Making the most of your money

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share or use with your clients to help them access tools and resources to support their daily money management. Making the most of your money is an easy-to-use, accessible, online course to help people living on a low income organize their finances and explore ways to increase the amount of money coming in and reduce what is going out. This interactive course has activities, videos, handouts and resources that are also downloadable.

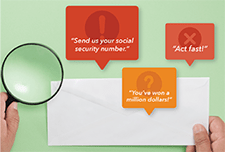

Threats and intimidation to pay your tax bill? How to spot tax season scams

During the income tax filing season, scammers pose as representatives of the Canada Revenue Agency (CRA) in an attempt to trick you into sending payment for fictitious "debts" or into providing sensitive personal information that they can use to commit fraud. Learn more on how to spot tax season scams and what to do if you are the victim of fraud.

Cyber security awareness quizzes

Discover a new quiz site to help Canadians and Canadian small businesses protect against phishing scams. The Canadian Bankers Association has created four quizzes for Canadians to learn more about cyber fraud and how to prevent becoming a victim. Quiz #2: Social engineering: a peek behind the curtain Quiz # 3: Protecting your small business from phishing attacks Quiz #4: How to protect yourself and others

English

Investing with interest: tips and tools for maximizing your savings

IWI – Worksheet #1: What do you want to save for?

IWI – Worksheet #2: Tracking your income and expenses

IWI- Worksheet #3: Are you ready to invest?

IWI- Worksheet #4: What can you invest in?

IWI-Worksheet #5: Where can you get advice?

IWI-Worksheet #6: Watch out for investment frauds and scams

IWI-Worksheet #7: Tips for success

Resources

Crypto Quiz, OSC

Grandparent scams and how to avoid them, OSC

Compound interest calculator, OSC

Emergency fund calculator, OSC

Tips to keep your credit card safe, OSC

Investment products, OSC

Types of fraud, OSC

Multilingual financial resources for Ontarians, OSC

Pay down debt or invest tool, OSC

Reporting fraud, OSC

Introduction to investing, OSC

Scam spotter tool, OSC

Your trusted person and why they matter, OSC

Getting Your Money Back; An Investor’s Guide to Navigating Canada’s Complaint System, FAIR Canada

Study explores Canadian attitudes about Crypto, OSC

How the stock market works, OSC

The basics of personal finance, Credit Canada

What is risk tolerance in investing, OSC

Eight common investment scams and how to spot them, OSC

4 signs of investment fraud, OSC

Evolution of the fraud pitch , Canadian Anti Fraud Centre

Saving or investing for short-term goals, OSC

Investor questionnaire, CIRO

Fees matter, MFDA

Fee calculator, OSC

Annual information about your investment fees, OSC

Investing basics, CIRO

The many faces of elder abuse, OSC

How to Read Your Account Statement and the Things to Focus on, CIRO

Long-haul scammers: Fraudsters who invest time to take your money, OSC

Cybersecurity and Fraud, CIRO

Investor’s guide: cryptocurrencies, CIRO

Artificial intelligence and investor behaviour, OSC

Loan and Trust, FSRA

Fighting Fraud 101: Smart tips for investors, First Nations Development Institute

Financial Planners and Financial Advisors, FSRA

Glossary of common investing terms, CIRO

Invest smart: Taxes and investing, CIRO

Investing charts, OSC

French

L’intérêt d’investir: Conseils et outils pour maximiser votre épargne

Ressources

Questionnaire sur les cryptoactifs, Commission des valeurs mobilières de l’Ontario

Les arnaques des grands-parents et comment les éviter, Commission des valeurs mobilières de l’Ontario

Calculatrice épargne REER, Commission des valeurs mobilières de l’Ontario

Calculatrice intérêts composés, Commission des valeurs mobilières de l’Ontario

Calculatrice fonds d’urgence, Commission des valeurs mobilières de l’Ontario

Astuces pour garder votre carte de crédit en toute sécurité, Commission des valeurs mobilières de l’Ontario

Produits d’investissement, Commission des valeurs mobilières de l’Ontario

Types de fraude, Commission des valeurs mobilières de l’Ontario

Ressources financières multilingues pour les Ontariennes et les Ontariens, Commission des valeurs mobilières de l’Ontario

Calculatrice rembourser des dettes ou investir, Commission des valeurs mobilières de l’Ontario

Signaler une escroquerie, Commission des valeurs mobilières de l’Ontario

Planification de la retraite, Commission des valeurs mobilières de l’Ontario

Questionnaire préparation des investisseurs, Commission des valeurs mobilières de l’Ontario

