Research to help FSRA improve the lives of vulnerable consumers

Financial Services Regulatory Authority of Ontario commissioned a research study that focused on consumer attitudes, how consumers are engaging with financial services, and consumer characteristics such as vulnerability. Insights from the research are allowing FSRA to better understand the realities of consumers’ changing financial lives and helping to identify key opportunities to respond to the needs of vulnerable consumers. 2022 Consumer Research Study highlights. 2022 Consumer Research Study full report

Research study: Crypto assets 2022

This study by the Ontario Securities Commission examines Canadians’ crypto ownership and knowledge. It found 13% of Canadians currently own crypto assets or crypto funds. The study also found most Canadians did not have a working knowledge of the practical, legal and regulatory dimensions of crypto assets. Crypto assets were believed to play a key role in the financial system by 38% of those surveyed. The study provides a profile of crypto owners, their reasons for purchasing crypto assets or crypto funds, the role of financial advice, impact of advertising, and the experience of crypto owners with crypto trading platforms.

Pilot study: Buy now, pay later services in Canada

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have resulted in a steady increase in retail e-commerce sales over the past several years, and the COVID-19 pandemic has had a significant impact on how consumers make retail purchases. Retail e-commerce sales reached record levels during the pandemic. This has further contributed to the proliferation of buy now, pay later (BNPL) services in Canada.

How Canadians bank

Banks in Canada are meeting the evolving preferences of their customers as powerful new technologies change the way people bank and how they pay for goods and services. Banking is transforming at a record pace, bringing innovation and new potential to empower Canadians’ lives in a digital world. This survey and other findings form the basis of How Canadians Banks, a biannual study by the Canadian Bankers Association and Abacus Data that examines the banking trends and attitudes of Canadians.

Multicultural and newcomer charitable giving study

While much research has been conducted on how giving is correlated to factors like educational attainment or income level, the influence of ethnicity has been elusive. This research attempts to better understand how newcomers to Canada and second-generation Canadians perceive and approach giving and volunteerism.

Economic impact of COVID-19 among Indigenous people

This article uses data from a recent crowdsourcing data initiative to report on the employment and financial impacts of the COVID-19 pandemic on Indigenous participants. It also examines the extent to which Indigenous participants applied for and received federal income support to alleviate these impacts. As Canada gradually enters a recovery phase, the article concludes by reporting on levels of trust among Indigenous participants on decisions to reopen workplaces and public spaces.

Investing and The COVID-19 Pandemic: Survey of Canadian Investors

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and trading activity of retail investors. Key findings include that 32 per cent of investors have experienced a decline in their financial situation during the pandemic while 16 per cent have experienced an improvement. Half of investors have not done any trading during the pandemic, but of those who have been trading, 63 per cent have increased their holdings.

Diversity of charity and non-profit boards of directors: Overview of the Canadian non-profit sector

Charities and non-profit organizations play a vital role in supporting and enriching the lives of Canadians. A crowdsourcing survey of individuals involved in the governance of charities and non-profit organizations was conducted from December 4, 2020, to January 18, 2021. The objectives of the survey were to collect timely information on the activities of these organizations and the individuals they serve and to learn more about the diversity of those who serve on their boards of directors. A total of 8,835 individuals completed the survey, 6,170 of whom were board members.

CPA Canada 2020 Canadian Finance Study

Chartered Professional Accountants of Canada (CPA Canada) has released its comprehensive Canadian Finance Study 2020, which examines people's attitudes and feelings towards their personal finances. The results highlight the new financial realities that Canadians are experiencing during these unprecedented times. Nielsen conducted the CPA Canada 2020 Canadian Finance Study via an online questionnaire, from September 4 to 16, 2020 with 2,008 randomly selected Canadian adults, aged 18 years and over, who are members of their online panel. Among the key pandemic-related findings:

A profile of Canadians with a mobility disability and groups designated as visible minorities with a disability

Results from the 2017 Canadian Survey of Disability (CSD) have shown that over half of Canadians with a mobility disability need at least one workplace accommodation. Among population groups designated as visible minorities who have a disability, one-quarter considered themselves to be disadvantaged in employment because of their condition. In recognition of the International Day of Persons with Disabilities, Statistics Canada released three new data products based on findings from the 2017 CSD. One infographic focuses on disabilities related to mobility and another takes a look at visible minorities with disabilities. In addition, two data tables, on industry and occupation of those with and without disabilities, are now available.

