Discover financial empowerment resources

Discover financial empowerment resources

Financial coaching (FC) is a transformative approach that empowers individuals to take control of their financial future. Through personalized interventions such as assessing financial positions, creating budgets, managing credit, accessing benefits, and filing taxes, financial coaching equips...

Some say money talks, but many people feel uncomfortable talking about money. However, talking openly about your finances with people you trust can be an important step in reaching your goals. It may be tough to talk about money with close family and friends, but it can be helpful. To break the...

When Canadians have a financial problem, want to make a financial plan, or need help with their taxes, most simply reach out to their financial institution, adviser, accountant, or commercial tax preparer for the help they need. But who do low-income individuals turn to? A new report by Prosper...

This collection of financial empowerment tools and resources is intended to support both Indigenous and non-Indigenous organizations working to build financial wellness in First Nation communities. It was created as part of the Financial Wellness in First Nations project (2021-2023) where...

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and...

Recover and Rebuild: Helping Canadians build financial security during the pandemic and beyond The 2021 ABLE Financial Empowerment (FE) virtual series is a collection of online financial empowerment events designed to provide frontline FE practitioners, FE stakeholders, policy-makers and...

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling...

Almost half of low-income households and 62 per cent of moderate-income households carry debt, with households on low incomes spending 31 per cent of their income on debt repayments, according to a new report published by national charity, Prosper Canada. This report analyzes the distribution,...

This research report compares the long-term financial outcomes of Canadians, based on a study comparing consumers who used a debt management program (DMP), bankruptcy (BK), or a consumer proposal (CP) to obtain relief from...

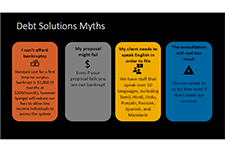

This is a one-hour webinar on debt management solutions in Canada for situations where someone's debt is significant enough that specialized solutions are needed. The speakers explain what steps are likely to be involved in the credit counselling process in setting up a debt management plan, or...

Many of us struggle to talk about money, especially when it comes to talking about debt. It is when debt becomes too much for us to manage, or when we do not have a plan to pay it off, that it can become stressful and even overwhelming. This is when it is time to have those tough conversations and...

This is a one-hour webinar on matched savings programs and personal savings strategies that work for people living on low incomes. Our panelists share experiences from their programs in Ontario and Calgary. The presenters in this webinar are: Dean Estrella, Momentum, Calgary, AB John...

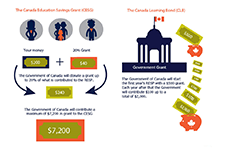

This is a one-hour webinar on increasing take up of Registered Education Savings Plans (RESPs) among people on low incomes. Our panelists share challenges and success stories in their work to help clients save for their children’s post-secondary education. Learn successful outreach strategies,...

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use....

This toolkit contains tools and worksheets you can use with your financial coaching clients. Each document should be used as a part of the coach-client relationship. This include financial coaching tools such as the financial wheel of life and tips for the first meeting, as well as tools and...

This report presents a study of the debt settlement and financial recovery industry and examines Canadian consumer issues from these services. Data is gathered from company websites and contracts as well as customer surveys and questionnaires completed by governmental and non-governmental...

This short guide explains the process of getting debt management help from a credit counselling agency. Credit counselling agencies provide a range of services for people in financial difficulty. One of the most common services they offer is help with finding the best strategy to pay off your debt...

Looking to give your credit score a lift? Credit Canada can show you how to obtain your credit score, what it means, and how to get it into better shape. Click on "Access this resource" to learn...

Mariposa is an AI agent built by Credit Canada, the country’s first and longest-standing non-profit credit counselling agency. Access free, 24/7 AI-powered financial advice and get a personalized debt assessment to help you take the next step toward being...

This toolkit contains resources and information which may offer support to organizations, agencies, or frontline staff supporting individuals, during a challenging time. This toolkit has been made possible with the support of the Canadian Investment Regulatory Organization (CIRO) and is now...