To qualify for TANF and SNAP, families in many states must prove, among other criteria, that their income and assets do not exceed state or federal levels. These asset limits are caps on the amount of cash, savings, or material property that a family can hold when applying. In the case of TANF, states often set different limits for people applying for assistance (applicant asset limit) and for those who are already receiving benefits (recipient asset limit). The Pew Charitable Trusts conducted original research to examine the second of these questions: How would modifying TANF asset limits affect states’ caseloads and costs? This brief captures the results of that research, which looked at data from 2000 through 2014 and tracked the trends in TANF caseloads and spending and documented what happened in individual states when asset thresholds changed.

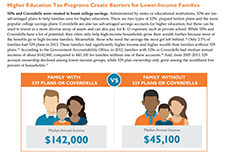

Expanding Educational Opportunity Through Savings