Discover financial empowerment resources

Discover financial empowerment resources

With February 2025 the thirteenth Index Release, the Institute’s Financial Resilience Index Model complements the national Financial Well-Being Studies instrument and the Financial Well-Being Index Model instruments. Access this resource to read the...

The Financial Consumer Agency of Canada’s (FCAC) report examines and compares key measures of financial well-being for 3 groups of Canadians: homeowners with mortgages, homeowners without mortgages, and renters. The data shown here are derived from FCAC’s COVID-19 Financial Well-being Survey....

Women and girls are highlighted within Canada’s National Financial Literacy Strategy as a diverse population that can benefit from tailored approaches to strengthen financial resilience. To help close the gender gap, the Financial Consumer Agency of Canada (FCAC) developed and tested the benefits...

In 2023, the Financial Consumer Agency of Canada (FCAC) and researchers from Carleton University developed and tested the effectiveness of brief, online interventions at improving the financial confidence, financial knowledge and positive financial behaviours of young women ages 16–25. To...

Understanding Technology-Facilitated Economic Abuse: This form of abuse arises when digital tools are misappropriated to monitor, control, or sabotage an individual's finances. It can take many forms, including tracking online banking, identity theft, restricting account access, and even utilizing...

The Organisation for Economic Co-operation and Development (OECD) is an international organisation establishes evidence-based international standards and finding solutions to a range of social, economic and environmental challenges. The OECD/INFE Toolkit includes a financial literacy questionnaire...

Trauma and violence are highly prevalent and have serious impacts on health and well-being. Being aware of how trauma and violence can present during service interactions can improve their effectiveness and client and provider satisfaction and well-being. Financial literacy educators are...

Longevity literacy is an understanding of how long people tend to live upon reaching retirement age. It is particularly important since retirement income security requires planning, saving, and preparing for a period that is uncertain in length. This matters because longevity literacy is...

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

Women’s shelters are often the first point of contact for victim-survivors fleeing abusive relationships. Therefore, safety and shelter are logically at the forefront of staff members’ immediate concerns. Once the victim-survivor is in a place of safety, it is crucial to explore the patterns of...

Financial Services Regulatory Authority of Ontario commissioned a research study that focused on consumer attitudes, how consumers are engaging with financial services, and consumer characteristics such as vulnerability. Insights from the research are allowing FSRA to better understand the...

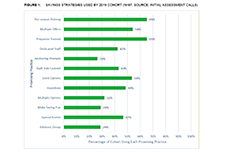

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said...

The Thriving or Surviving study uncovers the kitchen table issues that confront Canadians daily, revealing how the country is coping with concerns such as debt, savings, emergency funds and financial...

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving...

Being aware of potential biases can help you become a better decision-maker. Use this tool to improve your awareness of different behavioural biases or “blind spots” that may influence your...

This infographic explores 3 forms of economic abuse and associated tactics used to coercively control intimate partners. These abusive tactics are compounded by economic systems that systemically oppress groups including Black, Indigenous, and people of colour; people with disabilities; people...

The coronavirus pandemic has tested the limits of Canadians over the past 20 months. What began as a health crisis quickly morphed into an economic crisis, with the spread of COVID‑19 shocking large segments of the economy and leaving many without paycheques. While no generation has been...

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual...

Based on an extensive literature review and re-analysis of existing qualitative data, this report offers a working definition and an a priori conceptual model of financial well-being and its possible determinants. Using survey data from Norway (2016), ten regression models have been conducted to...

This study covers the rapidly growing literature on the causal effects of financial education programs in a meta-analysis of 76 randomized experiments with a total sample size of over 160,000 individuals. The evidence shows that financial education programs have, on average, positive causal...

Women are less financially literate than men. It is unclear whether this gap reflects a lack of knowledge or, rather, a lack of confidence. This survey experiment shows that women tend to disproportionately respond “do not know” to questions measuring financial knowledge, but when this response...

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s...

This paper introduces a novel survey measure of attitude toward debt. Survey results with panel data on Swedish household balance sheets from registry data are matched, showing that debt attitude measure helps explain individual variation in indebtedness as well as debt build-up and spending...

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to...

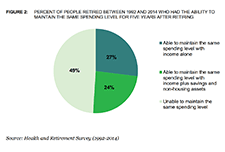

A growing number of retirees are not experiencing the expected gradual reduction in spending after they retire. This report summarizes the findings of a Bureau study into whether people who retired between 1992 and 2014 had the income, savings, and/or non-housing assets to maintain the same level...