Housing law: free legal information

This resource produced by Community Legal Education Ontario (CLEO) provides a list of free legal information about paying rent, eviction procedures and much more.

Making the most of your money

Managing money is challenging. In the current economic environment, it has become even more difficult. For people living on a low-income, managing the day-to-day expenses, let alone life changes or emergencies, can be overwhelming. Prosper Canada has created an online course that you can share or use with your clients to help them access tools and resources to support their daily money management. Making the most of your money is an easy-to-use, accessible, online course to help people living on a low income organize their finances and explore ways to increase the amount of money coming in and reduce what is going out. This interactive course has activities, videos, handouts and resources that are also downloadable.

Money management worksheets

CPA Canada has a selection of money management worksheets you can use with your clients. Goal Setting Financial Fitness Self-Assessment Values Validator Monthly Budget for Teens Role Model Self-Assessment Document Organizer Cash Flow Organizer Net Worth Worksheet Post-Secondary Student Budget

Set SMART goals that are specific, measurable, action-oriented, realistic, time-framed.

Determine how well you are currently managing your finances.

Determine the things in life that are most important to you.

Help teenagers living at home create a monthly budget.

Determine what kind of financial role model you are.

Organize your documents in preparation for filing your taxes.

Get a clear picture of your cash flow — what is coming in and what is going out

Get a snapshot of what you own (your assets) and what you owe (your liabilities)

This worksheet will help students accurately estimate the total budget they need

Financial wellness guide: questionnaire

CPA Canada developed the Financial Wellness Guide to help you understand money basics. Complete the online questionnaire to get straightforward tools and information, based on your financial situation, that will help you with your financial goals.

The mastering money podcast

Brought to you from CPA Canada, this financial literacy podcast talks about key issues, trends and tips as they relate to financial education. Season 7 of the Mastering Money podcast takes a deep dive into debt and the way it affects Canadians. Season 6 of the Mastering Money podcast will help prepare you for retirement and give you the tools to get there, no matter your age. Season 5 of the Mastering Money podcast unpacks the hard financial conversations you need to be having with your kids, partners, financial planners and more. Season 4 of the Mastering Money podcast explores the role money plays in the lives of women from all walks of life, now and in the future. Season 3 of the Mastering Money podcast looks at the difficult financial decisions Canadians are making during the ongoing COVID-19 pandemic. Season 2 of the podcast takes listeners on a journey across various financial literacy hot topics and trends. These include how to fit financial literacy into existing programs, the financial health of future generations as well what it takes to take the plunge and start your own business. In this introductory season of the podcast, hear from financial educators on topics such as behavioral economics, the emotions of money, financial wellness, and more.

Financial literacy courses for Canadian students

Teachers may incorporate two gamified financial literacy courses that are currently freely available into their lessons. Students can now access two age-appropriate courses designed to help boost students' financial knowledge and confidence at any stage of their financial journey. Course titles: Students will explore resources and tools on the FCAC website that they will be able to use well beyond high school. *Students can earn a completion certificate issued by the FCAC and ChatterHigh!

Economic abuse screening tool (a toolkit for social service providers)

Women’s shelters are often the first point of contact for victim-survivors fleeing abusive relationships. Therefore, safety and shelter are logically at the forefront of staff members’ immediate concerns. Once the victim-survivor is in a place of safety, it is crucial to explore the patterns of abuse the person has experienced. Economic security is an often overlooked pattern of abuse linked to physical safety. It is, therefore, crucial and the goal of this screening tool for shelter workers to identify potential Economic and Financial Abuse amongst their clients and to assist victim-survivors in accessing essential economic resources. Watch the webinar: Recognizing and responding to economic abuse; empowering survivors to thrive and succeed.

Cyber security awareness quizzes

Discover a new quiz site to help Canadians and Canadian small businesses protect against phishing scams. The Canadian Bankers Association has created four quizzes for Canadians to learn more about cyber fraud and how to prevent becoming a victim. Quiz #2: Social engineering: a peek behind the curtain Quiz # 3: Protecting your small business from phishing attacks Quiz #4: How to protect yourself and others

Do you know how to prevent fraud?

Test your knowledge on fraud prevention by answering these 11 questions.

Managing your money in a changing world

Managing your finances means finding the right balance. Inflation and higher interest rates signal that you may need to adjust your budget to find the right balance between daily spending and paying down debt. The right balance will depend on your financial situation and goals. This selection of tools from the FCAC provides information and tips on: How to manage your money when interest rates rise Make a plan to pay off your debt

Retirement savings course

The Association of Canadian Pension Management (ACPM) launched its new Retirement Savings Course to empower Canadians wishing to learn the basics of retirement savings and to foster awareness of the importance of retirement income savings at any age. Course highlights: The free course will provide you an overview of the building blocks of retirement savings and insight into the role that government pensions and workplace pension plans may have for your future or that of those you care about.

