31 per cent of their income on debt repayments, according to a new report published by national charity, Prosper Canada.

This report analyzes the distribution, amount and composition of non-mortgage debt held by low- and moderate-income Canadian households and explores implications for federal and provincial/territorial policy makers as they develop and implement COVID-19 economic recovery plans and fulfill their respective regulatory roles.

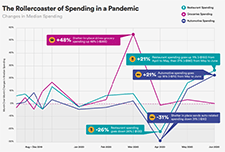

The Economic Toll of COVID-19 on SaverLife Members

SaverLife is an organization that seeks to advance savings programs, analytic insights, and policy initiatives through a network of employers, financial institutions, nonprofits and advocacy groups in the United States. This report provides insight into the financial challenges presented by their savings program members during the COVID-19 pandemic from March to August of 2020.

Impacts of COVID-19 on persons with disabilities

This article provides a general snapshot of the employment and income impacts of COVID-19 on survey participants aged 15 to 64 living with long-term conditions and disabilities.

How Are the Most Vulnerable Households Navigating the Financial Impact of COVID-19?

The COVID-19 pandemic has already had an unprecedented impact on the financial lives of households across the United States. During June and July 2020, Prosperity Now conducted a national survey of lower-income households to better understand the circumstances these households are confronted with and the strategies they use to secure resources to navigate this crisis.

Measuring financial health: What policymakers need to know

This report provides an overview of financial health and the policy responses around the world. Based on this, and the key questions of whether financial health measure more than income and if financial inclusion supports financial health, the report offers recommendations to policy makers on strategies for measuring the financial health of their population.

Economic volatility in childhood and subsequent adolescent mental health problems: a longitudinal population based study of adolescents

This research paper investigates the association between the patterns of duration, timing and sequencing of exposure to low family income during childhood, and symptoms of mental health problems in adolescence.

Financial Health Index: 2019 Findings and 3-Year Trends Report

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from 2017 to 2019.

2018 White Paper: Financial Wellbeing Remains Challenged in Canada

The study examines consumers’ financial knowledge and confidence levels; financial and money stressors, financial capability aspects and financial management behaviours and practices (across the financial services spectrum). The study also explores external or environmental factors such as income variability and the extent to which Canadians have access to and lever their social capital (i.e. their family and friends who can provide financial advice and/or support in times of hardship). The study also explores consumer financial product and service usage, debt management and debt stress, access to financial products, services, advice and tools, usage of more predatory financial services (e.g. payday lending) and perceived levels of support by consumers’ primary Financial Institution for their financial wellness. The study also provides benefits of improved support for financial providers improving the financial wellness of their customers – including from a banking share of wallet and brand perspective.

English

Download in English

French

Download in French

Urban Spotlight: Neighbourhood Financial Health Index findings for Canada’s cities

This report examines the financial health and vulnerability of households in Canada’s 35 largest cities, using a new composite index of household financial health at the neighbourhood level, the Neighbourhood Financial Health Index or NFHI. The NFHI is designed to shine a light on the dynamics underlying national trends, taking a closer look at what is happening at the provincial/territorial, community and neighbourhood levels. Update July 22, 2022: Please note that the Neighbourhood Financial Health Index is no longer available

Low income among persons with a disability in Canada

Persons with a disability face a higher risk of low income compared to the overall population. This report uses data from the 2014 Longitudinal and International Study of Adults (LISA) to study the relationship between low income and characteristics of people aged 25 to 64 with a disability, including disability type, severity class, age of onset of disability, family composition, and other risk factors associated with low income. It also examines the composition of the low-income population in relation to disability, and provides information on the relationship between employment and low income for this population.