Introduction au placement, Commission des valeurs mobilières de l’Ontario

Outil détecteur d’escroquerie, Commission des valeurs mobilières de l’Ontario

Votre personne de confiance et les raisons qui expliquent son importance, Commission des valeurs mobilières de l’Ontario

Une étude explore les attitudes des Canadiens à l’égard de la cryptomonnaie, Commission des valeurs mobilières de l’Ontario

Le fonctionnement de la bourse, Commission des valeurs mobilières de l’Ontario

Académie d’investissement, Commission des valeurs mobilières de l’Ontario

Quelle est votre tolérance au risque en matière d’investissement? CVMO

Huit escroqueries courantes en matière d’investissement et comment les repérer, CVMO

Quatre signes de fraude liée aux placements, CVMO

Bulletin : Évolution des types de fraudes, Centre centreantifraude du Canada

Épargner ou investir pour réaliser des objectifs à court terme, CVMO

Questionnaire de l’investisseur, OCRI

Calculateur de frais, CVMO

Information annuelle sur vos frais de placement, CVMO

Principes de base en matière de placement, OCRI

Choisir un conseiller, OCRI

Les nobreuses facettes de l’exploitation financière envers les personnes âgées, CVMO

Comment lire votre relevé de compte et les éléments particuliers qu’il contient, OCRI

La cybersécurité et la fraude, OCRI

Intelligence artificielle et comportement des investisseurs, CVMO

Planificateurs financiers et conseillers financiers, ARSF

Glossaire des placements, OCRI

Investir judicieusement : les impôts et les placements, OCRI

Tips to keep your credit card safe

Your credit card can help you make purchases quickly without needing to have cash on hand. Follow these tips by the Ontario Securities Commission to use your credit card safely.

Fraud alert videos

Learn more about fraud in this latest set of videos by the Ontario Securities Commission.

Cyber security awareness

The Canadian Bankers Association has created a new Cyber Security Awareness Quiz site to test your knowledge and ability to spot a “phishy” email, message or text.

Cyber security & fraud prevention learning guide

Banks take fraud very seriously and have highly sophisticated security systems and teams of experts to protect you from financial fraud. As a banking customer, there are also simple steps you can take to recognize cyber crime and protect your personal information and your money. Educating yourself, your family and your employees about cyber safety can seem overwhelming, but it doesn’t have to be that complicated and the CBA has developed a learning path to help.

Beware: Crypto scams on the rise

Fraudsters often use emotions to lure people in, making a person feel afraid of missing out on an opportunity that others are profiting from. With all the cryptocurrency hype in the media and online, it’s no surprise that scammers are taking note and trying to cash in on investors’ interest in digital currencies. Read this article for more information on the top crypto-related scams you should know.

Beware of One Time Passcode scams with these tips

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts securely.

Cyber security toolkit

There are also simple steps you can take to recognize cyber threats and protect yourself. With a cyber hygiene checklist and tips on how to spot common scams, the CBA’s Cyber Security Toolkit can help you protect against online financial fraud.

Cyber security checklist

Getting cyber safe doesn't have to be complicated. With the right resources and tools, you can stay safe and secure online. Here's a handy checklist for protecting your data online.

Reporting fraud

A comprehensive set of articles are available on the Ontario Securities Commission website on how to identify and report fraud as well as what to do if you have been defrauded.

Grandparent scams and how to avoid them

Imagine a loved one is in trouble or hurt. You get a call asking for urgent help. You’d likely want to act right away because you care about them. Exploiting family ties is the driving force behind grandparent scams — or emergency scams. This article from the OSC can help you to protect yourself from becoming a victim of an emergency scam. Watch this new video to learn more about grandparent scams.

Investing basics

Whether you’re a first-time investor, thinking of saving for your education, or planning for your retirement, FAIR Canada's investing basics may help you on your investing journey.

