Discover financial empowerment resources

Discover financial empowerment resources

Buy Now Pay Later apps like Klarna and Afterpay have become ubiquitous since the pandemic, allowing users to pay for items in small installments over time instead of footing the bill all at once. But now, some financial experts are sounding the alarm that these easy-to-use apps can lead to...

A new OSC behavioural science experiment reveals Canadians are equally open to investment suggestions from AI systems and human advisors. As the use of AI increases, understanding the role of AI in supporting retail investor decision-making is important. While AI presents a range of opportunities...

Following the crowd can help you simplify complex decisions like investing. But you could lose money by investing in something just because everyone else is. Find out how to avoid herd behaviour by watching this video from the Ontario Securities...

The Ontario Securities Commission (OSC) has a dedicated website for Fraud Prevention Month. Learn more by clicking on "Access this resource"...

FAIR Canada engaged The Strategic Counsel (TSC), a national market research firm, to undertake focus groups to better understand Canadian investors. The overall purpose of this research is to provide a broad portrait of Canadian investors including their knowledge, attitudes, behaviours, and...

Centering equity is key to the purpose and mission of any collective impact work, no matter the issue area or focus. It is very difficult to move population or systems change without redressing disparities that exist in almost every community. Part of the challenge is there is not one path to...

Generally speaking, overspending refers to spending more money than one can afford or more than was planned. Overspending can stem from various factors that may be within or outside of your control. Common causes of overspending within one's control include underestimating expenses, mismanaging...

A key component of the Financial Consumer Agency of Canada’s (FCAC’s) mandate is to monitor and evaluate trends and emerging issues that may have an impact on consumers of financial products and services. Technological innovations in financial services and shifting consumer behaviours have...

Having wealth, or a family’s assets minus their debts, is important not just for the rich— everyone needs wealth to thrive. Yet building the amount of wealth needed to thrive is a major challenge. Nearly 13 million U.S. households have negative net worth. Millions more are low wealth; they do...

In 2020, The Behavioural Insights Team partnered with United Way and Oak Park Neighbourhood Centre to develop and test an email intervention to increase participation in tax filing clinics. An "active choice" email (sample email) significantly increased response rate and attendance to virtual...

The Financial Consumer Agency of Canada’s (FCAC’s) mandate is to protect Canadian financial consumers and strengthen financial literacy. The National Strategy is a 5-year plan to create a more accessible, inclusive, and effective financial ecosystem that supports diverse Canadians in...

The Investor Office conducted this study to further our understanding of the experiences and behaviours of retail investors during the COVID-19 Pandemic. The study explored several topics including the financial preparedness, savings behaviour, financial situations, changing preference, and...

This paper provides a description of how having liquid savings contributes to people’s financial stability and resiliency, and the unique opportunity that tax time offers to begin saving for the short and longer term. Starting to save or continuing to save when receiving a tax refund may lead to...

There are numerous factors that influence the decisions that people make. Behavioural insights (BI) recognizes this and, through a combination of psychology, economic and more recently other behavioural research, examines how people are often neither deliberate nor rational in their decisions in...

Recent years have seen an explosion in interventions designed to improve financial outcomes of participants. Yet on-the-ground evidence suggests that not all financial education programs are equally successful at achieving this aim. This paper examines the difference between interventions that...

Human insights are used when designing programs and improving services through understanding clients’ hidden preferences, environment factors and behaviors. The Human Insights Tools from Prosperity Now are intended to take you through the process of discovering opportunities for innovation from...

This report explores consumer financial health, wellness/ stress and resilience for Canadians across a range of financial health indicators, demographics and all provinces excluding Quebec. This report provides topline results from the 2019 Financial Health Index study and three-year trends from...

This brief raises consumer perspectives on financial technology (fintech), and offers guidance for fintech developers on how to best serve low- to moderate-income...

Financial decisions are influenced by our own personal feelings and attitudes around money, and by the feelings, attitudes, and actions by our family and friends. This CFPB toolkit offers financial education practitioners three tools (Money Choices, Money Styles, and Money Network), each with a...

As financial educators know, making day-to-day decisions on spending money is one of the biggest challenges consumers face in keeping their financial lives in order. Many people find it difficult to manage their household finances on a daily basis, let alone over the long term. This brief from the...

The CFPB conducted research on consumer challenges in tracking spending and keeping to a budget. The research found that consumers aspire to manage their spending but for many reasons, many consumers spend more than intended and sometimes have\ difficulty in staying within their budgets. In...

A major national survey conducted in 2016 reveals a bold portrait of Canada’s Millennials (those born between 1980 and 1995), that for the first time presents the social values of this generation, and the distinct segments that help make sense of the different and often contradictory stereotypes...

In this video presentation Rob Levy from the Center for Financial Services Innovation (CFSI) examines the role of financial institutions in building consumer financial health. This presentation was given at the Prosper Canada Policy Research Symposium on March 9, 2018. Read the slide deck that...

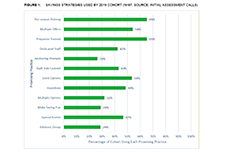

This study addresses these gaps in the literature through an evaluation of a nationwide credit counselling program called Sharpen Your Financial Focus, an initiative launched by the National Foundation for Credit Counseling (NFCC) in September of 2013. The Sharpen initiative builds upon and...

This is the resources handout for Module 9: Consumerism, from the Prosper Canada Financial Literacy Facilitator Resources. To view full Financial Literacy Facilitator Resources, click...