Resources

Presentation slides and video time stamps

Read the presentation slides for this webinar.

Time stamps for the video recording:

-

- 5:20 – Start

- 6:12 – Land acknowledgement

- 7:24 – Introduction of speakers

- 9:42 – Today’s presentation

- 10:45 – Barriers to access to benefits

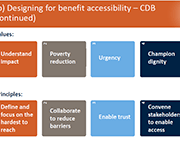

- 15:12 – Designing for benefit accessibility

- 21:53 – ESDC pilot project

- 32:46 –Demo of the disability benefit compass

- 44:36 – Importance of evaluation

- 50:58 – What’s next? What’s possible?

- 58:55 – Questions

Cyber security awareness

The Canadian Bankers Association has created a new Cyber Security Awareness Quiz site to test your knowledge and ability to spot a “phishy” email, message or text.

TFSA Calculator

A Tax-Free Savings Account (TFSA) can be used to save for any goal. You put after-tax dollars into a TFSA, but your investments grow tax-free and you won’t pay any tax on withdrawal. Use this calculator to estimate the value of the investments in your TFSA when you’re ready to withdraw them, and compare this amount to the value of your investments in a non-registered plan to see your overall estimated tax savings.

Compound interest calculator

Using OSC's online calculator, find out how your investment will grow over time with compound interest.

Emergency fund calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Ideally, this fund would provide enough money to cover your essential living expenses so you can avoid taking on debt. Use OSC's calculator to estimate how much money should be set aside to pay for financial emergencies.

Living your retirement

These resources from the Ontario Securities Commission are oriented towards planning for retirement. Resources include tips on insurance planning, government benefits, RRSP calculator, and more.

Emerging Technology for All: Conversational AI’s Pivotal Role

This infographic is a preview of Commonwealth's research survey of 1290 lower-and moderate-income people to understand their perceptions, needs, and uses of conversational AI.

Disability Tax Credit Tool

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to give them the information they need to fill out that form

OpportuNext (career transition online tool)

OpportuNext from The Conference Board of Canada is a free-to-use career tool created in partnership with the Future Skills Centre. The tool can be used by anyone looking to plan a career path with a similar skillset or for anyone providing employment services.

Financial Relief Navigator

The Financial Relief Navigator is an online tool that can help you find support to raise your income or lower your expenses in these challenging times. The tool will suggest income benefits or other support programs you may be eligible for in your province/territory in Canada.

Money Mentors – Savings & Debt Resources

Collection of money management resources, including how create effective budgets, realistic spending plans, deal with your debts, save more money, build a stronger credit rating, and prepare for retirement.

Testing the use of the Mint app in an interactive personal finance module

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s effectiveness at improving students’ financial knowledge, attitudes, and behavior. Students at the George Washington University participated in a half-day budgeting workshop and were exposed to either Mint, which is a real-time, automated platform, or Excel, which is an offline, static tool. The authors found that participation in both workshops was associated with improved preparedness to have conversations about money matters with parents, a greater sense of financial autonomy, and an increased awareness of the importance of budgeting, but that participants in the Mint workshop were more likely to have a positive experience using the budgeting tool, to feel confident that they could achieve a financial goal, and to be engaged in budgeting one month after the workshop. Results show that even short financial education interventions can meaningfully influence students’ financial attitudes and behavior and that an interactive tool like Mint may have advantages over a more static tool like Excel.

Consumer Price Index Personal Inflation Calculator

This interactive tool created by Statistics Canada allows you to explore your personal rate of inflation, based on the goods and services you consume. The Consumer Price Index (CPI) is the official measure of inflation in Canada. It is representative of the change in prices experienced by the average Canadian household. However, your personal experience of inflation may not perfectly match the Canadian average due to differences in your spending habits. The Personal Inflation Calculator accounts for those differences and provides a measure of inflation unique to you.

Helping Consumers Claim their Economic Impact Payment: A guide for intermediary organizations

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step instructions for frontline staff on how to:

Serving Individuals With Disabilities – A Day in the Life of an American Job Center

The Disability and Employment eLearning Task Force in collaboration with the Employment and Training Administration (ETA) released three eLearning Training Modules to help support the professional development needs of the workforce development staff across the United States. The first module provide tools and resources to support front-line American Job Center staff effectively serve customers with disabilities, covering strategies for effective communication and interaction with individuals with disabilities.

