Make it Count

Make it Count is a parent's resource for youth money management provided by the Manitoba Securities Commission that provides activities and tips to help you incorporate youth money management lessons into your daily routine. You can easily turn errands into education.

Money management worksheets

CPA Canada has a selection of money management worksheets you can use with your clients. Goal Setting Financial Fitness Self-Assessment Values Validator Monthly Budget for Teens Role Model Self-Assessment Document Organizer Cash Flow Organizer Net Worth Worksheet Post-Secondary Student Budget

Set SMART goals that are specific, measurable, action-oriented, realistic, time-framed.

Determine how well you are currently managing your finances.

Determine the things in life that are most important to you.

Help teenagers living at home create a monthly budget.

Determine what kind of financial role model you are.

Organize your documents in preparation for filing your taxes.

Get a clear picture of your cash flow — what is coming in and what is going out

Get a snapshot of what you own (your assets) and what you owe (your liabilities)

This worksheet will help students accurately estimate the total budget they need

Dimensions of poverty hub

Statistics Canada has created an "Opportunity for All"; a dashboard of 12 indicators to track progress on deep income poverty as well as the aspects of poverty other than income, including indicators of material deprivation, lack of opportunity and resilience. These indicators are broadly grouped into three categories: dignity, opportunity and inclusion and resilience and security.

Family violence in Canada: A statistical profile, 2019

Family violence in Canada: A statistical profile is an annual report produced by the Canadian Centre for Justice and Community Safety Statistics at Statistics Canada as part of the Federal Family Violence Initiative. Since 1998, this report has provided data on the nature and extent of family violence in Canada, as well as an analysis of trends over time. The information presented is used extensively to monitor changes that inform policy makers and the public.

Testing the use of the Mint app in an interactive personal finance module

To advance understanding of effective financial education methods, the Global Financial Literacy Excellence Center (GFLEC) conducted an experiment using Mint, a financial improvement tool offered by Intuit, whose financial products include TurboTax and QuickBooks. This study measures Mint’s effectiveness at improving students’ financial knowledge, attitudes, and behavior. Students at the George Washington University participated in a half-day budgeting workshop and were exposed to either Mint, which is a real-time, automated platform, or Excel, which is an offline, static tool. The authors found that participation in both workshops was associated with improved preparedness to have conversations about money matters with parents, a greater sense of financial autonomy, and an increased awareness of the importance of budgeting, but that participants in the Mint workshop were more likely to have a positive experience using the budgeting tool, to feel confident that they could achieve a financial goal, and to be engaged in budgeting one month after the workshop. Results show that even short financial education interventions can meaningfully influence students’ financial attitudes and behavior and that an interactive tool like Mint may have advantages over a more static tool like Excel.

State of the Child Report 2020: Protecting Child Rights in Times of Pandemic

The 2020 State of the Child Report includes six recommendations and gives a snapshot of some of the challenges New Brunswick children and youth will have to overcome as the province moves forward and juggles the new realities of public health measures to prevent the spread of COVID-19 while respecting child rights.

State of the Child Report 2019

This report's release was part of Child Rights Education Week and also in celebration of the 30th anniversary of the United Nations Convention on the Rights of the Child (UNCRC). 2019 was declared the International Year of Indigenous Languages by the United Nations. The report contains an overview of some of the serious challenges facing New Brunswick children and youth, including more than 200 statistics presented in the report’s Child Rights Indicators Framework. A special emphasis was placed on education rights. Some of the concerning findings revealed in the report include:

Strengthening the Economic Foundation for Youth and Young Adults During COVID & Beyond

The unemployment rate for young workers ages 16–24 jumped from 8.4% to 24.4% from spring 2019 to spring 2020 in the United States, representing four million youth. While unemployment for their counterparts ages 25 and older rose from 2.8% to 11.3% the Spring 2020 unemployment rates were even higher for young Black, Hispanic, and Asian American/Pacific Islander (AAPI) workers (29.6%, 27.5%, and 29.7%, respectively. The following speakers discuss how to build financial security for youth (16-24) in this webinar: Monique Miles, Aspen Institute, Forum for Community Solutions, Margaret Libby, My Path, Amadeos Oyagata, Youth Leader, and Don Baylor, The Annie E. Casey Foundation (moderator).