Spending habits calculator

Use this calculator to see how changes to your spending habits can impact your budget and help you save more of your money.

Crypto Quiz

Are you considering investing in crypto assets, but aren’t sure whether it’s right for you, legal or just a scam? Test your crypto knowledge and learn how to spot the warning signs of fraud using OSC's quiz.

Financial literacy self-assessment quiz

Take this self-assessment quiz to figure out how your financial literacy skills and knowledge measure up compared to other Canadians.

Investment knowledge quiz

Most people know a little about investing, but they need to know more to be able to manage their investments to meet their goals. Try this quiz by the FCAC to see if your knowledge is basic or more advanced.

Investment recovery calculator

This calculator will help you find out how long it will take for your investment to recover its value after a market downturn and identify how long it will take to get back on track to reach your original goal.

Cyber security awareness

The Canadian Bankers Association has created a new Cyber Security Awareness Quiz site to test your knowledge and ability to spot a “phishy” email, message or text.

Canadian Institute for Social Prescribing

The Canadian Institute for Social Prescribing (CISP) is a new national hub to link people and share practices that connect people to community-based supports and services that can help improve their health and wellbeing.

Introduction to behavioural insights for the social sector: a capacity building course

This self-paced online course will help you learn about behavioural insights and how they can help you increase impact in simple, practical ways. In this self-paced learning experience, you will learn foundational skills and tools that you can apply immediately to your work, creating a long-lasting social impact.

TFSA Calculator

A Tax-Free Savings Account (TFSA) can be used to save for any goal. You put after-tax dollars into a TFSA, but your investments grow tax-free and you won’t pay any tax on withdrawal. Use this calculator to estimate the value of the investments in your TFSA when you’re ready to withdraw them, and compare this amount to the value of your investments in a non-registered plan to see your overall estimated tax savings.

Debt consolidation calculator

Debt Consolidation is the process of combining multiple debts into one. Use this calculator to calculate what your new monthly payments would be, how soon you could be debt free, and how much your total interest amount would be when you consolidate your debts.

Take the stress out of budgeting

Making a budget is one of the most helpful financial tools you can use on a regular basis. A budget can give you a clear picture of where your money is going. It’s easier to plan for the life you want, when you know how much money you have for saving, spending and paying off debt. If you’ve never made a budget, or have not created one in a long time, it can be an intimidating reality check. Don’t let stress or worry keep you from creating a budget. The best budgeting method to use is the one that works for you.

Behavioural bias checker

Being aware of potential biases can help you become a better decision-maker. Use this tool to improve your awareness of different behavioural biases or “blind spots” that may influence your decisions.

Compound interest calculator

Using OSC's online calculator, find out how your investment will grow over time with compound interest.

Emergency fund calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Ideally, this fund would provide enough money to cover your essential living expenses so you can avoid taking on debt. Use OSC's calculator to estimate how much money should be set aside to pay for financial emergencies.

Scam spotter tool

Investor readiness quiz

Investing is an important part of planning for a financially secure future. It can battle the effects of inflation on your savings, grow your wealth, and provide sources of income in retirement. The sooner you invest, the longer compound interest can work to grow your savings exponentially. However, there are some important milestones to achieve and questions to consider before you start investing. Are you ready to invest? Take this quiz to find out!

Pay down debt or invest tool

If you have extra money, this calculator helps you decide whether to invest or pay off debt.

How income tax works

Filing your taxes might be one of the most important financial actions you’ll take each year. It can also feel confusing or stressful at times. Find out more about how income tax works, including tax deductions and tax credits using the Ontario Securities Commission's interactive chart to see what tax bracket you are in.

It’s time to get ready for taxes!

Intuit is committed to helping students across the country work towards a more prosperous financial future by equipping them with the education they need to feel confident about their taxes. Through the Intuit TurboTax Simulation, we are helping students overcome the fear of Tax Day. You do not need to be an expert to teach taxes, and we recommend teaching to grade levels 9-12.

Learn about your taxes (free CRA online course)

A free online course to learn about personal income taxes in Canada, developed by the Canada Revenue Agency. Contents include: Additional resources for teachers and facilitators are available.

Money Mentors’ free financial education programs

Money Mentors’ free online courses are available to everyone. The 1-2 hour narrated courses make it easy to learn at your own pace. These online courses provide the same great content as our in-person presentations, but at the touch of a finger. They cover a variety of topics including budgeting, debt, credit, fraud, life events and one course even focuses on managing money and understanding credit for high school students. Read more about Money Mentors' free financial literacy presentations to provide K-12 students with money concepts and skills here.

Debt got you down?