Présentation de l’Explorateur d’allègements financiers (EAF)

L’Explorateur d’allègements financiers : un outil pour connaître les mesures d’aide et d’allègement liées à la COVID-19 dont vos clients pourraient bénéficier En réponse à la pandémie de COVID-19 et en raison de la complexité des mesures d’aide et d’allègement offertes à la population canadienne, nous avons créé l’Explorateur d’allègements financiers (EAF), un outil en ligne qui aide les gens vulnérables au Canada et ceux qui les accompagnent à accéder aux mesures d’aide d’urgence et d’allègement financier proposées par les gouvernements, les établissements financiers, les fournisseurs de services de télécommunication, de services publics et de services Internet. Soyez des nôtres pour assister à notre webinaire d’une heure animé par Elodie Young, de Prospérité Canada, qui vous présentera l’EAF et vous donnera des conseils sur la manière d’aider vos clients à accéder aux mesures d’aide et d’allègement financier. Que vous travailliez dans le secteur de la salubrité des aliments, de la santé mentale, de l'autonomisation financière, de l’établissement ou encore dans le secteur privé, venez apprendre comment aider vos clients à augmenter leur revenu et à réduire leurs dépenses pendant la crise. Ce webinaire concerne tous les fournisseurs de services de première ligne qui gagnent un faible revenu et les populations vulnérables du Canada.

Resources

Handouts, slides, and time-stamps

Presentation slides for this webinar

Handouts for this webinar

Introducing the Financial Relief Navigator (FRN)

Access the Financial Relief Navigator here.

Time-stamps for the video recording:

3:22 – Agenda and Introductions

6:00 – Audience poll

9:00 – Why we created the Financial Relief Navigator (Speaker: Janet Flynn)

11:55 – What’s in the Financial Relief Navigator (Speaker: Janet Flynn)

16:35 – FRN Walkthrough using a Persona (Speaker: Galen McLusky)

33:15 – Tips for using the FRN (Speaker: Galen McLusky)

36:00 – The Working Centre experience using the FRN (Speaker: Sue Collison)

41:15 – Q&A

Financial Literacy Outcome Evaluation Tool

The Financial Literacy Outcome Evaluation Tool offers organizations a collection of evidence-based financial literacy outcomes and indicators. The tool guides users through a series of questions about their program and evaluation goals and then suggests scales (sets of questions) and individual questions they can use.

Budget Planner

The Financial Consumer Agency of Canada (FCAC)'s online tool helps you create a customized budget.

Emergency Fund Calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Use this calculator to estimate how much money should be set aside to pay for financial emergencies.

My money in Canada

Are you a newcomer to Canada, or someone who works with newcomers? This online tool will help you explore five money modules to better manage your finances in Canada. Learn about the financial system in Canada, income and expenses, setting goals and saving, credit and credit reports, and filing taxes. Updated July 26, 2022: My money in Canada provides important information about Canada’s financial system and promotes positive money management habits to support Canadians to succeed financially. Interactive exercises and checklists support you to make informed choices and to create a customized financial plan that works for you. Originally designed to support newcomers to Canada as they settle and establish themselves financially, My money in Canada has been updated to serve all Canadians, including those who are new to Canada.

RDSP calculator

Enhance the quality of life for a family member with a disability. By answering a few simple questions, the RDSP Calculator can help you project the estimated future value of an RDSP, and the approximate value of future withdrawal payments. Run various scenarios to see how it would affect the value of your RDSP. The RDSP Calculator is a tool to help you assess the potential of opening and contributing to an RDSP. The estimates provided by the Calculator are for information purposes only. The profile of your RDSP may differ from the RDSP Calculator projection.

Proliteracy.ca: Plan Finances for University or College

Proliteracy.ca analyzes historical living expenses from over 160 cities and tuition from over 100 universities and colleges in Canada to predict the cost of post secondary education in the future. Their tool suggests financing options based on your profile. Learn about RESP, grants, scholarships and various government and commercial programs with their online resources.

Canada Revenue Agency Child and Family Benefits Calculator

This online tool released by the Canada Revenue Agency can be used to determine the eligibility and payment amounts of child and family benefits. Additional information on child and family benefit programs may be found on the Canada Revenue Agency's child and family benefits page.

My money in Canada

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use. The tool is intended to be used with clients and settlement workers together, but can also be used by the client on their own if they are comfortable.

Mortgage Calculator

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment schedule.

Account Comparison Tool

Compare features for different chequing and savings accounts, including interest rates, monthly fees and transactions. Find an account that best suits your needs. Narrow your search, view search results, and compare your results using this account comparison tool from the Financial Consumer Agency of Canada.

RRSP Savings Calculator

Use this tool by the OSC to estimate how much your registered retirement savings plan (RRSP) will be worth at retirement and how much income it will provide each year.

TFSA Calculator

This calculator will help you estimate the value of the investments in your TFSA when you’re ready to withdraw them, and compare this amount to the value of your investments in a non-registered plan to see your overall estimated tax savings.