Government response to the Countervailing Power: Review of the coordination and funding for financial counselling services across Australia

In 2019, a comprehensive review (The Countervailing Power: Review of the coordination and funding for financial counselling services across Australia) of financial counselling services in Australia was undertaken and recommendations to ensure the long-term viability of the financial counselling sector, including the establishment of a nationally coordinated approach, and industry funding to strengthen the predictability and stability of funding for financial counselling were made. This document is the Australian Government's response to the review, outlining their response to each of the recommendations, and sets out their commitment to the following:

Federal Spending on First Nations and Inuit Health Care

An analysis of provincial/territorial health care funding and funding for First Nations and Inuit by Indigenous Services Canada through the First Nations and Inuit Health Branch. This report provides an analytical overview of federal and provincial/territorial government health spending for the First Nations and Inuit population.

Urban, Rural, and Northern Indigenous Housing

This report examines Indigenous housing in urban, rural, and northern areas, an expression which is taken to refer to Indigenous housing in all areas of Canada other than on reserves. This report is intended to provide an analysis of unmet Indigenous housing need and homelessness in these areas, and of government spending to address those issues. The report ends with a range

of estimated costs for addressing housing need to various extents under various programs.

This report was prepared at the request of the House of Commons Standing Committee on Human Resources, Skills and Social Development and the Status of Persons with Disabilities (HUMA).

Unconnected: Funding Shortfalls, Policy Imbalances and How They Are Contributing to Canada’s Digital Underdevelopment

Budget 2021: A Recovery Plan for Jobs, Growth, and Resilience

The federal budget released on April 19, 2021 covers the Canadian government's plan for:

Opportunity for All – Canada’s First Poverty Reduction Strategy

Canada is a prosperous country, yet in 2015 roughly 1 in 8 Canadians lived in poverty. The vision of Opportunity for All – Canada's First Poverty Reduction Strategy is a Canada without poverty, because we all suffer when our fellow citizens are left behind. We are all in this together, from governments, to community organizations, to the private sector, to all Canadians who are working hard each and every day to provide for themselves and their families. For the first time in Canada's history, the Strategy sets an official measure of poverty: Canada's Official Poverty Line, based on the cost of a basket of goods and services that individuals and families require to meet their basic needs and achieve a modest standard of living in communities across the country. Opportunity for All sets, for the first time, ambitious and concrete poverty reduction targets: a 20% reduction in poverty by 2020 and a 50% reduction in poverty by 2030, which, relative to 2015 levels, will lead to the lowest poverty rate in Canada's history. Through Opportunity for All, we are putting in place a National Advisory Council on Poverty to advise the Minister of Families, Children and Social Development on poverty reduction and to publicly report, in each year, on the progress that has been made toward poverty reduction. The Government also proposes to introduce the first Poverty Reduction Act in Parliament in Canada’s history. This Act would entrench the targets, Canada's Official Poverty Line, and the Advisory Council into legislation.

The Cost of Poverty in the Atlantic Provinces

This report costs poverty based on three broad measurable components: opportunity costs, remedial costs and intergenerational costs. The authors state that these costs could potentially be reallocated, and benefits could potentially be realized if all poverty were eliminated. The total cost of poverty in the Atlantic region ranges from $2 billion per year in Nova Scotia to $273 million in Prince Edward Island. It is close to a billion in Newfoundland and Labrador, $959 million, and $1.4 billion in New Brunswick. These costs represent a significant loss of economic growth of 4.76% of Nova Scotia’s GDP to 2.9% in Newfoundland and Labrador. The impact on Prince Edward Island’s GDP is 4.10%, and 3.71% in New Brunswick.

The purpose of this costing exercise is to illustrate the shared economic burden of poverty, and the urgency that exists for Atlantic Canadian governments to act to eradicate it.

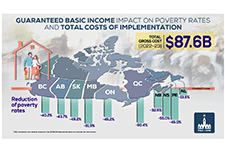

Distributional and Fiscal Analysis of a National Guaranteed Basic Income

Several parliamentarians requested that the PBO prepare a distributional analysis of Guaranteed Basic Income using parameters set out in Ontario’s basic income pilot project, examine the impact across income quintiles, family types and gender, and identify the net federal revenue increase required to offset the net cost of the new program. This analysis also accounts for the behavioural response.

2021 Reports of the Auditor General of Canada to the Parliament of Canada – Report 4 – Canada Child Benefit

A report from Auditor General Karen Hogan concludes that the Canada Revenue Agency (CRA) managed the Canada Child Benefit (CCB) program so that millions of eligible families received accurate and timely payments. The audit also reviewed the one-time additional payment of up to $300 per child issued in May 2020 to help eligible families during the COVID‑19 pandemic. The audit noted areas where the agency could improve the administration of the program by changing how it manages information it uses to assess eligibility to the CCB. For example, better use of information received from other federal organizations would help ensure that the agency is informed when a beneficiary has left the country. This would avoid cases where payments are issued on the basis of outdated information. To enhance the integrity of the program, the agency should request that all applicants provide a valid proof of birth when they apply for the benefit. The audit also raised the concept of female presumption and noted that given the diversity of families in Canada today, this presumption has had an impact on the administration of the Canada Child Benefit program.

