About half of households are considered financially fragile, which means they’re not sure they could come up with $2,000 in 30 days if they had to. Lack of emergency savings is common. It affects about half of households that earn $25,000 to $75,000 a year, and about a quarter of households that earn more than $75,000 a year. Research shows that consumers have many reasons for their actions. To gain insight into why it’s so hard for consumers to build savings to manage financial emergencies, consider these factors.

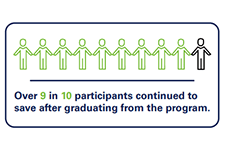

The Impact of Matched Savings Programs: Building Assets & Lasting Habits