Resources

Supported tax filing (STF) model general documents

This section contains resources that describe the supported tax file model and includes sample scripts and documents relevant to both virtual and in-person supported tax filing. These documents may be customized for your own agency.

Resources specific to in-person supported tax filing

This section contains documents that have been tailored for in-person supported tax filing.

Resources specific to virtual supported tax filing

This section contains documents that have been tailored for virtual supported tax filing.

Additional resources

This section contains additional resources to support at tax time. Be sure to also review our Tax filing toolkit and Financial Coaching toolkit for other relevant resources.

Sample client profiles (WoodGreen)

Common tax deductions

Common sources of income and their tax slips

Notice of Assessment – how to read it

Encouraging tax filing at virtual clinics

Resources

Presentation slides and video time stamps

Read the presentation slides for this webinar.

Time stamps for the video recording:

-

- 5:20 – Start

- 6:12 – Land acknowledgement

- 7:24 – Introduction of speakers

- 9:42 – Today’s presentation

- 10:45 – Barriers to access to benefits

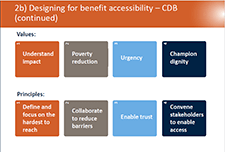

- 15:12 – Designing for benefit accessibility

- 21:53 – ESDC pilot project

- 32:46 –Demo of the disability benefit compass

- 44:36 – Importance of evaluation

- 50:58 – What’s next? What’s possible?

- 58:55 – Questions

Global Learning Partners: Shareable Resources

Global Learning Partners (GLP) helps individuals and organizations to learn by providing practical expertise in learning assessment, design, facilitation and evaluation. Their shareable resources cover a variety of topics in learning, taking a learning-centered approach, including: Learning Design, Needs Assessment, Facilitation, Evaluation, and others.

Webinar series on remote program delivery

A series of webinars hosted by ABC Life Literacy Canada to support literacy practitioners across the country to implement remote program delivery. Topics include:

Resources

Handouts, slides, and time-stamps

Read the presentation slides for this webinar.

Handouts for this webinar:

Online financial tools and calculators (Prosper Canada)

Virtual tools for participant engagement (Prosper Canada)

Online delivery check-list (Momentum)

Jeopardy game template (SEED)

Time-stamps for the video recording:

3:26 – Agenda and introductions

5:10 – Audience polls

8:19 – Virtual delivery considerations (Speaker: Glenna Harris, Prosper Canada)

12:39 – Virtual workshops best practices (Speaker: Fatima Esmail, Momentum)

33:12 – Online money management training (Speaker: Millie Acuna, SEED)

49:07 – Q&A

From Emergency to Opportunity: Building a Resilient Alberta Nonprofit Sector After COVID-19

This report presents an analysis of the impact of COVID-19 on the nonprofit sector drawn from data collected in CCVO's Alberta Nonprofit Survey, data from surveys by the Alberta The analysis in this report shows that the effects on the nonprofit sector have been magnified through increased service demand, decreased revenue, and diminished organizational capacity coupled by delays in support and inadequate recognition for the leadership role that the sector is being called upon to play.

Nonprofit Network, Imagine Canada, and partner organizations across the country.

Taxpayer Rights in the Digital Age

This paper explores the intersection of digital innovation, digital services, access, and taxpayer rights in the Canadian context, in light of the experiences of vulnerable populations in Canada, from the perspective of the Taxpayers’ Ombudsman. Many aspects of the CRA’s digitalization can further marginalize vulnerable populations but there are also opportunities for digital services to help vulnerable persons in accessing the CRA’s services.

The Financial Health Check: Scalable Solutions for Financial Resilience

A large majority of American households live in a state of financial vulnerability. Across a range of incomes, people struggle to build savings, pay down debt, and manage irregular cash flows. Even modest savings cushions could help households take care of unexpected expenses or disruptions in income without relying on costly credit. But in practice, setting aside savings can be difficult. Research from the field of behavioral science shows that light-touch interventions can help address these barriers. For example, changing default settings or bringing financial management to the forefront of everyday life have had powerful effects on savings activity. The Financial Health Check (FHC) draws on such insights to offer a new model of scalable support for achieving financial goals.

Innovative use of technology for VITA

In this presentation, German Tejeda, National Director of Financial Programs, Single Stop USA, shares results from the Virtual VITA Program in the United States since 2012. This presentation is from the session 'Innovations in tax filing assistance', at the tax research symposium hosted by Prosper Canada and Intuit, February 7, 2019, in Ottawa.

Virtual VITA: Expanding Free Tax Preparation. Program Insights

This brief highlights findings from a small-scale pilot that integrated Virtual Volunteer Income Tax Assistance (VITA) services at two New York City Head Start programs during the 2013 tax season. The New York City Department of Consumer Affairs Office of Financial Empowerment (OFE) coordinated the pilot in partnership with the Administration for Children & Families (ACF) Region Food Bank For New York City was the VITA provider. Participating Head Start programs included The Children’s Aid Society and Kingsbridge Heights Community Center (KHCC).