Discover financial empowerment resources

Discover financial empowerment resources

The CRA has launched taxology podcasts. These weekly informal sessions address different topics whether you’re starting your first job, doing your first return, or need a refresher on the basics. CRA hosts talk to experts to share tips and answer top questions to help listeners understand the...

This article by Credit Canada answers many questions around tax filing. For instance, what happens if you don't file your taxes, or you don't pay any tax owing. It also addresses the benefits of filing your taxes. Click on "Access this resource" to learn...

This CRA site has information on what Indigenous Peoples should know about the tax return they send to the Canada Revenue Agency (CRA), and how that return can result in various benefit payments. There's also information on available tax filing...

The overall purpose of the collaborative project between Seneca College and Prosper Canada was to build a supportive booking system for tax clinics serving low-income...

The Community Volunteer Income Tax Program (CVITP) is a partnership between the Canada Revenue Agency (CRA) and local community organizations. The program is intended to ensure that all taxpayers have equal access to the tax system. In Grey and Bruce Counties, 14 community organizations provide...

This toolkit was created to support the Virtual Self Filing tax filing model piloted in 2020-2022 by Canadian community agencies. In this model, individuals file their own tax returns, but receive support from community agency staff or volunteers to do so. In 2023, this toolkit was updated to...

When Canadians have a financial problem, want to make a financial plan, or need help with their taxes, most simply reach out to their financial institution, adviser, accountant, or commercial tax preparer for the help they need. But who do low-income individuals turn to? A new report by Prosper...

Need help filing your taxes? You may be able to avail of the Community Volunteer Income Tax Program. The Community Volunteer Income Tax Program (CVITP) has existed since 1971 and is a longstanding partnership between the Canada Revenue Agency (CRA), and community organizations and their...

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual...

The Get It Back Campaign helps eligible workers in the United States claim tax credits and use free tax filing assistance to maximize tax time. A project of the Center on Budget and Policy Priorities, the Campaign partners with community organizations, businesses, government agencies, and financial...

Tips and considerations for providing alternative tax filing service...

Considerations and best practices for drop-off and virtual tax filing...

Program strategies grounded in an understanding of your community can increase the likelihood of engagement and follow-through. The following resources are intended to support VITA programs with implementation strategies at key program stages, like outreach and intake, and offer examples of how...

During 2020, alternative approaches to the traditional community tax clinic model have become even more valuable as COVID-19 lockdown measures prevented in-person program delivery. In response to the growing demand for alternative ways to deliver tax-filing support Prosper Canada partnered with...

This tax season, community tax clinics across Canada will be preparing to support clients virtually rather than in person amidst physical distancing measures due to the COVID-19 pandemic. Adapting to a virtual tax clinic model means preparing for different ways of volunteer preparation, client...

Disability Alliance BC supports people in British Columbia with disabilities through direct services, community partnerships, advocacy, research and publications. Their website provides information on disability benefits including the Disability Tax Credit (DTC), CPP Disability, Registered...

The Consumer Financial Protection Bureau (CFPB) released a guide to assist intermediaries in serving individuals to access their Economic Impact Payments (EIPs). The guide, Helping Consumers Claim the Economic Impact Payment: A guide for intermediary organizations , provides step-by-step...

The CVITP provides people, who may otherwise have difficulty accessing income tax and benefit return filing services, with an opportunity to meet their filing obligations. Often, filing a return is required to gain access to, or continue to receive, the government credits and benefits...

The position of Taxpayers’ Ombudsman (the Ombudsman) was created to support the government priorities of stronger democratic institutions, increased transparency within institutions, and fair treatment. As an independent and impartial officer, the Ombudsman handles complaints about the service of...

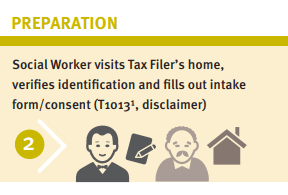

WoodGreen Community Services, a large multi-service frontline social service agency in Toronto, provides free tax preparation services year-round to people living on low incomes. WoodGreen was interested in designing a novel solution to address the tax filing needs of homebound seniors who are...

Many frontline community organizations provide free tax preparation services to people living on low incomes across Canada using a variety of methods. However, when COVID-19 struck, a large majority of agencies offering free tax-filing supports were forced to close their doors and halt in-person...

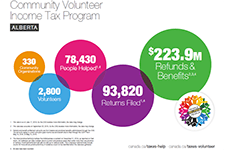

This infographics from the Community Volunteer Income Tax Program (CVITP) show information about the program by province for the tax filing year 2019, including number of returns filed and amount of refunds and benefits accessed. The information is presented in English and French. Les...

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at different points in the tax...

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video shows what the savings conversation could look like at a specific point in the tax...

This is one video in a series of videos catered to Volunteer Income Tax Assistance (VITA) program volunteers on how to introduce the savings conversation to tax filers during the tax filing process. This video discusses why promoting savings at tax time is a critical component of VITA...