Discover financial empowerment resources

Discover financial empowerment resources

This report explores the barriers newcomers face in accessing credit, and opportunities for governments, financial institutions, settlement agencies, fintech, investors and funders, and community organizations to better respond to this growing segment of the...

The Monthly Financial Well-being Monitor is a survey designed to collect information about Canadians' day-to-day financial management and financial well-being. It collects data from approximately 1,000 respondents per month and is a continuation of the COVID-19 Financial Well-being Survey, which...

Every day in Canada, nearly 1 in 4 people worry about eating, compromise on the quantity and quality of their groceries and/or go without food due to financial constraints. Food insecurity disproportionately impacts some groups, including Indigenous and racialized peoples, people with...

The Canadian Bankers Association’s Cyber Security Toolkit for Newcomers to Canada, developed in collaboration with Get Cyber Safe, aims to educate newcomers on cyber hygiene best practices and empower them so that they are equipped to recognize and avoid common scams in Canada. The Toolkit...

This free new course for newcomers consists of 4 short modules that should take 10-15 minutes each to complete. Each module includes short case studies, mini quizzes and other interactive elements. The topics for each module are: Essentials of credit in Canada How to build your credit...

November 26 is National Economic Abuse Awareness day. The Canadian Centre for Women's Empowerment has published their report on the state of economic abuse in Canada; championing financially strong futures for survivors. Here are some additional resources of potential interest: The economic...

When immigrants arrive in Canada, they face many financial challenges. From opening a bank account to using a credit card, from buying a house to paying for insurance, they may find it difficult to navigate the nuances of Canadian markets. Newcomers rely on industry professionals to assist them in...

This resource produced by Community Legal Education Ontario (CLEO) provides a list of free legal information about paying rent, eviction procedures and much...

The CRA has compiled benefits and credits factsheets for: Students Persons with disabilities Modest income individuals Housing insecure individuals Adults 65 and older Women in shelters Indigenous peoples Newcomers These are available in English and...

The Financial Consumer Agency of Canada’s (FCAC) COVID-19 Financial Well-being Survey, which began in August 2020, is a nationally representative hybrid online-phone survey fielded monthly, with approximately 1,000 respondents per month. The survey collects information on Canadians’ day-to-day...

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. Here is some basic information to get you started. A list of bank resources at the end of this article may also help with the...

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving...

Investing for your future is important. And no matter how much (or little) money you have to invest, having the right information and resources can help you make better decisions for you and your family. The resources and tools provided here are intended to be a starting point for new investors,...

Banks offer extensive information on how newcomers to Canada can get started in their new country, including checklists, information, financial services and advice. The Canadian Bankers Association has compiled some basic information to get you started including an infographic with features of the...

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of...

This paper explores the intersection of digital innovation, digital services, access, and taxpayer rights in the Canadian context, in light of the experiences of vulnerable populations in Canada, from the perspective of the Taxpayers’ Ombudsman. Many aspects of the CRA’s digitalization...

One-on-one financial help is a key financial empowerment (FE) intervention that Prosper Canada is working to pilot, scale and integrate into other social services, in collaboration with FE partners across the country. FE is increasingly gaining traction as an effective poverty reduction measure. FE...

Benefits and credits provide income and financial support for many individuals. This toolkit contains information on common tax credits and benefits, benefits for specific populations, and practitioner resources including case studies and information on identification documentation for accessing...

This Economic Insights article examines trends in the citizenship rate (the percent of immigrants who become Canadian citizens) among recent immigrants who arrived in Canada five to nine years before a given census. The citizenship rate among recent immigrants aged 18 and over peaked in 1996 and...

For many newcomers, living in Canada involves learning about finances and money management in new ways. This can include navigating new financial systems, and learning about tax filing and benefits, as well as day-to-day money management and saving. One-on-one financial coaching programs...

This fact sheet provides insights from Prosper Canada's Financial Empowerment for Newcomers pilot project conducted with three newcomer-serving organizations, Saskatoon Open Door Society (SODS), AXIS Employment Services (AXIS), and North York Community House (NYCH), who implemented and integrated...

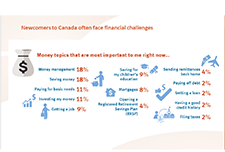

This infographic displays data gathered from interviewing 53 newcomer participants in three provinces (Saskatchewan, Ontario, and Newfoundland) between August and October 2017. Learn more about the stages of newcomer settlement, key money topics and experiences of newcomers, and three types of...

Are you a newcomer to Canada, or someone who works with newcomers? This online tool will help you explore five money modules to better manage your finances in Canada. Learn about the financial system in Canada, income and expenses, setting goals and saving, credit and credit reports, and filing...

This study examines the rate of chronic low income among adult immigrants (aged 25 or older) in Canada during the 2000s. Data is taken from the Longitudinal Immigration Database (IMDB) for the period from 1993 to 2012, with regional adjustments used for the analysis. Chronic low income is...

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use....