Together BC: British Columbia’s Poverty Reduction Strategy

British Columbia’s Poverty Reduction Strategy, sets a path to reduce overall poverty in B.C. by 25% and child poverty by 50% by 2024. With investments from across Government, TogetherBC reflects government’s commitment to reduce poverty and make life more affordable for British Columbians. It includes policy initiatives and investments designed to lift people up, break the cycle of poverty and build a better B.C. for everyone. Built on the principles of Affordability, Opportunity, Reconciliation, and Social Inclusion, TogetherBC focuses on six priority action areas:

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Youth Reconnect Program Guide: An Early Intervention Approach to Preventing Youth Homelessness

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth Reconnect. This document describes the key elements of the YR program model, including program elements and objectives, case examples of YR in practice, and necessary conditions for implementation. It is intended for communities who are interested in pursuing similar early intervention strategies. The key to success, regardless of the approaches taken, lies in building and nurturing community partnerships with service providers, educators, policy professionals, and young people.

Shelters for victims of abuse with ties to Indigenous communities or organizations in Canada, 2017/2018

There were 85 shelters for victims of abuse that had ties to First Nations, Métis or Inuit communities or organizations operating across Canada in 2017/2018. These Indigenous shelters, which are primarily mandated to serve victims of abuse, play an important role for victims leaving abusive situations by providing a safe environment and basic living needs, as well as different kinds of support and outreach services. Over a one-year period, there were more than 10,500 admissions to Indigenous shelters; the vast majority of these admissions were women (63.7%) and their accompanying children (36.1%). This article uses data from the Survey of Residential Facilities for Victims of Abuse (SRFVA). Valuable insight into shelter use in Canada and the challenges that shelters and victims of abuse were facing in 2017/2018 is presented.

Costing a Guaranteed Basic Income During the COVID Pandemic

The Parliamentary Budget Officer (PBO) supports Parliament by providing economic and financial analysis for the purposes of raising the quality of parliamentary debate and promoting greater budget transparency and accountability. This report responds to a request from Senator Yuen Pau Woo to estimate the post-COVID cost of a guaranteed basic income (GBI) program, using parameters set out in Ontario’s basic income pilot project. In addition, the report provides an estimate of the federal and provincial programs for low-income individuals and families, including many non-refundable and refundable tax credits that could be replaced by the GBI program.

Imagine Canada pre-budget consultation toolkit

The House of Commons Finance Committee recently released its call for pre-budget consultation briefs as the government considers its policy priorities for the 2021 federal budget. This toolkit created by Imagine Canada provides information on the reasons to submit a pre-budget consultation brief as well as tips on how to do so.

Economic and Fiscal Snapshot 2020

The COVID-19 crisis is a public health crisis and an economic crisis. The Economic and Fiscal Snapshot 2020 lays out the steps Canada is taking to stabilize the economy and protect the health and economic well-being of Canadians and businesses across the country.

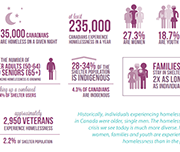

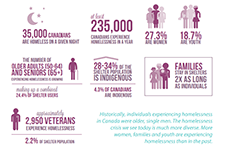

State of homelessness in Canada 2016

Ending homelessness in Canada requires partnerships across public, private, and not-for-profit sectors. Preventative measures, and providing safe, appropriate, and affordable housing with supports for those experiencing homelessness is needed. This paper provides a series of joint recommendations – drafted by the Canadian Observatory on Homelessness and the Canadian Alliance to end Homelessness – for the National Housing Strategy.

Comparison of Provincial and Territorial Child Benefits and Recommendations for British Columbia

First Call BC Child and Youth Advocacy Coalition has been tracking child and family poverty rates in BC for more than two decades. Every November, with the support of the Social Planning and Research Council of BC (SPARC BC), a report card is released with the latest statistics on child and family poverty in BC and recommendations for policy changes that would reduce these poverty levels. This report presents data from the latest report card released by First Call on a cross-Canada comparison of child benefits.

Registered Disability Savings Plans (RDSPs) and Financial Empowerment

This policy brief discusses issues surrounding access to Registered Disability Savings Plans (RDSPs) in the province of Alberta and recommended solutions for increasing RDSP uptake. With the Government of Alberta's commitment to improving financial independence for people in the province, suggestions are provided on how to link the government RDSP strategy with financial empowerment collaboratives and champions existing in the province to maximize effectiveness and efficiency.