Discover financial empowerment resources

Discover financial empowerment resources

This 90-minute webinar is provided on a quarterly basis and is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and...

This groundbreaking initiative is aimed at transforming emergency shelter services across Canada to better uphold the rights of women and gender-diverse people. Emergency shelters play a critical role in providing immediate support, but they are often overwhelmed and under-resourced. In response...

The disability tax credit (DTC) is an important program for those facing severe and prolonged physical or mental impairment. Some individuals face unique barriers when it comes to completing their application and claiming the credit. On this page, the CRA is correcting some of the most common myths...

This 60-minute webinar for frontline practitioners, social service providers, and funders shares insights from a two-year project designed to help build financial wellness in isolated and rural First Nation communities in Manitoba and Ontario. Partnerships between First Nation communities and...

Having a small emergency fund can alleviate major stress. Putting a few dollars away each month can help you prepare for the unexpected. Watch this new video by the Ontario Securities Commission to learn...

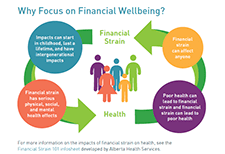

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

This 90-minute webinar is designed to provide frontline practitioners with foundational knowledge and skills to support Canadians who are living on a low income to access benefits. Participants learn the importance of access to benefits for individuals and families, review key skills and...

Financial abuse is one of the most common forms of elder abuse in Canada. Learn how to identify and prevent it, plus where to go for help if you or an older person you know is being financially...

Wealth inequality, health and health equity is one in a series of ongoing think pieces from Wellesley Institute that aim to stimulate ideas and new conversations to create a fairer and healthier tomorrow. Canadians are struggling with the rising cost of living. A national survey in November 2023...

Many people living in First Nations communities do not have access to housing that is safe and in good condition—a fundamental human right. Improving housing for First Nations is vital for their physical, mental, and economic health and well-being. This is the fourth time since 2003 that we...

In their study, entitled, “Experiences of Financial Stress and Supports in Caregivers During Pediatric Hospital Admission,” Nadarajah et al interviewed caregivers of children admitted to a pediatric hospital and conducted qualitative analyses to assess financial needs, health related financial...

In Canada and the United States, approximately 1 in 5 children live in poverty, contributing to poor health outcomes. Families with children with chronic illness may experience additional financial stress related to hospitalization. This study aimed to capture experiences of financial needs and...

If you’re saving for a goal in the near future and you’ll need to access the money within a year or two, chances are that’s a short-term goal. Whether it’s for a wedding, a dream vacation, or a new appliance for your home, if it’s something you’re unable to pay for right away then...

This year marks the 20th anniversary of Fraud Prevention Month. The theme of this year’s campaign is “20 years of fighting fraud: From then to now. With this theme, we’ll be exploring how certain frauds have evolved with the rise of the digital age, drawing insightful comparisons between the...

The Asset Funders Network engages philanthropy to advance equitable wealth building and economic mobility. For 19 years, AFN has provided a forum for grantmakers and financial institutions to connect, collaborate, and collectively invest in helping more people achieve economic security. The 2023...

After you file your tax return, Canada Revenue Agency processes it. It will issue you a refund or charge you for taxes owing, depending on the result of your return. While many returns are processed without a review, sometimes your tax return may be reviewed or audited. The Ontario Securities...

Investment scams often involve convincing you to put up money for a questionable investment – or one that doesn’t exist at all. In most cases, you’ll lose some or all of your money. There are many ways fraudsters can approach you. The digital era has allowed new kinds of scams as well as more...

With frauds and scams on the rise, it's important for Canadians to recognize fraud and protect themselves from it. The Canadian Anti-fraud Centre has many resources on their website to help Canadians navigate fraud, how to recognize it and how to report...

This study examined the financial lives of retired Canadians and those approaching retirement. While most retired Canadians said they are in a strong financial position, a concerning 15% of retirees rated their financial situation as poor. Almost one third of retirees reported their monthly...

Gender-based violence (GBV) is one of the most prevalent human rights issues in the world. Worldwide, an estimated one in three women will experience physical or sexual abuse in her lifetime. GBV is a multifaceted issue that undermines the health, dignity, security and autonomy of women and has a...

Have you ever made an impulsive purchase? Do you struggle to stick to a diet or exercise routine? What’s the longest you have gone in keeping your New Year’s resolutions? The field of behavioural insights tells us that we have an innate desire to live for today at the expense of tomorrow....

Renters across Canada are facing exorbitant rental housing costs, driven by excessive rent increases and the loss of affordable homes. Many renters are left with so few housing options that they can afford, leaving them vulnerable to “economic eviction,” or being forced to live in a home that...

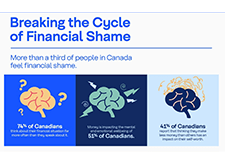

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

If you’re curious about Canadians experiences with buying crypto assets, you’ll want to read the results of the OSC’s Crypto Assets 2023. It provides insights into the evolution of Canadians’ crypto ownership and knowledge. Read the 2022 crypto survey results...

In this video by the Ontario Securities Commission, learn the 4 signs of investment fraud to help you keep your money...