The CBA partnered with Credit Counselling Canada, an association of accredited non-profit credit counselling agencies, to offer the Debt and Money Quiz. The online tool helps Canadians assess their financial health and provides recommendations to help those who are struggling financially. Take a short “Yes” or “No” quiz to find out if you need support managing money and debt. See how you compare with other quiz respondents.

Introduction to Indigenous Peoples’ cultures online course

This free, on-demand, introductory course provides learners with insight into the history of First Nations, Métis and Inuit Peoples; an understanding of the devastation of colonialism on Indigenous communities and economies from an Indigenous perspective and how it is critical to reconciliation; and how culturally sensitive health care models help inform how accounting and finance education can be inclusive and supportive. This course was developed to provide the writers and facilitators of CPA education programs, cases and examinations with insight, knowledge and skills to better understand the perspectives of Indigenous students, to help support their success. It will provide all learners with a valuable introduction into the deep cultural and historical foundations upon which the future prosperity of Indigenous communities must be built.

San’yas Indigenous Cultural Safety Training

Cultural safety is about fostering a climate where the unique history of Indigenous peoples is recognized and respected in order to provide appropriate care and services in an equitable and safe way, without discrimination. This website includes information about the San’yas: Indigenous Cultural Safety Training Program delivered by the Provincial Health Services Authority of British Columbia.

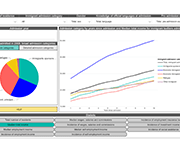

Trans PULSE Canada COVID Data Dashboard

In September – October 2020, the Trans PULSE Canada study team conducted the COVID Cohort to assess the social, economic, and health impacts of the COVID-19 pandemic on trans and non-binary people in Canada. This dashboard serves as an interactive tool for community members and researchers to explore key findings from the Trans PULSE Canada COVID survey, and to break down the results by one or more socio-demographic characteristics. The proportions in the dashboard are weighted to represent the 2019 Trans PULSE Canada sample.

Disability Tax Credit Tool

The Canadian Disability Tax Credit (DTC) can help reduce the taxes you or someone who supports you owe. It also offers a lot of other great benefits. To apply for the DTC, your healthcare provider will need to fill out the Disability Tax Credit Certificate (form T2201). This tool is designed to give them the information they need to fill out that form

OpportuNext (career transition online tool)

OpportuNext from The Conference Board of Canada is a free-to-use career tool created in partnership with the Future Skills Centre. The tool can be used by anyone looking to plan a career path with a similar skillset or for anyone providing employment services.

Financial Relief Navigator

The Financial Relief Navigator is an online tool that can help you find support to raise your income or lower your expenses in these challenging times. The tool will suggest income benefits or other support programs you may be eligible for in your province/territory in Canada.

Momentum’s Money Management Courses

The money management courses are offered online, on demand, for free. Learn at your own pace and on your own schedule on a variety of topics, including:

Statistic Canada’s Longitudinal Immigration Database: Birth area and income table, 2018

Statistics Canada's Longitudinal Immigration Database (IMDB) Interactive Application has been updated to include data on citizenship intake rates and income by birth area, sex, pre-admission experience and admission category. This table includes income measures up to 2018 for immigrants admitted to Canada since 2008.

Consumer Price Index Personal Inflation Calculator

This interactive tool created by Statistics Canada allows you to explore your personal rate of inflation, based on the goods and services you consume. The Consumer Price Index (CPI) is the official measure of inflation in Canada. It is representative of the change in prices experienced by the average Canadian household. However, your personal experience of inflation may not perfectly match the Canadian average due to differences in your spending habits. The Personal Inflation Calculator accounts for those differences and provides a measure of inflation unique to you.

G20/OECD INFE Core Competencies Framework on financial literacy for Adults (aged 18+)

This document describes the types of knowledge that adults aged 18 or over could benefit from, what they should be capable of doing and the behaviours that may help them to achieve financial well-being, as well as the attitudes and confidence that will support this process. It can be used to inform the development of a national strategy on financial education, improve programme design, identify gaps in provision, and create assessment, measurement and evaluation tools.

Data literacy training

Statistics Canada presents a learning catalogue to share knowledge on data literacy. Data literacy is the ability to derive meaningful information from data. It focuses on the competencies involved in working with data including the knowledge and skills to read, analyze, interpret, visualize and communicate data as well as understand the use of data in decision-making. Their aim is to provide learners with information on the basic concepts and skills with regard to a range of data literacy topics. The training is aimed at those who are new to data or those who have some experience with data but may need a refresher or want to expand their knowledge.

Serving Individuals With Disabilities – A Day in the Life of an American Job Center

The Disability and Employment eLearning Task Force in collaboration with the Employment and Training Administration (ETA) released three eLearning Training Modules to help support the professional development needs of the workforce development staff across the United States. The first module provide tools and resources to support front-line American Job Center staff effectively serve customers with disabilities, covering strategies for effective communication and interaction with individuals with disabilities.

