Discover financial empowerment resources

Discover financial empowerment resources

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

During the income tax filing season, scammers pose as representatives of the Canada Revenue Agency (CRA) in an attempt to trick you into sending payment for fictitious "debts" or into providing sensitive personal information that they can use to commit fraud. Learn how to spot tax season scams by...

Every year, scammers take advantage of income tax filing season to try to trick Canadians into divulging sensitive personal information that scammers can use to commit fraud or into sending money to pay off fictitious "debts". How to spot most tax season scams There are often red flags that the...

This CRA site has information on what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. There's also information on available tax filing...

After you file your tax return, Canada Revenue Agency processes it. It will issue you a refund or charge you for taxes owing, depending on the result of your return. While many returns are processed without a review, sometimes your tax return may be reviewed or audited. The Ontario Securities...

The Canada workers benefit (CWB) is a refundable tax credit to help individuals and families who are working and earning a low income. The CWB has two parts: a basic amount and a disability supplement. You can claim the CWB when you file your income tax return. Learn more including eligibility...

The Community Volunteer Income Tax Program (CVITP) is a partnership between the Canada Revenue Agency (CRA) and local community organizations. The program is intended to ensure that all taxpayers have equal access to the tax system. In Grey and Bruce Counties, 14 community organizations provide...

During the income tax filing season, scammers pose as representatives of the Canada Revenue Agency (CRA) in an attempt to trick you into sending payment for fictitious "debts" or into providing sensitive personal information that they can use to commit fraud. Learn more on how to spot tax season...

Registered Retirement Savings Plans (RRSPs) are accounts registered with the Canada Revenue Agency (CRA) that help you save for retirement or other goals. To make it easier, the British Columbia Securities Commission has created a simple guide to understanding RRSPs. In this post you’ll learn...

The CRA has compiled benefits and credits factsheets for: Students Persons with disabilities Modest income individuals Housing insecure individuals Adults 65 and older Women in shelters Indigenous peoples Newcomers These are available in English and...

The Annual Report by the Office of the taxpayer's ombudsman provides key achievements, identifies Canada Revenue Agency (CRA) service issues and outlines trends in complaints. In addition, the report includes three recommendations to the Minister of National Revenue and the Chair of the Board of...

A free online course to learn about personal income taxes in Canada, developed by the Canada Revenue Agency. Contents include: Starting to work: Why you need a social insurance number (SIN), when to fill out a TD1 form, and what’s on your pay stub and T4 slip. Preparing to do your taxes:...

The Canada Learning Bond is money that the Government of Canada adds to a Registered Education Savings Plan (RESP) to help pay the costs of full- or part-time studies after high school. If you are eligible for the Canada Learning Bond and have not already received it in an RESP, you will receive...

In November 2017, the Minister of National Revenue, the Honourable Diane Lebouthillier, announced the creation of the Disability Advisory Committee to provide advice to the Canada Revenue Agency (CRA) on interpreting and administering tax measures for persons with disabilities in a fair,...

A report from Auditor General Karen Hogan concludes that the Canada Revenue Agency (CRA) managed the Canada Child Benefit (CCB) program so that millions of eligible families received accurate and timely payments. The audit also reviewed the one-time additional payment of up to $300 per child issued...

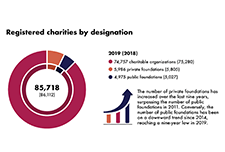

The charitable sector is a major social and economic force, offering vital services to Canadians and people around the world. The Canada Revenue Agency's Charities Directorate employs an education-first approach and client-centric philosophy. It aims to promote compliance with the charity-related...

This tax season, community tax clinics across Canada will be preparing to support clients virtually rather than in person amidst physical distancing measures due to the COVID-19 pandemic. Adapting to a virtual tax clinic model means preparing for different ways of volunteer preparation, client...

The Canada Revenue Agency administers dozens of cash transfer programs that require an annual personal income tax return to establish eligibility. Approximately 10–12 percent of Canadians, however, do not file a return; as a result, they will not receive the benefits for which they are otherwise...

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits...

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of...

Benefits and credits provide income and financial support for many individuals. This toolkit contains information on common tax credits and benefits, benefits for specific populations, and practitioner resources including case studies and information on identification documentation for accessing...

As a senior, you may be eligible for benefits and credits when you file your taxes. The Canada Revenue Agency has tips to help you get all of them! This page includes tips for seniors at tax time and links to relevant Government of Canada...

Questions and answers released by the Canada Revenue Agency (CRA) about filing your taxes, including information on: Prior to filing your tax return changing your address getting someone else permission to access your tax information getting free tax help Filing your tax...

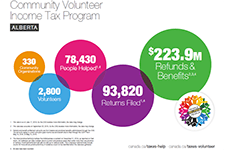

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les...

This report presents the findings of an ethnographic research project undertaken by researchers at the Accelerated Business Solutions Lab (ABSL) at the Canada Revenue Agency (CRA). It is the second of a series of ethnographic reports on the experiences of vulnerable populations. The objective of...