As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors impacting financial circumstances at every earning bracket, the beliefs people hold about their financial situation and money management are exacerbated leaving money shame to prevail.

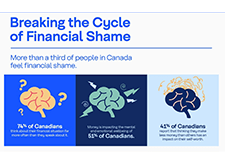

Canada’s largest federal financial cooperative and Certified B Corporation®, Coast Capital, has released a new study — Breaking the Cycle of Financial Shame — that explores financial shame and its impact on people’s ability to address the factors keeping them from being able to improve their financial reality. The credit union aims to shine a light on financial shame — not just its existence, but how it works, how it feels, and why it’s happening to all of us — in an effort to help break down the stigma and the silence on this topic to help people in Canada build a better financial future for themselves.

The study, which polled a sample of 1,512 online Canadians 18+, plus an additional 154 Millennials in British Columbia, and was hosted on the Angus Reid Forum, revealed that people in Canada are stuck in a cycle of shame, silence, and isolation when it comes to their finances.

- More than a third of Canadians (36 per cent) feel shame when it comes to their financial situation, and yet, three out of four Canadians (74 per cent) think about their financial situation far more often than they speak about it.