Discover financial empowerment resources

Discover financial empowerment resources

The Behavioural Insights Team, in conjunction with Fair4All Finance, have worked with three community finance providers to launch a new customer engagement support guide to better improve customer engagement using insights from behavioural science. Building on our work with three lenders, this...

There are many reasons why someone might be struggling financially. Job loss, health challenges, or a sudden financial emergency could cause hardship, preventing someone from staying afloat. In times like these, it’s not uncommon for someone to ask for help from friends or family. Before agreeing...

This report examines how diary participants achieve the financial wellbeing that they have. The evidence we found is that low-income people work very hard to manage their finances. They endeavor to control their finances so that, as one participant said, their finances don’t control them. They...

The DUCA Impact Lab defines fair banking as any financial product or service that lives up to the following set of principles: Pricing is clear, transparent, and well understood Pricing is representative of the cost of funds, cost of administration and risk, rather than what the market will...

For many, homeownership is a vital part of the American dream. Buying a home represents one of the largest lifetime expenditures for most homeowners, and the mortgage has generally become the financing instrument of choice. For many families, their mortgage will be their greatest debt and their...

The Canada Mortgage and Housing Corporation (CMHC) publishes a quarterly report on Canadian trends relating to mortgage debt and consumer borrowing. Find out the level of Canadian household indebtedness, and emerging trends in outstanding debt balances in different urban areas and by age...

In early 2017 Momentum reached out to over 50 community members and participants to better understand local experiences with high-cost alternative financial services. In addition to connecting with individuals through interviews, Momentum hosted community consultations in partnership with Poverty...

Many Albertans turn to high-cost alternative financial services when they need a short-term fix for a financial issue. Though these services are expensive and unsafe, they are often the only option for low-income individuals, particularly those who struggle to obtain credit at mainstream financial...

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that...

CFSI presents their 2017 Financially Underserved Market Size Study that illustrates the growing opportunity to address the needs of financially underserved consumers and identifies significant trends driving marketplace evolution and...

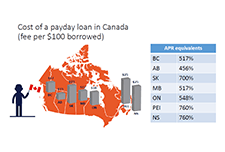

This webinar, "High cost lending in Canada: Risks, regulations, and alternatives," is about why high cost lending products are concerning, especially for financially vulnerable Canadians. Speakers discuss what is driving the use of these products, what kind of regulations are involved, and what...

This study analyzes the effect of individual finances (specifically creditworthiness and severely delinquent debt) on mortality risk. A large (approximately 170,000 individuals) subsample of a quarterly panel data set of individual credit reports is utilized in an instrumental variables design....

In order to monitor the financial and economic status of American consumers, the Federal Reserve Board conducted the third annual Survey of Household Economics and Decisionmaking in October and November 2015. This survey provides insights into the well-being of households and consumers, and...

The United Kingdom is at the forefront of the global finance industry and is a leader in the fields of financial services, technology and innovation. Despite this high standing, a sizeable number of UK citizens lack access to even the most basic financial services, while still more are forced to...

Comprehensive research on microfinance and subsidy shows that virtually all microfinance institutions are subsidized, but these subsidies are small. There are two clear paths for increasing microcredit’s impact through continued investment: » Lowering the cost of microcredit by lowering...

When household emergencies strike or there’s not enough in the bank to make it to the next paycheck, some families turn to small-dollar credit—small loans from alternative financial service (AFS) providers, such as payday lenders or pawnshops, or from mainstream sources. In October 2014, the...

This report presents the results of the Survey of Consumer Views on Debt (“survey”) which was conducted by the Consumer Financial Protection Bureau (“Bureau”) between December 2014 and March 2015. The survey results substantially expand the understanding of debt collection in the United...

Using a dataset covering one quarter of the U.S. general-purpose credit card market, we document that 29% of accounts regularly make payments at or near the minimum payment. We exploit changes in issuers' minimum payment formulas to distinguish between liquidity constraints and anchoring as...

While the recession may technically draw to a close in the third quarter, its reverberations will be felt for some time. Most notably, recovery will be sluggish relative to that in the wake of past recessions. Unemployment will continue to rise into 2010 as re-hiring proceeds slowly and more...

The report’s primary aim was to analyze the existing microfinance industry in the United States from the point of view of its ability to scale up services to the underserved (the working poor) and its sustainability, i.e., its ability to operate such that MFIs cover all of their operating costs,...

This paper analyzes findings from a survey by ACORN Canada of a sampling of its membership to understand why they turn to alternative financial services such as high interest payday loans. The survey finds that the majority of the 268 respondents turn to these services as a last resort because they...

Payday loans are an expensive way for consumers to borrow money. The use of these short-term, high-cost loans has more than doubled in Canada recently to four percent of Canadian households. The Financial Consumer Agency of Canada (FCAC) has been tasked with raising public awareness about the costs...

In 2014, the licensed Canadian payday loan industry provided nearly 4.5 million short-term loans to Canadian households, at a total value of $2.2 billion. Despite its unfavourable reputation, the licensed payday loans industry provides a necessary service for cash-strapped Canadians. Placing...

Just as different credit cards have different interest rates, rewards and benefits, the fees charged on credit cards can vary from one credit card to another. You can avoid many of those fees by making smart choices. Understanding how fees work will help you to shop around for a credit card that...

For most post-secondary students, money is tight. But remember that every dollar you save while you’re in school is one less dollar that you’ll owe in student debt when you graduate. Consider whether the tips below will work for...