2022 Canadian Retirement Survey

The key takeaways from the 2022 Canadian Retirement Survey are: Read the full presentation conducted for Healthcare of Ontario Pension Plan.

Financial consumer protection framework

This presentation provides information about the FCAC's public awareness strategy for Canada's new Financial Consumer Protection Framework including an overview of FCAC's planned activities and resources and highlights the importance of collective action to inform Canadians. Additional promotional toolkits can be found on the FCAC website.

Encouraging tax filing at virtual clinics

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual clinics.

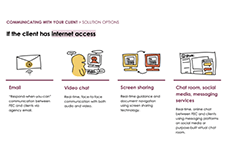

Helping financial empowerment champions deliver critical services to low-income Canadians

Service design consultancy Bridgeable provides an overview of the project partnership with Prosper Canada in April 2020 to take a design sprint approach in providing remote tax-filing and benefits application service solution. Over the course of four consecutive days, Bridgeable worked with eighteen financial empowerment champion (FEC) partners to generate solutions to four key aspects for remote service delivery:

Resources

Talking to our neighbours: America’s household balance sheets

Household Financial Stability and Income Volatility, Ray Boshara, Federal Reserve Bank of St. Louis

Income volatility: What banking data can tell us, if we ask, Fiona Greig, JP Morgan Chase Institute

Up Close and Personal: Findings from the U.S. Financial Diaries, Rob Levy, CFSI

The good, the bad, and the ugly: Canada’s household balance sheets

Canada’s household balance sheets, Andrew Heisz, Statistics Canada

Income volatility and its effects in Canada: What do we know?

Pervasive and Profound: The impact of income volatility on Canadians, Derek Burleton, TD Economics

Income and Expense Volatility Survey Results, Patrick Ens, Capital One

Neighbourhood Financial Health Index: Making the Invisible Visible, Katherine Scott, Canadian Council on Social Development

What gets inspected, gets respected: Do we have the data we need to tackle household financial instability?

Do we have the data we need to tackle household financial instability?, Catherine Van Rompaey, Statistics Canada

Emerging solutions

Income volatility: Strategies for helping families reduce or manage it, David S. Mitchell, Aspen Intitute

Building consumer financial health: The role of financial institutions and FinTech, Rob Levy, CFSI

Redesigning Social Policy for the 21st Century, Sunil Johal, Mowat Centre

Strengthening retirement security for low- and moderate-income workers, Johnathan Weisstub, Common Wealth

Resources

Barriers to tax filing experienced by people with low incomes

Income tax filing and benefits take-up: Challenges and opportunities for Canadians living on low income, Uttam Bajwa, University of Toronto

Tax time insights, Nirupa Varatharasan, Prosper Canada

“Stories from the field”: Contextualizing the barriers Indigenous People face, Erin Jeffery, Canada Revenue Agency (CRA)

Closing the tax-filing gap: Challenges and opportunities

The Community Volunteer Income Tax Program, Nancy McKenna, CVITP, Canada Revenue Agency

Supporting organizations in the CVITP, Aaron Kozak, Employment and Social Development Canada, and Melissa Valencia, Canada Revenue Agency

A Realist analysis of nonprofit tax filing services, Kevin Schachter, University of Manitoba and SEED Winnipeg

National and regional strategies to boost tax filing

The Community Volunteer Income Income Tax Program, Nancy McKenna, Canada Revenue Agency

GetYourBenefits! Diagnose and Treat Poverty, Dr. Noralou Roos, Manitoba Centre for Health Policy

Get your piece of the money pie, Althea Arsenault, New Brunswick Economic and Social Inclusion Corporation

Innovations in tax filing assistance

Scaling tax filing assistance, John Silver, Community Financial Counselling Service (CFCS)

Virtual Tax Filing Pilot, Radya Cherkaoui, Intuit Canada, and Steve Vanderherberg, Woodgreen Community Services

Innovative use of technology for VITA, German Tejeda,

Innovative use of technology for VITA

In this presentation, German Tejeda, National Director of Financial Programs, Single Stop USA, shares results from the Virtual VITA Program in the United States since 2012. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Virtual Tax Filing Pilot

In this presentation, Radya Chaerkaoui, Senior Product Manager and Innovation Catalyst, Intuit Canada, and Steve Vanderherberg, Director-Strategic Initiatives, WoodGreen Community Services, share insights from their Virtual Tax Filing Pilot program. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Scaling tax filing assistance

