Credit scores and credit reporting in Canada

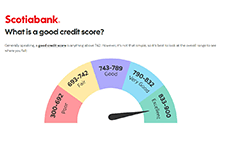

While your credit score is a number to quickly show how creditworthy you are, your credit report is more detailed. It covers your entire credit profile and includes information such as personal information, credit account (including credit cards, lines of credit, mortgages...), bankruptcies... Watch this video by Scotiabank to learn what a credit score is and why it matters. Then learn how to check your credit score for free in Canada. You may also learn how borrowing can impact your credit score. If you check your credit report and your credit score is low, follow these tips for how to help increase credit scores.

English

Dealing with debt: Tips and tools to help you manage your debt

Dealing with debt – About this resource

DWD Worksheet #1 – Your money priorities – Fillable PDF

DWD Worksheet #2: What do I owe? – Fillable PDF

DWD Worksheet #3: Making a debt action plan – Fillable PDF

DWD Worksheet #4: Tracking fluctuating expenses – Fillable PDF

DWD Worksheet #5: Making a spending plan – Fillable PDF including calculations

DWD Worksheet #6: Your credit report and credit score – Fillable PDF

DWD Worksheet #7: Know your rights and options

Dealing with debt – Full booklet

Dealing with debt: Training tools

Resources

Managing debt , Ontario Securities Commission

Options you can trust to help you with your debt, Office of the Superintendent of Bankruptcy Canada

Debt advisory marketplace/ consumer awareness, Office of the Superintendent of Bankruptcy Canada

Navigating Finances: Paying Down Debt vs. Investing, CIRO

Loan and Trust, FSRA

French

Gestion de la dette: Conseils et outils pour vous aider à gérer votre dette

01 – Vos priorités financières

02 – Combien ai-je de dettes?

03 – Faire un plan d’action

04 – Suivi des dépenses variables

05 – Faire un plan de dépense

06 – Dossier de crédit et cote de solvabilité

07 – Connaître nos droits et nos options

Ressources : Pour en savoir plus

Gestion de la dette : Livret complet

Ressources

Gestion de la dette, La Commission des valeurs mobilières de l’Ontario

Des options fiables pour vous aider avec vos dettes, Bureau du surintendant des faillites

Marché des services-conseils en redressement financier et sensibilisation des consommateurs, Bureau du surintendant des faillites

What to do if you are defrauded

Financial fraud can be stressful and time-consuming experience. It can affect you both financially and emotionally. If you are defrauded, or suspect that you may have been defrauded, follow the steps outlined in this article.

Annual report of credit and consumer reporting complaints: an analysis of complaint responses by Equifax, Experian and TransUnion

This report summarizes the information gathered by the Consumer Financial Protection Bureau (CFPB) regarding certain consumer complaints transmitted by the CFPB to the three largest nationwide consumer reporting agencies - Equifax, Experian and TransUnion.

Debt and Consumer Rights: Credit repair

This educational brief from CLEO explains what a credit report is, and what to do if you want to fix your credit report or work with a credit repair agency.

Consumer Financial Protection Bureau Data Point: Becoming Credit Viable

Very little is known about the number or characteristics of credit This Data Point documents the results of a research project undertaken by Staff in the Office of Research of the Consumer Financial Protection Bureau (CFPB) to better understand how many consumers are either credit invisible or have unscored credit records and what the demographic characteristics of such consumers are.

invisibles or consumers with unscored credit records.

Handout 7-13: Credit reporting glossary

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Glossary of terms for credit reporting. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-12: Credit reporting resources

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Web resources for credit reporting in Canada. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-10: Ways to improve your credit score

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Ways to improve your credit score. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-8: Correcting common errors on credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. How to correct common errors on credit reports. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-4: Reading a credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. The information in an Equifax credit report varies slightly from a TransUnion credit report, but both contain the same basic sections. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-3: Sample Equifax credit report

This handout is from Module 7 of the Financial Literacy Facilitator Resources. A sample of a credit report received from Equifax. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-2: Credit reports

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus summarize your credit use in a report. The credit report is one of the main things lenders look at when they decide whether or not to give you credit. A credit report contains your history of credit use, and your credit ratings. To view full Financial Literacy Facilitator Resources, click here.

Handout 7-1: Credit bureaus

This handout is from Module 7 of the Financial Literacy Facilitator Resources. Credit bureaus are agencies that collect information about how we use credit. They produce personal credit reports. Credit bureaus are private companies. They are regulated by the province, but they are not part of the government. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-7: TransUnion sample request form

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the TransUnion request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.

Activity sheet 7-6: Sample Equifax request sheet

This activity sheet is from Module 7 of the Financial Literacy Facilitator Resources. A sample of the Equifax request sheet to obtain a free credit report. To view full Financial Literacy Facilitator Resources, click here.