Discover financial empowerment resources

Discover financial empowerment resources

Fast facts: More than 99 per cent of Canadians have a bank account 31 per cent of Canadians say they pay no service fees at all and another 45 per cent pay $15 or less per month Canadians are careful borrowers. Only 0.17 per cent of mortgages are in arrears Access this resource to read...

Since 2020, the Bank of Canada has engaged with Canadians, the financial industry and civil society groups to better understand how a digital version of the Canadian dollar might affect everyone. Bilateral and roundtable discussions were held, as well as demographically representative focus groups...

While cyber criminals are always looking for ways to trick you into revealing information they can use to access your accounts, we have a few simple tips to avoid getting tricked by “one time passcode” scams that you may encounter while attempting to access your accounts...

There are also simple steps you can take to recognize cyber threats and protect yourself. With a cyber hygiene checklist and tips on how to spot common scams, the CBA’s Cyber Security Toolkit can help you protect against online financial...

Getting cyber safe doesn't have to be complicated. With the right resources and tools, you can stay safe and secure online. Here's a handy checklist for protecting your data...

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world....

Canada’s digital divide has often been narrowly defined as the gap that exists between urban and rural broadband internet availability — Canadian urban centres have significantly greater internet subscription levels at faster speeds than rural communities.(Government of Canada, 2019). The cost...

Nonprofit organizations in Canada were significantly impacted by COVID-19, including lost revenue and needing to adjust the program delivery. The lack of technology capacity in the nonprofit sector is a key barrier for many nonprofit organizations to adapt to delivering programs online. Momentum, a...

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step...

Technology can play a key role in addressing some of the financial challenges that Canadians face on a day-to-day basis. Over the last five to ten years we have seen a growing number of companies, called fintechs, that primarily use technology to change and enhance the way we do banking or access...

In response to the COVID-19 pandemic and the complexities of the benefits and financial relief measures available to Canadians, we developed the Financial Relief Navigator (FRN), an online resource that helps vulnerable Canadians and those that work with them access critical emergency benefits and...

The engagement of Canadians with lived experiences of poverty in government consultations on poverty reduction is critical. But as hard as governments work to try to include people living in poverty as full participating members in their consultation processes, there are many barriers that continue...

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in...

This pilot study explores the delivery and effectiveness of MyBudgetCoach, a financial coaching program designed to help low- and moderate-income adults develop budgeting skills, set financial goals, and work towards those goals. Specifically, this study compares two modes of program delivery,...

This publication reveals the outcomes of Bridgable's work with a federal credit union, cutting through their overwhelming number of offerings to better engage with their low-income members. It also discusses why agility is a better bet than digitization when it comes to our changing financial...

This review is intended to serve as a resource for employers who are interested in promoting employee financial well-being by helping their employees develop the skills to better manage their money. Section One introduces the need for financial education in the workplace. Section Two offers an...

This is the slide deck from the CFSI / Assets & Opportunity Network webinar on Fintech apps to support financial health. The webinar explains financial health, the goal of financial solutions technologies, the FinLab project to help wealther financial shocks through financial technology -...

The purpose of this guide is to provide detailed guidance on designing and developing an e-learning course for trainers and instructional designers who are new to e-learning design. It also provides basic concepts and information on the processes and resources involved in e-learning development,...

This is the slide deck for the webinar presentation by the Cities of Migration project from the United Nations. This webinar presents research on refugrees and their reliance on technology as an aspect of improving well-being and access to humanitarian...

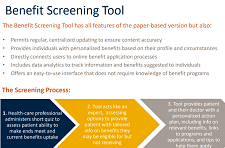

This report provides information on the results of Phase 1 of the Benefits Screening Tool project. Details on Phase 2 of the project (July 2016 to March 2018) are also included. The online Benefits Screening Tool (BST) enables health practitioners to screen patients for poverty and suggest...

The Children’s Savings Account (CSA) movement has taken off in the past few years. These programs provide long-term savings or investment accounts and savings incentives to help children build savings for their future. In 2016, CSA initiatives started in a diverse range of locations, such as...

In 2014, the licensed Canadian payday loan industry provided nearly 4.5 million short-term loans to Canadian households, at a total value of $2.2 billion. Despite its unfavourable reputation, the licensed payday loans industry provides a necessary service for cash-strapped Canadians. Placing...

Approximately 2 million Ontarians live in low-income households, many allocating a significant portion of their finances to powering their homes. In these situations, electricity costs can force individuals to have to decide between paying energy bills and providing for other essential food,...

This article explores benefits screening, a system of auditing patients to identify those living in poverty and the benefits they may be eligible for, as an innovative step towards realizing the right to health in Canada by advancing health equity. In particular, it assesses one online tool...

Americans experience tremendous income volatility, and that volatility is on the rise. Income volatility matters because it is hard to manage. The typical household faces a shortfall in the financial buffer necessary to weather this volatility. Moreover, the decline in real wages since 2009 for all...