Race, Ethnicity, and the Financial Lives of Young Adults: Exploring Disparities in Financial Health Outcomes

Young adults of color, particularly those who are Black and Latinx, have borne a disproportionate share of economic hardship, as decades of systemic racism have made their communities more vulnerable to the effects of these crises. This report shares new data on the financial lives of young adults, focusing on Black and Latinx young adults, in order to inform policies, programs, and solutions that can improve financial health for all.

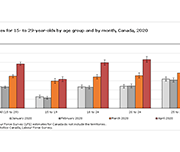

Impact of the COVID-19 pandemic on the NEET (not in employment, education or training) indicator, March and April 2020

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit its spread—have affected young people in a number of ways, including high unemployment rates, school closures and education moving online.

Gender, Diversity and Inclusion Statistics Hub

Launched by the Centre for Gender, Diversity and Inclusion Statistics (CGDIS), the Gender, Diversity and Inclusion Hub focuses on disaggregated data by gender and other identities to support evidence-based policy development and decision making.

Youth Reconnect Program Guide: An Early Intervention Approach to Preventing Youth Homelessness

Since 2017, the Canadian Observatory on Homelessness and A Way Home Canada have been implementing and evaluating three program models that are situated across the continuum of prevention, in 10 communities and 12 sites in Ontario and Alberta. Among these is an early intervention called Youth Reconnect. This document describes the key elements of the YR program model, including program elements and objectives, case examples of YR in practice, and necessary conditions for implementation. It is intended for communities who are interested in pursuing similar early intervention strategies. The key to success, regardless of the approaches taken, lies in building and nurturing community partnerships with service providers, educators, policy professionals, and young people.

Canadian Health Survey on Children and Youth, 2019

The current pandemic has reinforced the need for additional information on the health of Canadian children and youth, particularly for those younger than age 12. Results from the new Canadian Health Survey on Children and Youth (CHSCY) indicate that 4% of children and youth aged 1 to 17, as reported by their parents, had fair or poor mental health in 2019, one year prior to the pandemic. The survey also found that poor mental health among children and youth was associated with adverse health and social outcomes, such as lower grades and difficulty making friends. Recently released crowdsourced data suggest that the perceived mental health of Canadian youth has declined during the pandemic, with over half (57%) of participants aged 15 to 17 reporting that their mental health was somewhat worse or much worse than it was prior to the implementation of physical distancing measures.

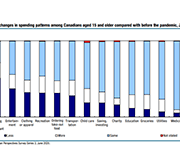

Expected changes in spending habits during the recovery period

Around mid-June, physical distancing measures began easing across the country, giving Canadians more opportunities to spend money. However, COVID-19 is still with us, shopping habits have changed and there are 1.8 million fewer employed Canadians now than there were prior to the pandemic. How our economy evolves going forward will largely depend upon the spending choices Canadians make over the coming weeks and months. This study presents results from a recent web panel survey conducted in June, looks at how spending habits may change.

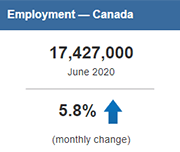

Labour Force Survey, June 2020

Labour Force Survey (LFS) results for June reflect labour market conditions as of the week of June 14 to June 20. A series of survey enhancements continued in June, including additional questions on working from home, difficulty meeting financial needs, and receipt of federal COVID-19 assistance payments. New questions were added to measure the extent to which COVID-19-related health risks are being mitigated through workplace adaptations and protective measures.

Why are lower-income parents less likely to open an RESP account? The roles of literacy, education and wealth

Parents can save for their children's postsecondary education by opening and contributing to a Registered Education Savings Plan (RESP) account, which provides tax and other financial incentives designed to encourage participation (particularly among lower-income families). While the share of parents opening RESP accounts has increased steadily over time, as of 2016, participation rates remained more than twice as high among parents in the top income quartile (top 25%) compared with those in the bottom quartile. This study provides insight into the factors behind the gap in (RESP) participation between higher and lower-income families.

