Ten frugal habits to save money

The Angus Reid institute reported from a recent study that 50% of Canadians couldn’t manage an unexpected expense of $1000 or more. In the same study, when Albertans were asked what they would do with a surprise bonus or gift of $5000, 46% said they would use it to pay down debt. Only 41% said they would put it in savings or invest it. With inflation as high as it has been in over 40 years, saving money is becoming increasingly difficult for some. This article lists ten frugal habits to help you save.

Empower U Financial Coaching

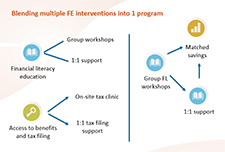

Financial empowerment consists of five complementary strategies including financial literacy and coaching; taxes and access to benefits; safe financial products; savings and asset building; and consumer protection. Empower U serves primarily as a financial literacy and coaching and savings and asset building intervention (although partners also contribute to the other interventions). The Sustainable Livelihood Model identifies five distinct sets of assets including personal, human, social, physical and financial. The Empower U program activities are grounded by two overarching philosophies: Financial Empowerment (as defined by Prosper Canada) and the Sustainable Livelihood Model (adapted by the Canadian Women’s Foundation, based on the work of the University of Sussex Institute for Development Studies). Focusing on financial literacy and coaching, Empower U has developed an individual financial coaching component to the overall program.

Empower U Evaluation Report

For a family living in poverty, every day is about making tough choices – to pay rent or buy groceries? Having the means to attain the basic necessities, is one thing. Having the skills, confidence and access to resources to manage finances in ways that build pathways out of poverty is something far different. Thanks to the generosity of partners, supporters and donors of Empower U, families can move beyond just managing the day-to-day challenges of poverty. Participants in the program learn valuable money management skills and are given the means to build savings and assets to create financial stability. A future where they and their families can thrive.

Welfare in Canada, 2020

Maytree released the 2020 edition of the Welfare in Canada report. For each province and territory, this report provides data and analysis on the total welfare income that households receiving social assistance would have qualified for in 2020, including COVID-19 pandemic-related supports. Welfare in Canada is a series that presents the total incomes of four example households who qualify for social assistance benefits in each of Canada’s provinces and territories in a given year. Welfare in Canada, 2020 looks at the maximum total amount that a household would have received over the course of the 2020 calendar year, assuming they had no other source of income and no assets. Some households may have received less if they had income from other sources, while some households may have received more if they had special health- or disability-related needs. The report looks at: In addition, this year the report includes a new section that looks at the adequacy of welfare incomes in each province over time, an analysis that hearkens back to past reports prepared by the National Council of Welfare. Also, please note that this report measures the adequacy of welfare incomes relative to both the Market Basket Measure (MBM) – Canada’s Official Poverty Line – and the Deep Income Poverty threshold (MBM-DIP), which is equivalent to 75 per cent of the MBM. This analysis will replace the low-income threshold comparisons in future reports. We hope these additions will be helpful for those using the report. In each jurisdiction, the total welfare income for which a household is eligible depends on its specific composition. For illustrative purposes, this resource focuses on the welfare incomes of four example household types:

Money Mentors’ free financial education programs

Money Mentors’ free online courses are available to everyone. The 1-2 hour narrated courses make it easy to learn at your own pace. These online courses provide the same great content as our in-person presentations, but at the touch of a finger. They cover a variety of topics including budgeting, debt, credit, fraud, life events and one course even focuses on managing money and understanding credit for high school students. Read more about Money Mentors' free financial literacy presentations to provide K-12 students with money concepts and skills here.

Increasing education savings for families living on low incomes: An outcome harvest evaluation

Momentum is a changing-making organization located in Calgary, Alberta that works with people living on low incomes and partners in the community to create a thriving local economy for all. In 2008, Momentum launched the StartSmart program to support families living on low incomes to open Registered Education Savings Plans (RESPs) to access free government education savings incentives such as the Canada Learning Bond (CLB). Momentum subsequently partnered with community agencies and advocated for systems level change in order to reach more families and scale up CLB uptake. This report captures the collective efforts and outcomes of Momentum and community partners regarding increasing the Canada Learning Bond (CLB) uptake in Canada, as well as lessons learned. The report highlights include:

Creating Change: Momentum’s Contribution to High-Cost Credit Reform in Alberta

As part of Momentum’s systems change planning process that was grounded in both participant and community experience, the issue of payday loans and other forms of high-cost credit (e.g., pawn, installment, rent-to-own, title and car loans) emerged as a priority issue for Momentum to address the financial barriers for people living on low incomes to exit poverty and build sustainable livelihoods.

