Discover financial empowerment resources

Discover financial empowerment resources

The overall purpose of the collaborative project between Seneca College and Prosper Canada was to build a supportive booking system for tax clinics serving low-income...

The Community Volunteer Income Tax Program (CVITP) is a partnership between the Canada Revenue Agency (CRA) and local community organizations. The program is intended to ensure that all taxpayers have equal access to the tax system. In Grey and Bruce Counties, 14 community organizations provide...

This tax season, community tax clinics across Canada will be preparing to support clients virtually rather than in person amidst physical distancing measures due to the COVID-19 pandemic. Adapting to a virtual tax clinic model means preparing for different ways of volunteer preparation, client...

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits...

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of...

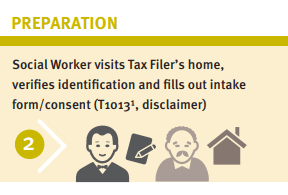

WoodGreen Community Services, a large multi-service frontline social service agency in Toronto, provides free tax preparation services year-round to people living on low incomes. WoodGreen was interested in designing a novel solution to address the tax filing needs of homebound seniors who are...

Many frontline community organizations provide free tax preparation services to people living on low incomes across Canada using a variety of methods. However, when COVID-19 struck, a large majority of agencies offering free tax-filing supports were forced to close their doors and halt in-person...

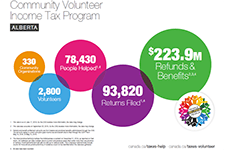

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les...

In this presentation, Radya Chaerkaoui, Senior Product Manager and Innovation Catalyst, Intuit Canada, and Steve Vanderherberg, Director-Strategic Initiatives, WoodGreen Community Services, share insights from their Virtual Tax Filing Pilot program. This presentation is from the session...

In this presentation, Althea Arsenault, Manager of Resource Development, NB Economic and Social Inclusion Corporation, shares insights from the 'Get Your Piece of the Money Pie' tax clinic program. This program has operated since 2010, and currently files over 23,000 returns each year. This...

In this presentation, Noralou P. Roos, Co-Director, GetYourBenefits! and Professor, Manitoba Centre for Health Policy, explains how access to tax filing and benefits is an important poverty intervention. This presentation is from the panel discussion 'National and regional strategies to boost tax...

In this presentation, Simon Brascoupé, Vice President, Education and Training, AFOA Canada, explains the financial wellness framework and how tax filing presents opportunities for building financial wellness in Indigenous communities. This presentation is from the session 'Closing the tax-filing...

In this presentation, Aaron Kozak, ESDC and Melissa Valencia, CRA, present findings from their research on the Community Volunteer Income Tax Program (CVITP). This includes recommendations for structural changes to the program, review of CVITP training, changes to registration, and more. This...

In this presentation, Nancy McKenna, Manager, CVITP, Canada Revenue Agency, explains how the Community Volunteer Income Tax Program (CVITP) works. This includes eligibility requirements, the size of the program in 2017/2018, and partnerships. This presentation is from the session 'Closing the...

For people living with low incomes in Canada, tax time is an important opportunity to access a wide range of federal and provincial/territorial benefits and credits. However, many people with low incomes experience barriers to tax filing that prevent them from accessing these important sources of...

In this toolkit you'll find materials to help you learn about what's involved in tax filing, and some materials to support setting up your own community tax clinic. Updated February 18, 2025: Find the income tax package for the province or territory where you resided on December 31,...

For Canadians with low-incomes, tax time is an important opportunity to boost their incomes by accessing a wide range of government benefits. This can be done by claiming benefits directly when they tax file or by using tax filing to establish their eligibility for benefits that they can then apply...