Canadian Health Survey on Children and Youth, 2019

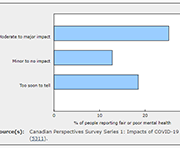

The current pandemic has reinforced the need for additional information on the health of Canadian children and youth, particularly for those younger than age 12. Results from the new Canadian Health Survey on Children and Youth (CHSCY) indicate that 4% of children and youth aged 1 to 17, as reported by their parents, had fair or poor mental health in 2019, one year prior to the pandemic. The survey also found that poor mental health among children and youth was associated with adverse health and social outcomes, such as lower grades and difficulty making friends. Recently released crowdsourced data suggest that the perceived mental health of Canadian youth has declined during the pandemic, with over half (57%) of participants aged 15 to 17 reporting that their mental health was somewhat worse or much worse than it was prior to the implementation of physical distancing measures.

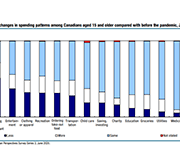

Expected changes in spending habits during the recovery period

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How our economy evolves going forward will largely depend upon the spending choices Canadians make over the coming weeks and months. This study presents results from a recent web panel survey conducted in June, looks at how spending habits may change.

Labour Force Survey, June 2020

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance payments. New questions were added to measure the extent to which COVID-19-related health risks are being mitigated through workplace adaptations and protective measures.

Canadian Perspectives Survey Series 1: Impacts of COVID-19 on job security and personal finances, 2020

Findings from a web panel survey developed by Statistics Canada on how Canadians are coping with COVID-19. More than 4,600 people in the 10 provinces responded to this survey from March 29 to April 3. In addition to content on the concerns of Canadians and the precautions they took to reduce the risk of exposure to COVID-19, the survey includes questions on work location, perceptions of job security, and the impact of COVID-19 on financial security.

Canadians and their money: Key findings from the 2019 Canadian Financial Capability Survey

This report provides results from the 2019 Canadian Financial Capability Survey (CFCS). It offers a first look at what Canadians are doing to take charge of their finances by budgeting, planning and saving for the future, and paying down debt. While the findings show that many Canadians are acting to improve their financial literacy and financial well-being, there are also emerging signs of financial stress for some Canadians. For example, about one third of Canadians feel they have too much debt, and a growing number are having trouble making bill, rent/mortgage and other payments on time. Over the past 5 years, about 4 in 10 Canadians found ways to increase their financial knowledge, skills and confidence. They used a wide range of methods, such as reading books or other printed material on financial issues, using online resources, and pursuing financial education through work, school or community programs. Findings from the survey support evidence that financial literacy, resources and tools are helping Canadians manage their money. For example, those who have a budget have greater financial well-being based on a number of indicators, such as managing cashflow, making bill payments and paying down debt. Further, those with a

financial plan to save are more likely to feel better prepared and more confident about their retirement.

Financial well-being in Canada

Financial well-being is the extent to which you can comfortably meet all of your current financial commitments and needs while also having the financial resilience to continue doing so in the future. But it is not only about income. It is also about having control over your finances, being able to absorb a financial setback, being on track to meet your financial goals, and—perhaps most of all—having the financial freedom to make choices that allow you to enjoy life. The Financial Consumer Agency of Canada (FCAC) participated in a multi-country initiative that sought to measure financial well-being. FCAC conducted this survey to understand and describe the realities of Canadians across the financial well-being spectrum and help policy-makers, practitioners and Canadians themselves achieve better financial well-being. This is in keeping with the Agency’s ongoing work to monitor trends and emerging issues that affect Canadians and their finances.

Retirement 20/20: The 2019 Fidelity Retirement Survey

The Fidelity Retirement Survey is focused on how Canadians near, and already in, retirement approach the next stage of their lives. This is the 14th year of the survey. The results indicate Canadians are retiring earlier than expected. They also show 46% of pre-retirees expect to have some long-term debt when they retire, and that 70% believe they will be working in retirement, among other results.

Gig Workers in America: Profiles, Mindset and Financial Wellness

The Gig Worker On-Demand Economy survey was conducted online by Harris Poll on behalf of Prudential from January 5 to February 18, 2017, among a nationally representative (U.S.) sample of 1,491 workers including 514 full-time and 256 part-time traditional employees and 721 gig workers. Gig work was defined as providing a service or labor, and did not include renting out assets. Survey respondents were selected from among adults aged 18+ who had agreed to participate in online surveys from the Harris Poll Online panel and preferred sample partners.

Financial Capability of Children, Young People and their Parents in the UK 2016

This new research study: the 2016 UK Children and Young People’s Financial Capability Survey, is the first of its kind: a nationally representative survey of the financial knowledge, attitudes and behaviours of 4- to 17-year-olds and their parents, living in the UK. A total of 4,958 children and young people aged 4–17, and their parents, were interviewed as part of this research. This report presents an initial analysis of the findings of this new survey and covers: ■ how children get money ■ how children spend and save money ■ children’s attitudes to spending, saving and debt ■ children’s confidence about managing their money ■ children’s understanding of the value of money and the need to make trade-offs ■ children’s knowledge and education about financial products, concepts, and terminology ■ parents’ beliefs and attitudes towards their own financial capability and the skills, abilities and attitudes of their children.