Discover financial empowerment resources

Discover financial empowerment resources

Financial empowerment (FE) is an approach to poverty reduction that focuses on improving the financial security of people living on low income. Evidence shows that embedding FE interventions into municipal welfare, employment, housing, shelter and health services can significantly boost service...

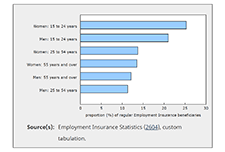

February Employment Insurance (EI) statistics reflect labour market conditions as of the week of February 14 to 20. Ahead of the February reference week, non-essential businesses, cultural and recreation facilities, and in-person dining reopened in many provinces, subject to capacity limits and...

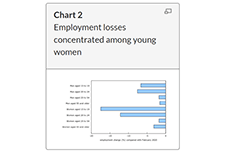

February Labour Force Survey (LFS) data reflect labour market conditions during the week of February 14 to 20. In early February, public health restrictions put in place in late December were eased in many provinces. This allowed for the re-opening of many non-essential businesses, cultural and...

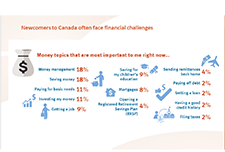

For many newcomers, living in Canada involves learning about finances and money management in new ways. This can include navigating new financial systems, and learning about tax filing and benefits, as well as day-to-day money management and saving. One-on-one financial coaching programs...

In early 2018, Enterprise Community Partners (Enterprise) began a pilot program, Enterprise Community Plus (EC+), to provide financial capability services to residents in two neighborhoods in New York City. Enterprise is a nonprofit housing developer seeking to create opportunity for low- and...

In this toolkit you'll find materials to help you learn about what's involved in tax filing, and some materials to support setting up your own community tax clinic. Updated February 18, 2025: Find the income tax package for the province or territory where you resided on December 31,...

By providing a refundable credit at tax time, the Earned Income Tax Credit (EITC) is widely viewed as a successful public policy that is both antipoverty and pro-work. But most of its benefits have gone to workers with children. Paycheck Plus is a test of a more generous credit for low-income...

Children need stability to thrive. But across the United States, more and more children are facing the most extreme form of instability and poverty—homelessness. In no place is this more evident than in New York City, where one out of every eight children attending public school in SY...

This is a short New York Times article on debt and the racial wealth gap - black Americans are more likely to experience debt issues than white...

This brief and an accompanying interactive map were commissioned by the New York City Department of Consumer Affairs’ Office of Financial Empowerment. The brief provides information on how many New Yorkers are unbanked and underbanked, recognizing their links to financial health. It also...

New York City’s Earned Sick Time Act (Paid Sick Leave Law) created the legal right to sick leave for 3.4 million private and non-profit sector workers. For one third of those workers—nearly 1.2 million—the Paid Sick Leave Law (PSL) marked the first time they had access to this vital workplace...

This is a brief New York Times article on income volatility and paying the bills, discussing 2013 Federal Reserve survey data and US Financial...

This brief highlights findings from a small-scale pilot that integrated Virtual Volunteer Income Tax Assistance (VITA) services at two New York City Head Start programs during the 2013 tax season. The New York City Department of Consumer Affairs Office of Financial Empowerment (OFE) coordinated the...

We deployed field researchers into communities in California, Mississippi, New York, Ohio, and Kentucky to delve into the intimate financial details of approximately 200 households. Over the course of a year, field researchers visited each family once or twice a month, logging detailed information...

The Immigrant Financial Services Study combined quantitative and qualitative methods to obtain a picture of demand and supply-side barriers and opportunities for financial access for immigrants in New York City. Demand-side research consisted of three initial focus groups, a three-month survey...

This report, the third in a series about the “supervitamin” effect of improved social service outcomes when integrating financial empowerment and asset building strategies into public programs, details New York City’s efforts to increase access to safe and affordable banking...

This Report, the second in a series about the “supervitamin effect” of improved social service outcomes when integrating financial empowerment and asset building strategies into public programs, details New York City’s efforts to provide high-quality, effective financial counseling at scale...

The Citywide Financial Services Study provides key data about financial behaviour and access to financial services among New Yorkers with low and moderate incomes. The purpose of the study was to quantify the unbanked marketplace in New York City, identify critical indicators of financial behaviour...

This report, which documents how New York City introduced professional financial counseling into key City services, is the first in a series that build the case for fully integrating financial empowerment and asset building strategies into core social service delivery to achieve better outcomes,...

Financial counselling may be an effective way to improve individuals’ financial behaviour and outcomes. However, its impacts have not been adequately studied. Previous studies show weak positive effects of counselling, but are subject to a number of limitations. This study, a collaboration...

The objectives for this research were to: Quantify the unbanked marketplace in New York City; Establish baseline for critical indicators of financial behaviour and household financial stability; Inform the development and targeting of financial counseling services, asset-building programs, and...

This guide was created to be a resource for community college educators, staff, and administrators interested in implementing financial coaching as a way to empower students to build money management skills and make healthy financial decisions. Strategies for integrating financial coaching into a...

This toolkit contains resources and information which may offer support to organizations, agencies, or frontline staff supporting individuals, during a challenging time. This toolkit has been made possible with the support of the Canadian Investment Regulatory Organization (CIRO) and is now...