Gender, Diversity and Inclusion Statistics Hub

Launched by the Centre for Gender, Diversity and Inclusion Statistics (CGDIS), the Gender, Diversity and Inclusion Hub focuses on disaggregated data by gender and other identities to support evidence-based policy development and decision making.

Labour Force Survey in brief: Interactive app

Part of the Canadian Labour Market Observatory, this interactive data visualization application showcases publicly available labour market information. The fully interactive applications allow Canadians to quickly and easily personalize the information in a way that is relevant to them and their interests.

Financial Literacy Outcome Evaluation Tool

The Financial Literacy Outcome Evaluation Tool offers organizations a collection of evidence-based financial literacy outcomes and indicators. The tool guides users through a series of questions about their program and evaluation goals and then suggests scales (sets of questions) and individual questions they can use.

Retirement Literacy Website

The ACPM Retirement Literacy Program complements the financial literacy education efforts by the federal and provincial governments, and other organizations. The website contains a series of quizzes to help improve your knowledge of pensions and retirement savings plans as well as links to financial literacy resources.

Budget Planner

The Financial Consumer Agency of Canada (FCAC)'s online tool helps you create a customized budget.

Emergency Fund Calculator

Some emergencies in life can affect you financially. You could get sick, lose your job, or have a costly repair to your car or home. An emergency fund can provide a financial safety net. Use this calculator to estimate how much money should be set aside to pay for financial emergencies.

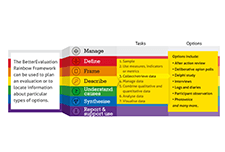

Rainbow Framework

The Rainbow Framework organizes different methods and processes that can be used in monitoring and evaluation. The range of tasks are organised into seven colour-coded clusters: Manage, Define, Frame, Describe, Understand Causes, Synthesise, and Report & Support Use. Users can use the framework to plan an evaluation that covers all necessary tasks or choose from an approach which contains a pre-packaged combination of task options.

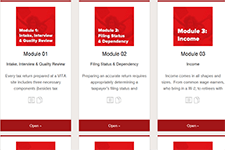

My money in Canada

Are you a newcomer to Canada, or someone who works with newcomers? This online tool will help you explore five money modules to better manage your finances in Canada. Learn about the financial system in Canada, income and expenses, setting goals and saving, credit and credit reports, and filing taxes. Updated July 26, 2022: My money in Canada provides important information about Canada’s financial system and promotes positive money management habits to support Canadians to succeed financially. Interactive exercises and checklists support you to make informed choices and to create a customized financial plan that works for you. Originally designed to support newcomers to Canada as they settle and establish themselves financially, My money in Canada has been updated to serve all Canadians, including those who are new to Canada.

RDSP calculator

Enhance the quality of life for a family member with a disability. By answering a few simple questions, the RDSP Calculator can help you project the estimated future value of an RDSP, and the approximate value of future withdrawal payments. Run various scenarios to see how it would affect the value of your RDSP. The RDSP Calculator is a tool to help you assess the potential of opening and contributing to an RDSP. The estimates provided by the Calculator are for information purposes only. The profile of your RDSP may differ from the RDSP Calculator projection.

Proliteracy.ca: Plan Finances for University or College

Proliteracy.ca analyzes historical living expenses from over 160 cities and tuition from over 100 universities and colleges in Canada to predict the cost of post secondary education in the future. Their tool suggests financing options based on your profile. Learn about RESP, grants, scholarships and various government and commercial programs with their online resources.

Canada Revenue Agency Child and Family Benefits Calculator

This online tool released by the Canada Revenue Agency can be used to determine the eligibility and payment amounts of child and family benefits. Additional information on child and family benefit programs may be found on the Canada Revenue Agency's child and family benefits page.

My money in Canada

This online tool will help you learn about the financial system in Canada and how to manage your money. Explore five money modules on banking, income and expenses, money goals and savings, credit, and taxes. Clients can do the modules in the order they appear, or just the ones they want to use. The tool is intended to be used with clients and settlement workers together, but can also be used by the client on their own if they are comfortable.

Mortgage Calculator

This calculator from the Financial Consumer Agency of Canada determines your mortgage payment and provides you with a mortgage payment schedule.

Account Comparison Tool

Compare features for different chequing and savings accounts, including interest rates, monthly fees and transactions. Find an account that best suits your needs. Narrow your search, view search results, and compare your results using this account comparison tool from the Financial Consumer Agency of Canada.

RRSP Savings Calculator

Use this tool by the OSC to estimate how much your registered retirement savings plan (RRSP) will be worth at retirement and how much income it will provide each year.

TFSA Calculator

This calculator will help you estimate the value of the investments in your TFSA when you’re ready to withdraw them, and compare this amount to the value of your investments in a non-registered plan to see your overall estimated tax savings.