Scam spotter tool

FCAC new consumer information – electronic alerts

Le français suit l’anglais. As of June 30, 2022, banks will be required to send electronic alerts to their customers to help them manage their finances and avoid unnecessary fees. Some banks have already started sending these alerts to their customers. The electronic alerts are part of the new and enhanced protections in Canada’s Financial Consumer Protection Framework (the Framework) that comes into effect on June 30, 2022. To inform Canadians about electronic alerts and their benefits, the Financial Consumer Agency of Canada (FCAC) published new consumer information on electronic alerts, developed an infographic, and prepared social media content that you can use on your own social media channels. Under the Framework, banks will be required to: À compter du 30 juin 2022, les banques seront tenues d’envoyer des alertes électroniques à leurs clients afin de les aider à gérer leurs finances et à éviter de payer inutilement des frais, ce que certaines ont déjà commencé à faire. Ces alertes font partie des mesures de protection nouvelles ou améliorées prévues dans le Cadre de protection des consommateurs de produits et services financiers du Canada (le Cadre) qui entre en vigueur le 30 juin 2022. Pour informer les Canadiens et les Canadiennes à propos des alertes électroniques et de leurs avantages, l’Agence de la consommation en matière financière du Canada (ACFC) a publié de nouveaux renseignements à ce sujet pour les consommateurs. Elle a également créé une infographie et préparé du contenu pour les réseaux sociaux que vous pouvez utiliser dans vos propres comptes de médias sociaux. En vertu des dispositions du Cadre, les banques seront tenues :

Fraud Prevention Toolkits

In 2021, losses reported to the Canadian Anti-Fraud Centre reached an all time high of 379 million with Canadian losses accounting for 275 million of this. Fraud Prevention Month is a campaign held each March to inform and educate the public on protecting yourself from being a victim of fraud. This year's theme is impersonation, and focuses on scams where fraudsters will claim to be government official, critical infrastructure companies, and even law enforcement officials. This collection of fraud prevention toolkits is available in English and French. In English: En Français:

Making more purchases online? Beware of fake websites and phony retailer apps

Many of us have shifted some of our shopping online during the pandemic – it’s easy and very often you can have items delivered right to your door. Criminals are taking advantage of the increased popularity of online shopping by creating fake websites and apps that look authentic but are just a ploy to steal your personal information. The Canadian Banker's Association helps you identify fake websites and apps and shares tips on how to protect yourself while shopping online and what to do if you are a victim of an online shopping scam.

COVID-19 Fraud Alerts

GetSmarterAboutMoney.ca is an Ontario Securities Commission (OSC) website that provides unbiased and independent financial tools to help you make better financial decisions. This series of videos increases awareness of fraudulent activity during COVID-19. Topic include:

Identity theft

Identity thieves try to use your personal information to take money from your bank account, shop with your credit card, or even commit crimes in your name. This publication explains how to spot the warning signs of identity theft, how to protect yourself, and what you can do if it happens to you.

Beware of scams related to the coronavirus

Scammers are taking advantage of the coronavirus (COVID-19) pandemic to con people into giving up their money. Though the reason behind their fraud is new, their tactics are familiar. It can be even harder to prevent scams right now because people 62 and older aren’t interacting with as many friends, neighbors, and senior service providers due to efforts to slow the spread of disease. This blog post presents consumer protection toolkit resources produced by Consumer Financial Protection Bureau in addition to tips for consumers regarding COVID-19 related scams.

New Risks and Emerging Technologies: 2019 BBB Scam Tracker Risk Report

The Better Business Bureau Institute for Marketplace Trust (BBB Institute) is the 501(c)(3) educational foundation of the Better Business Bureau (BBB). BBB Institute works with local BBBs across North America. This report uses data submitted by consumers to BBB Scam Tracker to shed light on how scams are being perpetrated, who is being targeted, which scams have the greatest impact, and much more. The BBB Risk Index helps consumers better understand which scams pose the highest risk by looking at three factors—exposure, susceptibility, and monetary loss. The 2019 BBB Scam Tracker Risk Report is a critical part of BBB’s ongoing work to contribute new, useful data and analysis to further the efforts of all who are engaged in combating marketplace fraud. Update February 24, 2022: BBB Scam Tracker- Risk Report 2020

Seniors: tips to help you this tax season

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada resources.

Video: Debt collection scams

Dealing with debt collection issues can be challenging—especially when you’re not sure if the person you’re being contacted by is a legitimate debt collector or someone trying to scam you. This video from the Consumer Financial Protection Bureau in the United States shares useful tips on spotting debt collection scams and protecting yourself from scammers.

The Little Black Book of Scams (2nd edition)

Scammers are sneaky and sly. They can target anyone, from youngsters to retirees. They can also target businesses. No one is immune to fraud. Read this booklet to find out how you can also become a fraud-fighting superhero. Share this booklet with family and friends and start powering up!

Our group of superheroes has found a way to see through the scams. Their secret is simple: knowledge is power!