In this presentation, John Silver, Executive Director, Community Financial Counselling Service (CFCS), Winnipeg, shares insights from the low income tax program at CFCS. This program files almost 10,000 returns each year, and also provides tax clinic support to other agencies and delivers detailed training for tax clinic volunteers. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Get Your Piece of the Money Pie

In this presentation, Althea Arsenault, Manager of Resource Development, NB Economic and Social Inclusion Corporation, shares insights from the 'Get Your Piece of the Money Pie' tax clinic program. This program has operated since 2010, and currently files over 23,000 returns each year. This presentation is from the panel discussion 'National and regional strategies to boost tax filing', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Get Your Benefits! Diagnose and Treat Poverty

In this presentation, Noralou P. Roos, Co-Director, GetYourBenefits! and Professor, Manitoba Centre for Health Policy, explains how access to tax filing and benefits is an important poverty intervention. This presentation is from the panel discussion 'National and regional strategies to boost tax filing', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Providing tax filing and benefits assistance to Indigenous communities

In this presentation, Simon Brascoupé, Vice President, Education and Training, AFOA Canada, explains the financial wellness framework and how tax filing presents opportunities for building financial wellness in Indigenous communities. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

A Realist Analysis of Nonprofit Tax Filing Services

In this presentation, Kevin Schachter, Graduate Student at University of Manitoba and Information Manager at SEED Winnipeg, presents a realist analysis of nonprofit tax filing services. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Supporting Organizations in the CVITP

In this presentation, Aaron Kozak, ESDC and Melissa Valencia, CRA, present findings from their research on the Community Volunteer Income Tax Program (CVITP). This includes recommendations for structural changes to the program, review of CVITP training, changes to registration, and more. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

The Community Volunteer Income Tax Program (CVITP)

In this presentation, Nancy McKenna, Manager, CVITP, Canada Revenue Agency, explains how the Community Volunteer Income Tax Program (CVITP) works. This includes eligibility requirements, the size of the program in 2017/2018, and partnerships. This presentation is from the session 'Closing the tax-filing gap: Challenges and opportunities', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Stories from the field: Contextualizing the barriers Indigenous People face

In this presentation, Erin Jeffery, Outreach Officer with Canada Revenue Agency (CRA) shares what the CRA Outreach team has learned about tax filing barriers facing Indigeous People in Canada. These barriers include lack of documentation, lack of trust, access to services, and challenges around accessing Canada Child Benefit. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Tax time insights: Experiences of people living on low income in Canada

In this presentation, Nirupa Varatharasan, Research & Evaluation Officer with Prosper Canada, explains the research methods and insights gathered in the report 'Tax time insights: Experiences of people living on low income in Canada.' This includes demographic information, the type of tax filing resources accessed by this population, and insights on the types of challenges and opportunities that result from their tax filing processes. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Income tax filing and benefits take-up: Challenges and opportunities for Canadians living on low incomes

In this presentation, Uttam Bajwa, Global Health and Research Associate with the Dalla Lana School of Public Health, University of Toronto, reports on tax filing challenges and opportunities for Canadians living on low incomes. This includes the challenges of not knowing what to do, fear and mistrust, and challenges accessing supports. This presentation is based on the research conducted for the Prosper Canada report 'Tax time insights: Experiences of people living on low incomes in Canada'. This presentation is from the session 'Barriers to tax filing experienced by people with low incomes', at the research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

National Investor Research Study

This presentation shows the results of a quantitative study undertaken by the Ontario Securities Commission to assess attitudes, behaviour and knowledge among Canadians pertaining to a variety of investment topics. These topics include retirement planning and conversations about finances.

Complaints Related to Service from the CRA: Lessons Learned and Working Towards Better Service

Operating at arm’s length from the Canada Revenue Agency, the Office of the Taxpayers' Ombudsman (OTO) works to enhance the Canada Revenue Agency's (CRA) accountability in its service to, and treatment of, taxpayers through independent and impartial reviews of service-related complaints and systemic issues. OTO receives complaints and concerns from members of First Nations, Inuit and Métis communities. In this conference presentation, the Taxpayers’ Ombudsman provides examples of the types of issues her Office receives in order to provide community leaders with her insights in helping Indigenous people get better service from the CRA. In support of the AFOA Canada 2018 National Conference theme of Human Capital – Balancing Indigenous Culture and Creativity with Modern Workplaces, this presentation will provide participants with information on the types of issues and trends her office sees from members of the Indigenous communities and on better ways of serving these populations.

Implementing Financial Coaching

A presentation on how financial coaching is different, client interaction and program evaluation and coaching as presented by Richard Simonds of Family Services of Greater Houston.