Discover financial empowerment resources

Discover financial empowerment resources

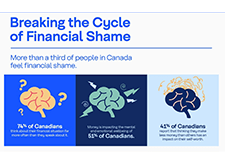

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

This report provides insights from the project, including highlighting the challenges people with disabilities in British Columbia face in their journey to get income benefits, the opportunities to remove those barriers and implications for future benefits design. The demand for access to benefits...

In 2014, the government of BC declared October RDSP Awareness Month to help raise awareness about the Registered Disability Savings Plan (RDSP). The RDSP is the world’s first savings plan specifically designed for people with disabilities. Even with little to no personal contributions, there are...

Registered Retirement Savings Plans (RRSPs) are accounts registered with the Canada Revenue Agency (CRA) that help you save for retirement or other goals. To make it easier, the British Columbia Securities Commission has created a simple guide to understanding RRSPs. In this post you’ll learn...

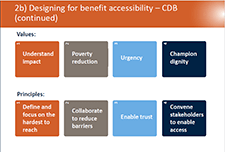

In this webinar you will learn about the barriers facing people with disabilities in accessing benefit programs and the work currently underway to identify, influence and pilot solutions to help advance the access to benefits process now and in the future. This webinar includes: - An...

Maytree released the 2020 edition of the Welfare in Canada report. For each province and territory, this report provides data and analysis on the total welfare income that households receiving social assistance would have qualified for in 2020, including COVID-19 pandemic-related supports. Welfare...

Amidst the COVID-19 lockdown, community service agencies across Canada have had to rapidly adapt the way they engage and support people in the community. A growing number of Canadians need (or soon will need) support as they deal with the financial strain brought on by an unprecedented global...

Recover and Rebuild: Helping Canadians build financial security during the pandemic and beyond The 2021 ABLE Financial Empowerment (FE) virtual series is a collection of online financial empowerment events designed to provide frontline FE practitioners, FE...

This report, Roadblocks and Resilience Insights from the Access to Benefits for Persons with Disabilities project, provides insights on the barriers people with disabilities in British Columbia face in accessing key income benefits. These insights, and the accompanying service principles that...

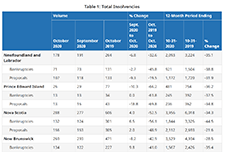

The Office of the Superintendent of Bankruptcy Canada releases statistics on insolvency (bankruptcies and proposals) numbers in Canada. The latest statistics released on November 4, 2020 show that the number of insolvencies in Canada increased in the third quarter of 2020 by 7.9% compared to the...

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered...

The September Labour Force Survey (LFS) results reflect labour market conditions as of the week of September 13 to 19. At the beginning of September, as Canadian families adapted to new back-to-school routines, public health restrictions had been substantially eased across the country and many...

A fact sheet released by Statistics Canada shows that, in March and April 2020, the proportion of young Canadians who were not in employment, education or training (NEET) increased to unprecedented levels. The COVID-19 pandemic—and the public health interventions that were put in place to limit...

The ability to build assets allows an individual or family to meet long-term financial goals and create economic stability for the future. This toolkit contains resources on goal setting, action planning and information on financial products and government supports that can help with building...

This research project aims to identify the relationship between COVID-19 pandemic and poverty in Vancouver, by analyzing how the COVID-19 pandemic has pushed people into poverty and the impact of COVID-19 on people already living in poverty. Several examples of COVID-19 recovery policies and...

While social finance could have a transformative impact on the funding and financial landscape, relatively little is understood about its implications for charities. This webinar presents the results of a national survey of over 1,000 registered charities undertaken by Imagine Canada to better...

In response to the COVID-19 pandemic and the complexities of the benefits and financial relief measures available to Canadians, we developed the Financial Relief Navigator (FRN), an online resource that helps vulnerable Canadians and those that work with them access critical emergency benefits and...

The Social Assistance Summaries series tracks the number of recipients of social assistance (welfare payments) in each province and territory. It was established by the Caledon Institute of Social Policy to maintain data previously published by the federal government as the Social Assistance...

These reports look at the total incomes available to those relying on social assistance (often called “welfare”), taking into account tax credits and other benefits along with social assistance itself. The reports look at four different household types for each province and territory....

This report examines the financial health and vulnerability of households in Canada’s 35 largest cities, using a new composite index of household financial health at the neighbourhood level, the Neighbourhood Financial Health Index or NFHI. The NFHI is designed to shine a light on the dynamics...

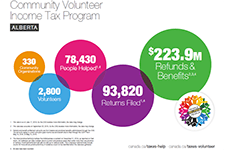

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les...

British Columbia’s Poverty Reduction Strategy, sets a path to reduce overall poverty in B.C. by 25% and child poverty by 50% by 2024. With investments from across Government, TogetherBC reflects government’s commitment to reduce poverty and make life more affordable for British...

In this toolkit you'll find materials to help you learn about what's involved in tax filing, and some materials to support setting up your own community tax clinic. Updated February 18, 2025: Find the income tax package for the province or territory where you resided on December 31,...

This toolkit contains tools and worksheets you can use with your financial coaching clients. Each document should be used as a part of the coach-client relationship. This include financial coaching tools such as the financial wheel of life and tips for the first meeting, as well as tools and...

First Call BC Child and Youth Advocacy Coalition has been tracking child and family poverty rates in BC for more than two decades. Every November, with the support of the Social Planning and Research Council of BC (SPARC BC), a report card is released with the latest statistics on child and family...