Economic volatility in childhood and subsequent adolescent mental health problems: a longitudinal population based study of adolescents

This research paper investigates the association between the patterns of duration, timing and sequencing of exposure to low family income during childhood, and symptoms of mental health problems in adolescence.

Money and Youth

The Canadian Foundation for Economic Education (CFEE) works collaboratively with funding partners, departments of education, school boards, schools, educators, and teacher associations to develop and provide free, non-commercial programs and resources for teachers and students – developed and reviewed by educators. The online version of their curriculum Money and Youth is organized into separate modules so that users can select individual topics that align with interests. An introduction to the topic, a teachers guide containing lesson plans, and parent resources are included within each module.

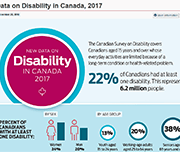

Infographic: New Data on Disability in Canada, 2017

This infographic released from Statistics Canada compiles some of the data collected from the 2017 Canadian Survey on Disability. 22% of Canadians had at least one disability, representing 6.2 million people.

Does State-Mandated Financial Education Affect High-Cost Borrowing?

Using pooled data from the 2012 and 2015 waves of the National Financial Capability Study (NFCS), this research finds that young adults who were required to take personal finance courses in high school were significantly less likely to borrow payday loans than their peers who were not. These effects do not significantly differ by race/ethnicity or gender, suggesting that financial education may be useful regardless of demographics.

Better Borrowing: How State-Mandated Financial Education Drives College Financing Behaviour

As student loan reform continues to dominate national discourse, a NEFE-funded study shows that financial education in states with state-mandated personal finance graduation requirements causes students to make better decisions about how to pay for college. It increases applications for aid, federal aid taken, and grants — all while decreasing credit card balances. Put simply, financial education makes better borrowers. This study examines positive effects of state-mandated financial education graduation requirements. As of 2017, 25 states have implemented mandates for personal finance education prior to graduation.

Financial Literacy of Indigenous Secondary Students in the Atlantic Provinces

Research conducted by agencies such as AFOA, Native Women’s Association of Canada, and various other Canadian entities, has identified the need for improved financial literacy education in Indigenous communities, particularly among youth and Elders. Such research reports are often equipped with a list of recommendations for improving and addressing the gaps in education around financial literacy. In the spirit of building upon this research into financial literacy and Indigenous peoples, the Purdy Crawford Chair in Aboriginal Business Studies (PCC) proposed a project focused on Atlantic Canada’s 14-18 year old Indigenous population and their levels of financial literacy. The results reveal that the majority of respondents would like to learn more about money. As well, they affirm that face-to-face learning from family members and in classroom settings remain the preferred way to learn about financial issues. Finally, based on the literature review, the environmental scan, survey data, and feedback from the community consultation process, a web application titled Seven Generations Financial Literacy was developed and is located at www.sevengenerationsfinancial.com.

Core competencies frameworks on financial literacy

Developed in response to a call from G20 Leaders in 2013, the core competencies frameworks on financial literacy highlight a range of financial literacy outcomes that may be considered to be universally relevant or important for the financial well-being in everyday life of adults and youth. These documents describe the types of knowledge that youth aged 15 to 18, and adults aged 18 and up, could benefit from.

Child Welfare and Youth Homelessness in Canada: A Proposal for Action

“We’re Going to Do This Together”: Examining the Relationship between Parental Educational Expectations and a Community-Based Children’s Savings Account Program

This paper presents quantitative and qualitative evidence of the relationship between exposure to a community-based Children’s Savings Account (CSA) program and parents’ educational expectations for their children. First, we examine survey data collected as part of the rollout and implementation of The Promise Indiana CSA program. Second, we augment these findings with qualitative data gathered from interviews with parents whose children have Promise Indiana accounts. Though results differ by parental income and education, the quantitative results using the full sample suggest that parents are more likely to expect their elementary-school children to attend college if they have a 529 account or were exposed to the additional aspects of The Promise Indiana program (i.e., the marketing campaign, college and career classroom activities, information about engaging champions, trip to a University, and the opportunity to enroll into The Promise).