To evaluate its work for high-cost credit reform in Calgary and Alberta in the period of 2012 to 2019, an outcome harvest was conducted. This evaluation reflects the collective efforts of multiple partners, identifies outcomes achieved as well as Momentum’s contribution to these outcomes.

Homeless Shelter Flows in Calgary and the Potential Impact of COVID-19

Social distancing and self-isolation are two of the key responses asked of citizens during a pandemic. For people without a home, this advice is rather more difficult to follow. This article uses daily data describing the movements of 36,855 unique individuals who used emergency homeless shelters in Calgary over the period 1 January 2014–31 December 2019. The use of emergency shelters is characterized by large flows from and into the broader community and smaller flows between individual shelters. Between admissions of new people into the shelter system and multiple re-admissions of current clients, there were an average of 43,613 movements between the community and between shelters each month. The size of these flows provide a measure of the extent to which people reliant on homeless shelters are exposed to the risk of transmission of coronavirus disease 2019 (COVID-19).

Creating Communities Where We Live – A Good Practices Guide

Creating Communities Where We Live - A Good Practices Guide is a locally-driven community-based researched project conducted in Edmonton, Alberta, by e4c and the University of Alberta Community Service-Learning program. The project seeks to add to the knowledge and practice of community care around supporting people to achieve a safe, secure, and affordable housing experience. The 10 good practices in this guide describe structures, roles, and relationships which promote community and wellbeing for tenants who live in affordable housing. The practices are informed, in part, by research into tenant and staff experiences at affordable housing complexes run by four Edmonton housing providers.

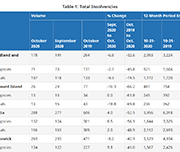

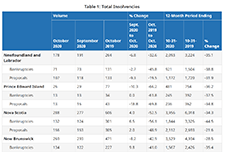

Office of the Superintendent of Bankruptcy Canada: Statistics and Research

The Office of the Superintendent of Bankruptcy Canada releases statistics on insolvency (bankruptcies and proposals) numbers in Canada. The latest statistics released on November 4, 2020 show that the number of insolvencies in Canada increased in the third quarter of 2020 by 7.9% compared to the second quarter.

Impact of the COVID-19 pandemic on the NEET (not in employment, education or training) indicator, March and April 2020

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit its spread—have affected young people in a number of ways, including high unemployment rates, school closures and education moving online.

The Impact of Matched Savings Programs: Building Assets & Lasting Habits

Matched Savings programs, or Individual Development Accounts, are a financial empowerment strategy that aim to build financial stability and reduce poverty. These programs build sustainable livelihoods by working with participants to earn savings while learning about money management, build regular savings habits, self-confidence, and hope for the future. Matching This brief presents key findings from Momentum's Matched Saving programs and the impact on program graduates' saving habits, establishment of emergency savings, and contribution to registered savings.

funds act as a power boost to the participants’ own savings, allowing them to purchase productive assets to move their lives forward.

From Emergency to Opportunity: Building a Resilient Alberta Nonprofit Sector After COVID-19

This report presents an analysis of the impact of COVID-19 on the nonprofit sector drawn from data collected in CCVO's Alberta Nonprofit Survey, data from surveys by the Alberta The analysis in this report shows that the effects on the nonprofit sector have been magnified through increased service demand, decreased revenue, and diminished organizational capacity coupled by delays in support and inadequate recognition for the leadership role that the sector is being called upon to play.

Nonprofit Network, Imagine Canada, and partner organizations across the country.

Social Assistance Summaries

The Social Assistance Summaries series tracks the number of recipients of social assistance (welfare payments) in each province and territory. It was established by the Caledon Institute of Social Policy to maintain data previously published by the federal government as the Social Assistance Statistical Report. The data is provided by provincial and territorial government officials.

Are charities ready for social finance? Investment readiness in Canada’s charitable sector

While social finance could have a transformative impact on the funding and financial landscape, relatively little is understood about its implications for charities. This webinar presents the results of a national survey of over 1,000 registered charities undertaken by Imagine Canada to better understand charities’ current readiness to participate in Canada’s growing social finance market

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar

Introducing the Financial Relief Navigator (FRN)

Access the Financial Relief Navigator here.

