Discover financial empowerment resources

Discover financial empowerment resources

Individuals with lower incomes may face a range of economic challenges and barriers to upward mobility. Two types of services that may both contribute to the goal of improving individuals’ financial situations are employment and training (E&T) services, which have the goal of improving...

This 60-minute webinar for frontline practitioners, social service providers, and funders shares insights from a two-year project designed to help build financial wellness in isolated and rural First Nation communities in Manitoba and Ontario. Partnerships between First Nation communities and...

Having a small emergency fund can alleviate major stress. Putting a few dollars away each month can help you prepare for the unexpected. Watch this new video by the Ontario Securities Commission to learn...

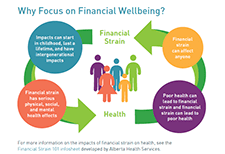

More and more people are having difficulties in covering day-to-day expenses, saving money, and paying down debts. The Financial Wellbeing Café Scientifique was an opportunity to bring people together to talk about how to drive action on financial wellbeing in Canada. The event included a...

FCAC’s new webpage, Choosing a financial institution, will help consumers determine which type of financial institution best meets their needs. The topics covered include: Identifying the financial products and services you need Deciding if you want all your products and services with one...

Wealth inequality, health and health equity is one in a series of ongoing think pieces from Wellesley Institute that aim to stimulate ideas and new conversations to create a fairer and healthier tomorrow. Canadians are struggling with the rising cost of living. A national survey in November 2023...

Internet use in Canada is prolific, with 94% of Canadians going online for personal use in 2022, up from 91% in 2018. Not only are more Canadians using the Internet since the COVID-19 pandemic, but more are managing their personal and household finances online. Based on data from the Canadian...

Many people living in First Nations communities do not have access to housing that is safe and in good condition—a fundamental human right. Improving housing for First Nations is vital for their physical, mental, and economic health and well-being. This is the fourth time since 2003 that we...

Between 2016 and 2021, B.C. lost nearly 100,000 rental units priced below $1,000 monthly. For every new affordable rental home built in B.C., four more are lost to investors, conversions, demolition and rent increases, and new affordable units do not compensate for the loss of existing ones. The...

In Canada and the United States, approximately 1 in 5 children live in poverty, contributing to poor health outcomes. Families with children with chronic illness may experience additional financial stress related to hospitalization. This study aimed to capture experiences of financial needs and...

In their study, entitled, “Experiences of Financial Stress and Supports in Caregivers During Pediatric Hospital Admission,” Nadarajah et al interviewed caregivers of children admitted to a pediatric hospital and conducted qualitative analyses to assess financial needs, health related financial...

The Behavioural Insights Team, in conjunction with Fair4All Finance, have worked with three community finance providers to launch a new customer engagement support guide to better improve customer engagement using insights from behavioural science. Building on our work with three lenders, this...

If you’re saving for a goal in the near future and you’ll need to access the money within a year or two, chances are that’s a short-term goal. Whether it’s for a wedding, a dream vacation, or a new appliance for your home, if it’s something you’re unable to pay for right away then...

The Canada Disability Benefit is an opportunity to guarantee that people with disabilities can live a life with dignity and have an adequate standard of living. For the new Canada Disability Benefit (CDB) to meet its goal of financially supporting and reducing poverty of people with disabilities,...

Investment scams often involve convincing you to put up money for a questionable investment – or one that doesn’t exist at all. In most cases, you’ll lose some or all of your money. There are many ways fraudsters can approach you. The digital era has allowed new kinds of scams as well as more...

Momentum is a Calgary-based community organization that works with people living on low incomes and partners in the community to create a thriving local economy for all. For over 20 years, Momentum has offered matched savings programs that build financial stability by working with participants to...

QR codes are a popular way to offer access to information by scanning the now familiar black and white code with your mobile phone. But not all QR codes are safe to scan. Scammers are taking advantage of the widespread use of QR codes to launch new versions of old scams. Learn more on the...

FAIR Canada engaged The Strategic Counsel (TSC), a national market research firm, to undertake focus groups to better understand Canadian investors. The overall purpose of this research is to provide a broad portrait of Canadian investors including their knowledge, attitudes, behaviours, and...

With the holidays now behind us, it’s time to focus on what’s ahead: a fresh year full of possibilities. Many individuals have popular New Year’s resolutions involving better nutrition, weight loss and work-life balance. Yet others decide that now is the time to focus on enhancing their...

Scammers continue to take advantage of people anxious about finding a new job by perpetuating scams with phony employment offers or by involving job seekers in a money laundering operation . Read this article by the Canadian Banker's Association to learn how to spot common red flags of an...

Have you ever made an impulsive purchase? Do you struggle to stick to a diet or exercise routine? What’s the longest you have gone in keeping your New Year’s resolutions? The field of behavioural insights tells us that we have an innate desire to live for today at the expense of tomorrow....

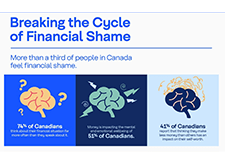

As people in Canada navigate the impacts of a challenging economic environment that includes inflation, the rising cost of living, record debt levels, and high levels of income volatility, we’re seeing a greater connection between financial and emotional wellbeing. With these external factors...

The overall purpose of the collaborative project between Seneca College and Prosper Canada was to build a supportive booking system for tax clinics serving low-income...

Since 2020, the Bank of Canada has engaged with Canadians, the financial industry and civil society groups to better understand how a digital version of the Canadian dollar might affect everyone. Bilateral and roundtable discussions were held, as well as demographically representative focus groups...

Do you know who is calling? New generative artificial intelligence (AI) can be used to imitate anyone’s voice or face. Learn to protect yourself from scams that use AI clones. Access this resource on the Getsmarteraboutmoney.ca website to learn more. Watch this video about AI cloning...