English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

Navigating Finances: Paying Down Debt vs. Investing, CIRO

Loan and Trust, FSRA

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

Debt Relief Options in Canada – Long Term Outcome Comparison

This research report compares the long-term financial outcomes of Canadians, based on a study comparing consumers who used a debt management program (DMP), bankruptcy (BK), or a consumer proposal (CP) to obtain relief from debt.

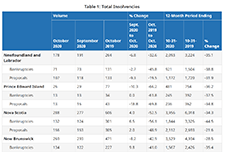

Office of the Superintendent of Bankruptcy Canada: Statistics and Research

The Office of the Superintendent of Bankruptcy Canada releases statistics on insolvency (bankruptcies and proposals) numbers in Canada. The latest statistics released on November 4, 2020 show that the number of insolvencies in Canada increased in the third quarter of 2020 by 7.9% compared to the second quarter.

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Access the handouts for this webinar:

How we help people – An overview (Webinar handout) – Credit Counselling Society

Our services (Webinar handout) – Credit Counselling Society

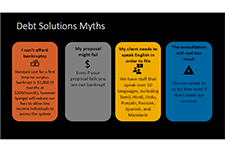

Debt solutions 101 (Webinar handout) – msi Spergel Inc

Time-stamps for the video-recording:

4:13 – Agenda and introductions

7:00 – Audience polls

12:31 – Debt in Canada (Speaker: Glenna Harris)

15:20 – Credit Counselling Society on debt management plans (Speaker: Anne Arbour)

34:05 – Spergel Msi on Consumer Proposals and Bankruptcy plans (Speaker: Gillian Goldblatt)

56:00 – Q&A