Time-stamps for the video recording:

3:22 – Agenda and Introductions

6:00 – Audience poll

9:00 – Why we created the Financial Relief Navigator (Speaker: Janet Flynn)

11:55 – What’s in the Financial Relief Navigator (Speaker: Janet Flynn)

16:35 – FRN Walkthrough using a Persona (Speaker: Galen McLusky)

33:15 – Tips for using the FRN (Speaker: Galen McLusky)

36:00 – The Working Centre experience using the FRN (Speaker: Sue Collison)

41:15 – Q&A

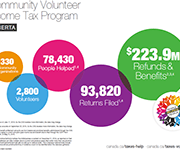

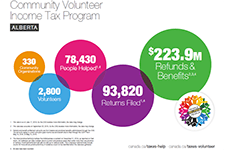

Community Volunteer Income Tax Program (CVITP) provincial snapshots

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les informations sont présentées en anglais et en français.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

How Savings Circles Works

Information about the Strive program

Time-stamps for the video recording:

3:35 – Agenda and introductions

6:00 – Audience polls

10:58 – Financial empowerment interventions (Speaker: Glenna Harris)

14:00 – Savings Circles program at Momentum (Speaker: Anna Jordan)

33:18 – Strive program (Speaker: Monica daPonte)

55:50 – Q&A

Welfare in Canada, 2018

These reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and territory. Established by the Caledon Institute of Social Policy, Welfare in Canada is a continuation of the Welfare Incomes series originally published by the National Council of Welfare, based on the same approach.

Urban Spotlight: Neighbourhood Financial Health Index findings for Canada’s cities

This report examines the financial health and vulnerability of households in Canada’s 35 largest cities, using a new composite index of household financial health at the neighbourhood level, the Neighbourhood Financial Health Index or NFHI. The NFHI is designed to shine a light on the dynamics underlying national trends, taking a closer look at what is happening at the provincial/territorial, community and neighbourhood levels. Update July 22, 2022: Please note that the Neighbourhood Financial Health Index is no longer available

Incentivized Savings: An Effective Approach at Tax Time

A tax refund is often the largest amount of money a low-income household will receive throughout the year. It offers a unique opportunity to think long term and save for the future. Thus, in 2018, Momentum launched a new pilot program called Tax Time Savings (TTS), presented by ATB. It was through a dedicated collaboration with ATB Financial, Aspire Calgary, Sunrise Community Link Resource Centre, Centre for Newcomers, and First Lutheran Church Calgary that made it all possible. This report shares results and highlights from the 2018 Tax Time Savings program. 93% of participants earned the maximum match of $500.

High-Cost Alternative Financial Services: The Customer Experience

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty Talks! and Sunrise Community Link Resource Centre. The following document summarizes what we learned from these conversations and the loan contracts that borrowers shared with us. It also identifies several themes that emerged from these discussions.

Summary Brief: High-Cost Alternative Financial Services

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial institutions. High-cost alternative financial services contribute to a two-tiered banking system, in which the poor often pay more for inferior services. Without more stringent regulation, and in the absence of safe and affordable short-term credit options, Albertans living on lower-incomes will continue to experience financial exclusion and take on heavy debt loads – both of which are major contributors to long-term poverty.

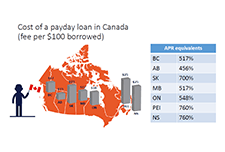

High-Cost Alternative Financial Services: Policy Options

Many Canadians turn to high-cost alternative financial services when they need a short-term fix for a budgetary issue. Though these banking and credit alternatives are a convenient choice for individuals in search of fast cash, particularly those who face barriers to obtaining credit at a bank or credit union, access comes at a steep price and with a high degree of risk. On its own, one high-cost loan has the potential to trap a borrower in a cycle of debt, not only amplifying their short-term problem, but also limiting their ability to secure the income and assets needed to thrive in the long term. The policy recommendations presented in this brief, and summarized in the chart on page two, are inspired by the regulatory initiatives across the country, and reflect ways in which all three levels of government can contribute to better consumer protection for all Canadians.

Financial Coaching Process Evaluation Report

This report presents the findings of the process evaluation of the Financial Coaching pilot, a part of the Financial Empowerment Collaborative in Calgary. In documenting the procedures and early thoughts of participating programs on the implementation of this pilot project, we assessed how well early goals are being met, documented some promising best practices, identified common roadblocks encountered by agencies, and compiled solutions developed in response to those roadblocks.